Sarepta Therapeutics has confirmed a third patient death linked to its gene therapy programs, this time involving a 51-year-old man who died in June from acute liver failure after receiving the investigational therapy SRP-9004 for limb-girdle muscular dystrophy (LGMD).

The company confirmed the death to BioSpace and it was widely reported on Friday morning. Sarepta shares were lower by about 25% heading into the cash open.

Like Elevidys—Sarepta’s approved Duchenne muscular dystrophy gene therapy—SRP-9004 uses an adeno-associated virus (AAV) vector, which the company has previously associated with fatal liver complications.

The death, which went unmentioned during Sarepta’s corporate restructuring update earlier this week, has drawn scrutiny from analysts.

“We think the LGMD patient death could amplify patient hesitancy to use commercial Elevidys and increase investor distrust since the company did not disclose the event on its call,” William Blair noted Friday.

A Sarepta spokesperson responded to the omission, saying, “The event had already been communicated to regulators and investigators in an appropriate and timely manner. We have also transparently disclosed this tragic event to the community with whom we have partnered closely throughout the development process.”

The spokesperson also expressed sympathy, stating: “While we do everything possible to ensure patient safety, there is inherent risk in clinical trials. Our deepest condolences go to the family and all those involved in his care.”

The incident adds to mounting safety concerns for Sarepta. Earlier this year, two patients treated with Elevidys also died from acute liver failure, prompting the company to strengthen its risk mitigation strategies. In recent weeks, Sarepta added a boxed warning to Elevidys for liver injury and halted shipments for non-ambulatory patients. It also convened an independent expert panel to review a revised immunosuppressive regimen.

The revelation follows Sarepta’s announcement Wednesday that it will lay off roughly 500 employees—36% of its workforce—and shift focus away from gene therapies in favor of siRNA programs, aiming to save $420 million. Development of SRP-9004 and most other LGMD gene therapies will be halted, with SRP-9003 the only LGMD program moving forward toward a planned FDA submission later this year.

Shares surged 20% on news of the restructuring on Wednesday, but then fell 27% Friday after the death was reported.

BMO Capital Markets had previously commented that the only significant risk remaining was “the death of a third Elevidys patient.”

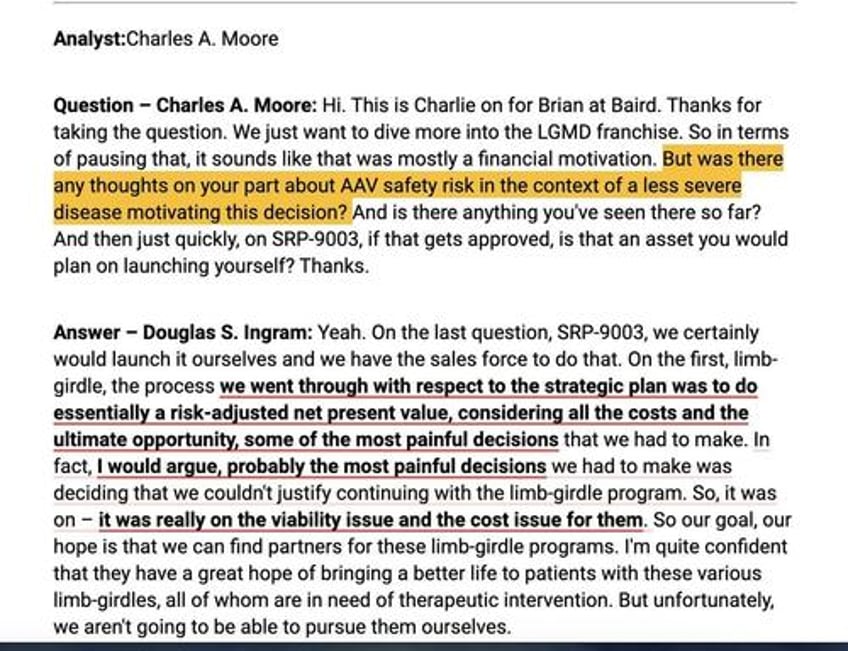

Multiple biotech analysts and traders online, including STAT's Adam Feuerstein, have pointed out that when CEO Doug Ingram was asked if safety played any role in the decision to cut the Limb-Girdle gene therapy programs on Wednesday, he avoided the question...and what appears to also be the answer.

Other analyst reactions to the recent patient death associated with Sarepta Therapeutics' gene therapy programs have been notably cautious and concerned.

William Blair analyst Sami Corwin, who maintains a Market Perform rating on the stock, called the patient death “unfortunate and concerning,” especially given it occurred in one of Sarepta’s other gene therapy programs.

Corwin noted that although development of the SRP-9004 program has been discontinued, the incident could lead to increased scrutiny of SRP-9003’s safety profile ahead of its biologics license application (BLA) submission. If approved, this heightened safety focus could potentially weigh on commercial interest.

Moreover, Corwin warned that the death may amplify patient hesitancy toward the use of Sarepta's already-approved gene therapy, Elevidys, and could fuel investor distrust—particularly given that the company did not disclose this third death in its business update earlier in the week.

Leerink Partners analyst Joseph P. Schwartz, who holds an Outperform rating, focused on the implications for management credibility and market perception. Schwartz emphasized that SRP-9004 is engineered using the same AAVrh.74 vector as Elevidys, underlining the relevance of safety concerns to Sarepta’s commercial pipeline.

He stated that management was allegedly aware of the patient death during their recent restructuring conference call, suggesting that withholding this information could erode any remaining goodwill with investors. Schwartz added a broader commentary on the investment thesis, noting: “Fundamentally, we believe there can be a distinction between a good company and a good stock,” and clarified that his current view is now “driven purely by expected cash flows.”