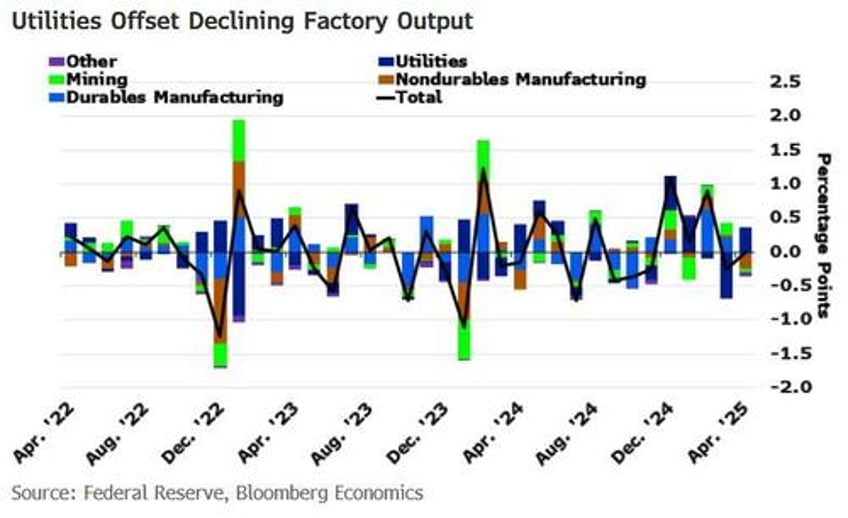

Headline industrial production held steady in April, driven by utilities production, while manufacturing production declined 0.4% due to decreased production of vehicles and nondurable goods.

Source: Bloomberg

The 0.4% decrease in manufacturing production (followed an upwardly revised 0.4% gain a month earlier) was the first decline since October 2024 and worse than the expected 0.3% decline...

Source: Bloomberg

However, as the chart above shows, despite the decline, upward revisions raised production by 1.2% YoY - the biggest rise since Oct 2022 (tariff-front-running?).

Output at utilities increased, while mining and energy extraction dropped.

The decrease in April factory output reflected declining production of motor vehicles, computers and apparel.

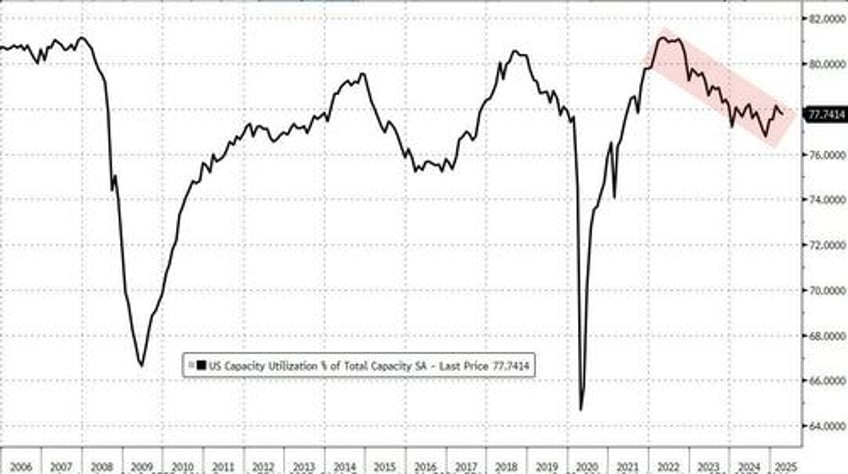

The Fed’s report showed capacity utilization at factories, a measure of potential output being used, fell to 76.8%.

Does April's decline mean we reached peak tariff-front-running? And will that drag down 'hard' data?