Nationally Recognized Statistical Rating Organizations (NRSRO’s), commonly referred to (incorrectly) as Rating Agencies and their ratings are not why anyone buys US treasuries.

US Treasuries are often mandated directly or included with other government backed debt in mandates.

The downgrade by Fitch is a non-event for yields.

It does play into our “hypothetical” question from a few months ago - “Will the sovereign ceiling apply to USD debt”?

Companies in other countries have difficulty achieving a rating higher than the country they are domiciled in, but I suspect that isn’t relevant here as this is largely a symbolic move.

Too much debt, debt ceiling negotiations etc. are issues, so the downgrade makes sense, but it won’t affect buying of treasuries.

One question I ask, at least in my own head, is what are the assets of the US?

Not the ability to tax, but the value of the land (national parks), and things like drilling rights.

Every company is examined, from a credit standpoint on their debt, their cash flow AND their assets.

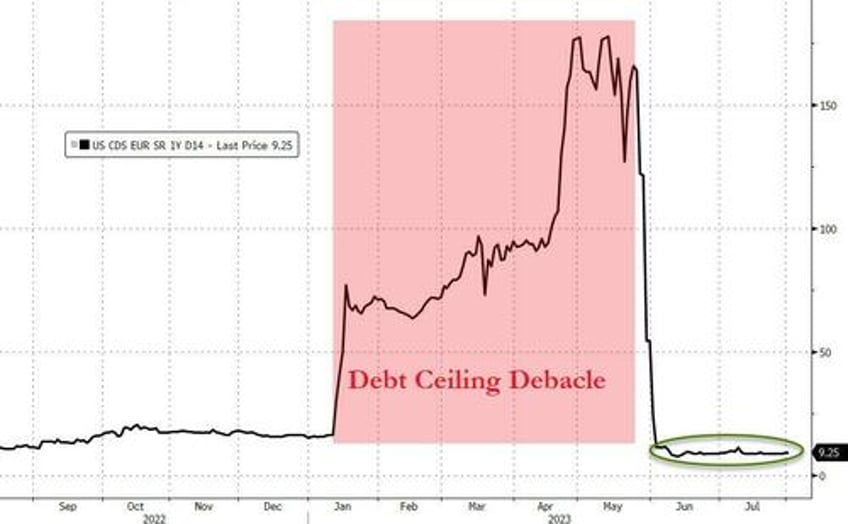

[ZH: USA Credit Risk has completely ignored the downgrade...]

I think this is a non-event from a US market standpoint. Maybe some dollar weakness, but even that seems like a stretch.