Following Moody's late-Friday downgrade of the U.S. government's top credit rating, gold futures were bid Sunday evening into early Monday morning as investors sought safe-haven trades. However, we shift our attention to a Chinese trader whose highly profitable precious metals trade has recently pivoted toward copper, where he has established a sizable long position.

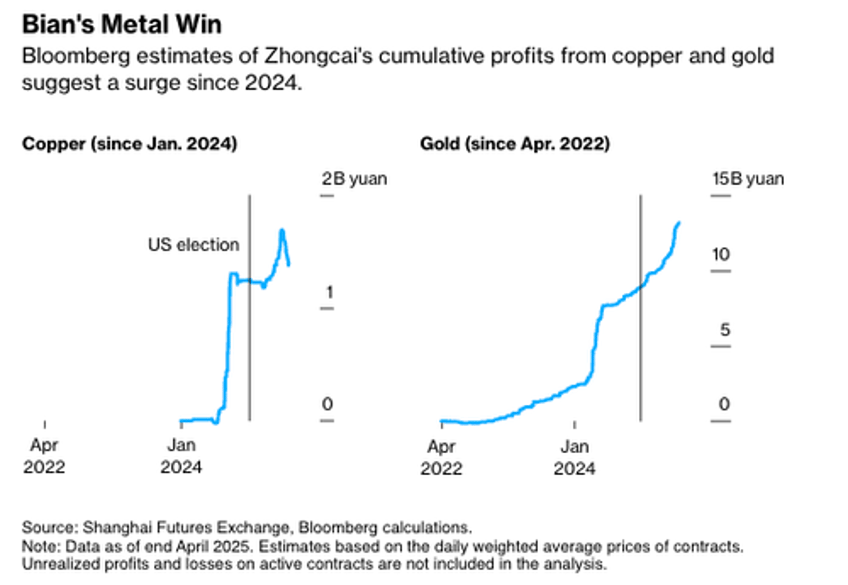

Bloomberg reports that Chinese billionaire Bian Ximing—who netted $1.5 billion from gold futures trades driven by his de-dollarization and inflation-hedging thesis—has now emerged as China's largest copper bull.

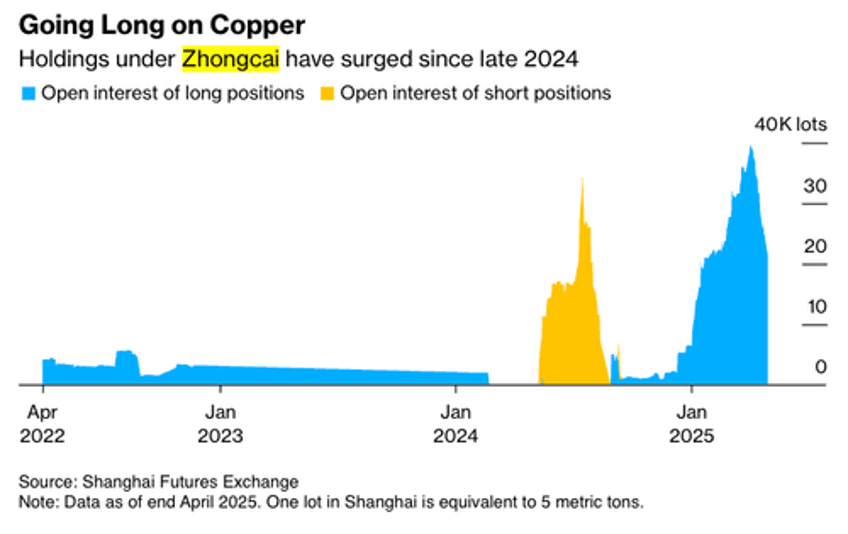

People familiar with Shanghai Futures Exchange data say Ximing has amassed the largest net long position in copper contracts. Bourse data shows the billionaire has built a massive position totaling around 90,000 tons in copper futures over the past ten months.

"It's a quite unique copper position that is worth following," said Li Yiyao, a vice president of Cofco Futures Co.'s Shanghai North Bund division, adding, "It reflects a very long-term, bullish sentiment on the metal based on fundamentals — which differs from the usual mid or short-term strategies we see in the market."

Yiyao added that Ximing's trades during the trade war turmoil stood firm while others exited long copper trades.

Ximing, an industrialist-turned-investor who now lives in Gibraltar, worked with his brokerage, Zhongcai Futures Co., to acquire the long copper position before the November U.S. presidential elections. His bullish view was on a Trump win and Chinese stimulus would produce tailwinds for industrial metal. So far, the bet has returned $200 million in profits.

Ximing's position "is not big enough to distort the market, but it does provide a rare insight into Bian's strategy," said Jia Zheng, head of trading at Shanghai Soochow Jiuying Investment Management Co.

Zheng noted, "People in the market have been tracking his gold and copper trades closely."

Visibility on Ximing's copper bet comes after U.S. imports of Chinese goods plunged from 145% to 30% last week, while Chinese imports of U.S. goods dropped from 125% to just 10%. A 90-day cooling-off period is now in effect as trade negotiations between the two economic superpowers have begun. For now, it appears the peak of trade war turmoil has subsided.

Not long ago, Kostas Bintas—Trafigura Group's former co-head of metals and now with Mercuria Energy Group Ltd.—spoke with Bloomberg in an exclusive interview, expressing an incredibly bullish outlook on copper prices, primarily due to forecasts that global demand will outstrip supply this year.

Former Goldman metals strategist Nick Snowdon, also at Mercuria and head of metals research at the commodity trading firm, forecasted earlier this year that copper prices would average $15,000 a ton for 2025.

Also, Carlyle Group's Jeff Currie (the former Goldman commodities boss) has voiced his bullish view on copper.

Earlier this month, Goldman analyst Eoin Dinsmore noted to clients, "The deescalation in trade tensions and resilient Chinese copper demand will likely continue to support the copper price in the coming months, and we upgrade our 2Q/3Q price forecast to $9,330/$9,150/t from $8,620/$8,370 previously."

We've diligently detailed in multiple notes that the 'Powering Up America' theme and the 'Next AI Trade' have been key demand drivers behind the copper trade.