Implied volatility of traditional havens such as the Swiss franc and US Treasuries remains remarkably subdued despite the situation in the Middle East, even as the former has outperformed most other havens, including the dollar. However, vol is beginning to pick up, in a sign risks are beginning to be more fully priced in.

Volatility is typically episodic. Most of the time it is low or falling, but then punctuated by episodes of extreme fear when it spikes, before beginning to trend lower again. It is a good metaphor for human behavior: ignore a potential risk up until the last minute - either believing it’s not really a danger, or pretending it’s not there at all and hoping it will go away, i.e. the ostrich effect – and then panic when said risk does turn out to be major problem (the UK government’s response to the pandemic is a good example).

Recency bias perhaps explains why markets have been surprisingly calm in the face of the ratcheting up of tensions in the Middle East. The geopolitical backdrop across the world has been increasingly quarrelsome, but it has not so far led to a major multi-regional conflagration. With any luck that persists, but the generally still-contained volatility in most markets is perhaps not fully reflective of the underlying risks.

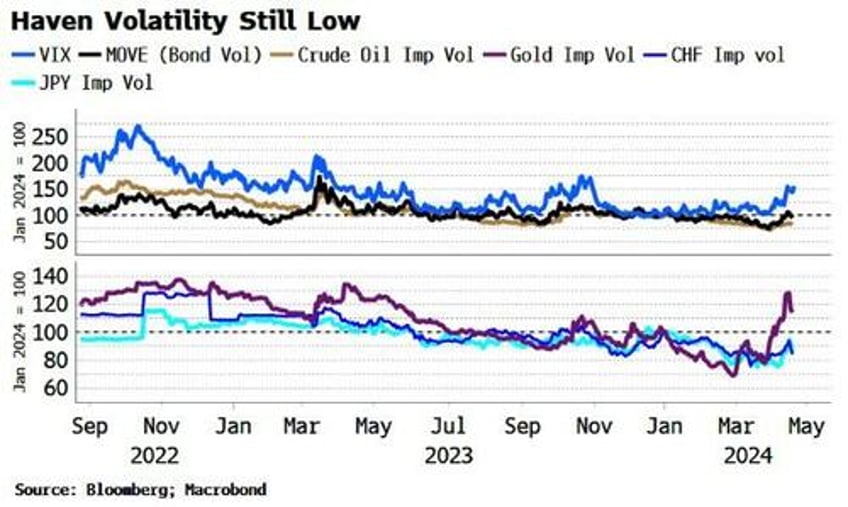

The chart below shows the implied volatility of bonds, the Swiss franc, the yen and crude oil has barely risen this year (all series are normalized to 100 at the start of the 2024).

We are seeing call skew in oil rising showing tail-risk probabilities are rising, even though at-the-money vol remains low.

The Swiss franc has been catching a bid, but that has so far not led to a significant marking up of its vols, while the yen is not acting as the haven it once did.

The VIX (blue line in top panel of chart) and gold volatility (purple line, bottom panel) have started to rise, but that has been more about inflation rather than geopolitical risks.

Generally, though, assets are not at panic stations, and therefore hedging portfolio risks is still cheap.