US and Chinese policies have created a rush to hoard chips amid fears of price gouging

Global chips market: What is the impact of China threats on manufacturing?

Fox News host Bret Baier has more on U.S. and its allies efforts to increase semiconductor manufacturing on 'Special Report.'

The world could face another chip shortage as companies and nations seek to lead the way with artificial intelligence (AI) development, having seemingly made few changes after the impacts of the 2021 supply chain crisis, experts said.

"The answer is different for different segments of the semiconductor industry and the chip economy," Gregory C. Allen, the director of the Wadhwani Center for AI and Advanced Technologies for the Center for Strategic and International Studies, told Fox News Digital.

"Companies that make these chips are building out additional capacity to a different extent and in different market niches," he said, adding that while the world is "headed to an oversupply of certain types of chips," there is "already a shortage" of more advanced chips, reflected in the "extraordinary cost of each of these chips."

China enacted a series of extreme lockdown measures, known as "zero-COVID," to combat the coronavirus pandemic, which required cities to shut down and test every resident after officials detected just a few positive cases.

The impact of this shortage proved severe. Everything from cell phones to cars to Javelin and Stinger missiles halted production and distribution. The U.S. Department of Commerce estimated the shortage accounted for a loss of a full percentage point off the GDP for the year.

STUDY FINDS CHATGPT PROVIDED INACCURATE ANSWERS TO MED QUESTIONS

"[It is] a really big deal when companies can’t get enough of the types of chips that they need," Allen said. He highlighted the difference, though, between the chips needed to train AI models and the kinds of chips in cars that allow for simple operations and navigation.

The demand for semiconductor chips and microprocessors skyrocketed following public engagement with ChatGPT and mainstream attention on AI models and platforms. Chip manufacturer Nvidia’s revenue rose 206% over the prior year in its latest quarter thanks to the surge in AI interest and demands.

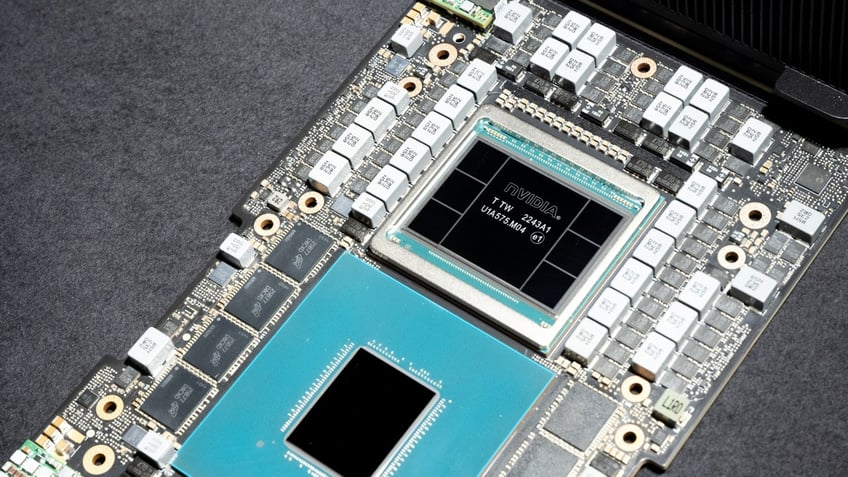

A Nvidia GH200 Grace Superchip is arranged at the company's headquarters in Santa Clara, California, on Monday, June 5, 2023. Nvidia Corp., suddenly at the core of the world's most important technology, owns 80% of the market for a particular kind of chip called a data-center accelerator, and the current wait time for one of its AI processors is eight months. (Photographer: Marlena Sloss/Bloomberg via Getty Images)

The United Kingdom, for example, pledged to spend hundreds of millions of pounds on purchasing chips to allow researchers and developers to pursue breakthroughs and remain at the cutting edge of the industry as nations jockey for a leading role in AI.

Matt McInnis, senior fellow for the Institute for the Study of War's China program, told Fox News Digital that a renewed chip shortage is "a legitimate concern" since it remains "difficult for the industry to estimate how much the demand is going to be as we grow."

WHAT IS ARTIFICIAL INTELLIGENCE (AI)?

Despite the risk of a shortage, McInnis noted that it is not yet clear if such a shortage may be "imminent."

Allen warned about a more considerable issue arising from China’s efforts to try and control the chip supply, which currently rests on Taiwan, which controls a near total monopoly on the production of the most advanced semiconductor and processor chips needed for AI research and development.

A photo from outside a TSMC microchip fabrication plant in Taichung, Taiwan. Sept. 13, 2023. (An Rong Xu for The Washington Post via Getty Images)

"In the case of China, they have been faced with U.S. regulations that prohibit the sale of the most advanced types of AI chips to China, and what China has done in response to that is – with the most advanced chip that they are able to purchase – companies like Tencent purchased a two-year stockpile of the most advanced GPU chips for their AI applications," Allen said.

These efforts help constrict the supply of the most advanced chips, thereby raising the price and putting competitors into a difficult choice - potentially driving them out of business altogether.

ELON MUSK REPORTEDLY WARNED AI COULD DESTROY HUMAN COLONY ON MARS

"They basically paid above market price on these chips to jump the line in allocating the capacity: What chips have been made, who gets to buy them post an extraordinary jump in price," Allen explained.

That may lead to a tug-of-war, with China dumping cheaper, legacy – or simpler – chips onto the market, while the U.S. may continue to limit access to the more advanced chips as well, leading to companies stockpiling chips even more than they have already done.

The AS Savanna cargo ship pulls into the Port of Miami on April 29, 2020 in Miami. (Joe Raedle/Getty Images)

"AI is the hottest category in global venture capital markets and technology investments," Allen said. "So many different companies are being created to pursue AI technology and so many major technology giants are remaking themselves around AI technology – especially after the more recent breakthroughs in generative AI and foundation models."

Nathan Picarsic, a senior fellow focused on China and Technology for the Foundation for the Defense of Democracies, argued that the limiting factor may not be demand but the capacity to produce chips to meet demand, since many countries have not yet diversified their supply chains enough to meaningfully have reduced reliance on China.

"It's not always at the same exact nodes, but you can start all the way at the upstream and the export restrictions that China imposed on gallium and germanium, for example, a few months back, which speaks to the degree to which China's positioning in the supply chain can cause problems starting at the upstream down through everything from the chips that are going to make your car work to the ones that are going to make data servers operate the way that cutting edge applications they need," Picarsic explained.

"I don’t think we’re necessarily better prepared because the market is segmented, so we’ve maybe closed one hole in the dike but left another open, if you will," he added. "I think that the exposure we have to China remains there."

Peter Aitken is a Fox News Digital reporter with a focus on national and global news.