Despite weak US macro data, oil prices rebounded from yesterday's China-driven drop today amid risk-on sentiment in broader markets and signs that Russia is making good on its pledge to curb supplies.

"Supply concerns could continue to support an uptrend in the market over the medium term as traders could remain cautious in the face of potential new intervention from OPEC+ to balance prices," Denys Peleshok, head of Asia at CPT Markets, said in a note.

"However, demand concerns could remain the center of attention for traders and could create some uncertainty and fuel some volatility and price corrections. In this regard, the market reacted to Chinese economic data which continued to show a weaker-than-expected recovery," Peleshok wrote.

After last week's surprise build, expectations are for a return to crude inventory draws this week.

"Traders expect the oil market to remain tight as Russian shipments decline and as China prepares to provide more support to households," said Edward Moya, senior market analyst at OANDA.

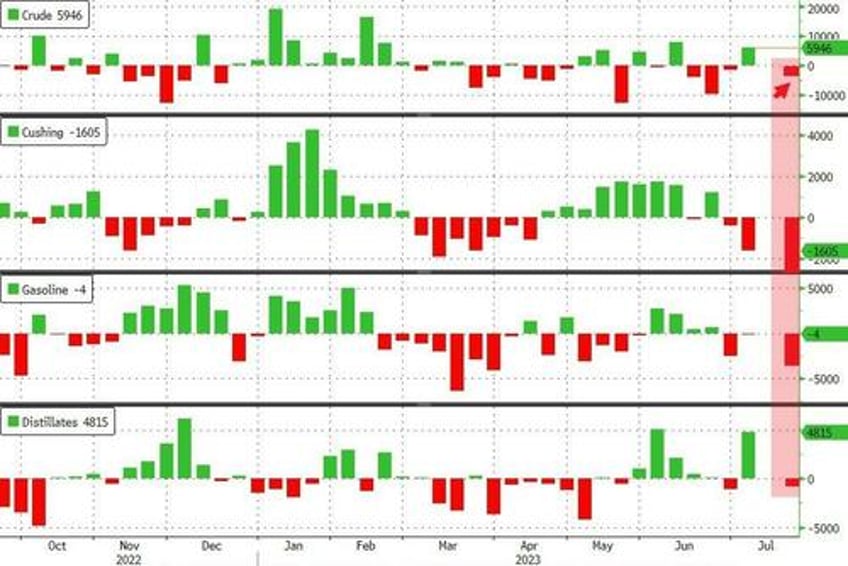

API

Crude -797k (-1.8mm exp)

Cushing -3.00mm

Gasoline -2.8mm (-1.1mm exp)

Distillates -100k (+200k exp)

API reports a smaller than expected crude draw (but still a draw) and bigger than expected crude draw. Stocks at the Cushing Hub fell for the 3rd week in a row...

Source: Bloomberg

WTI was hovering around $75.60 ahead of the API print and dipped modestly after...

Finally, we note that Ed Morse, global head of commodity research at Citi, said that oil is unlikely to fall below $70 a barrel, but it would take a “wild card” event to push prices above $90.

The oil market will move between supply shortages and oversupply, said Morse. But “oversupply won’t be big enough to get us down to $20, or let alone negative prices, and the undersupply won’t be big enough to get us over $100, but it will mean volatility in the market.”