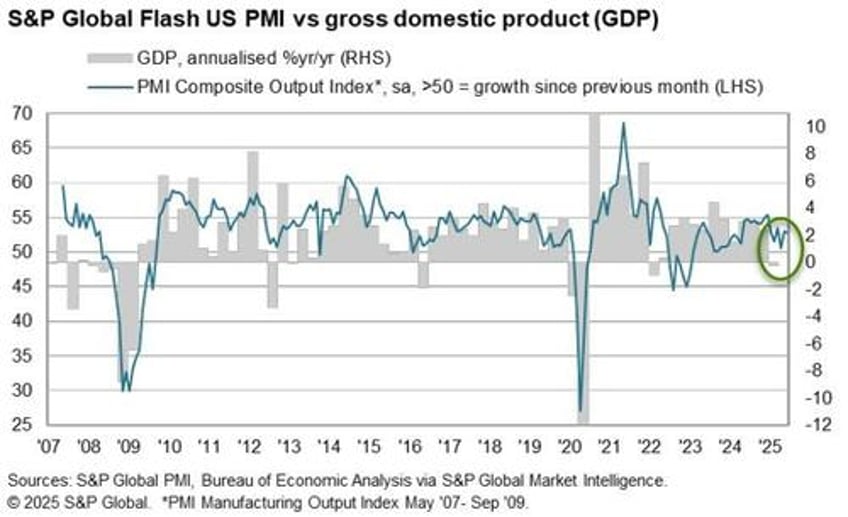

Following May's resurgence in 'soft' survey data, S&P Global's PMI surveys were expected to dip modestly in preliminary June data this morning.

But the picture was mixed with both Manufacturing flat (but beating expectations 52.0 vs 51.0 exp) and Services down very modestly (but beating expectations 53.1 vs 52.9 exp) rising at the start of June (even as hard data fades)...

Source: Bloomberg

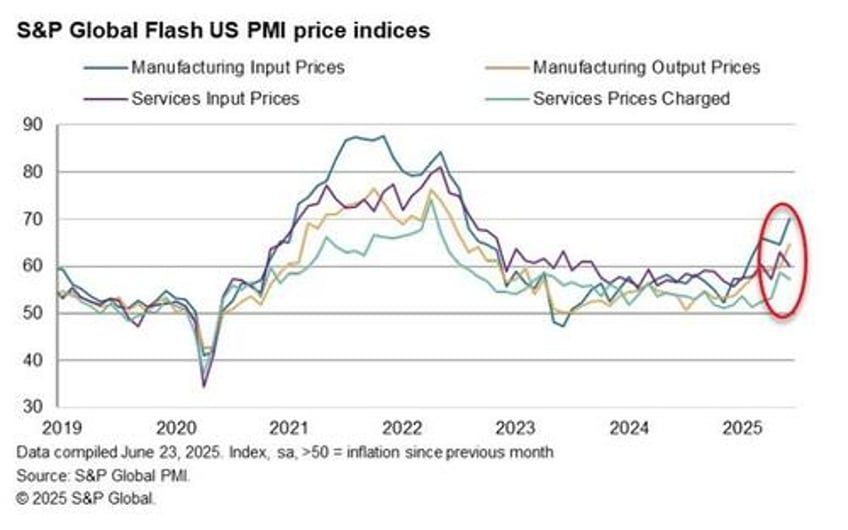

However, prices also rose sharply in the service sector, likewise often attributed to tariffs but also reflecting higher financing, wage and fuel costs. Service sector input costs and selling prices nonetheless rose at slower rates than in May, in part reflecting more intense competition.

Commenting on the flash PMI data, Chris Williamson, Chief Business Economist at S&P Global Market Intelligence said:

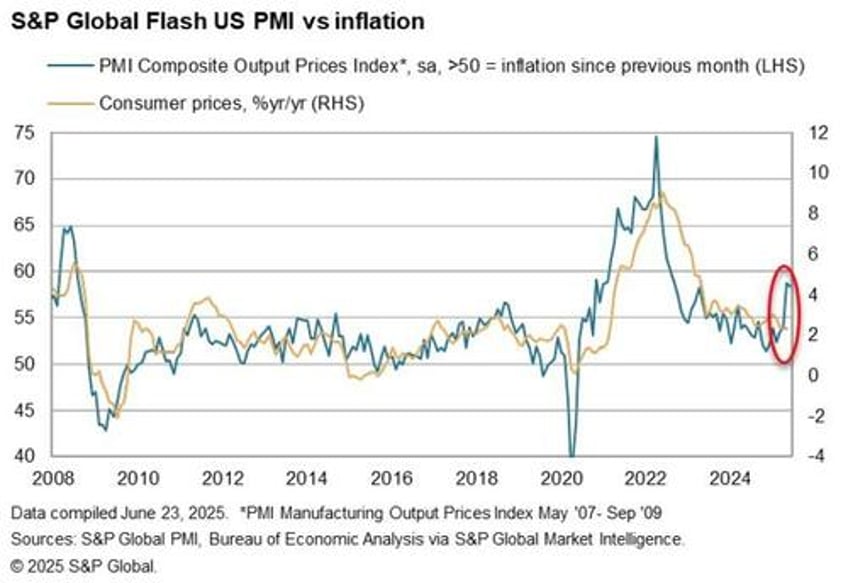

“The June flash PMI data indicated that the US economy continued to grow at the end of the second quarter, but that the outlook remains uncertain while inflationary pressures have risen sharply in the past two months.

“Although business activity and new orders have continued to grow in June, growth has weakened amid falling exports of both goods and services. Furthermore, while domestic demand has strengthened, notably in manufacturing, to encourage higher employment, this in part reflects a boost from stock building, in turn often linked to concerns over higher prices and supply issues resulting from tariffs. Such a boost is likely to unwind in the coming months.

But inflationary fears remais

“Prices for goods have meanwhile jumped sharply again, the rate of increase accelerating to a three year high as firms pass higher tariff-related costs on to customers. Service providers are by no means immune to this tariff impact and likewise reported another jump in prices, often linked to tariffs on inputs such as food.

“The data therefore corroborate speculation that the Fed will remain on hold for some time to both gauge the economy’s resilience and how long this current bout of inflation lasts for.”

So take your pick - better than expected but no ongoing recovery and prices are soaring.