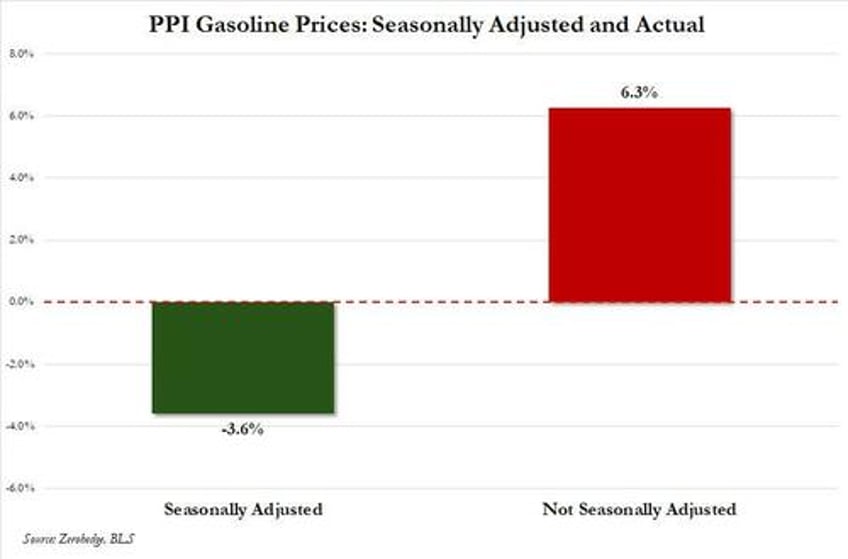

What started off as another ugly day with stocks tumbling and yields surging following yesterday's VaR-shock inducing CPI print, quickly reversed after the market - in its infinite stupidity - took what was a hot PPI print (core PPI came in at 2.4% vs Exp. 2.2% and up from 2.0%) but which the Biden BLS massaged just enough to make it appear that headline PPI actually missed (coming at 2.1% vs exp 2.2%), on what we earlier showed was blatant (and literal) gaslighting, with the entire miss the result of seasonal adjustments to gasoline prices which "dropped" by 3.6% even though they actually rose 6.3% to the highest price in 6 months.

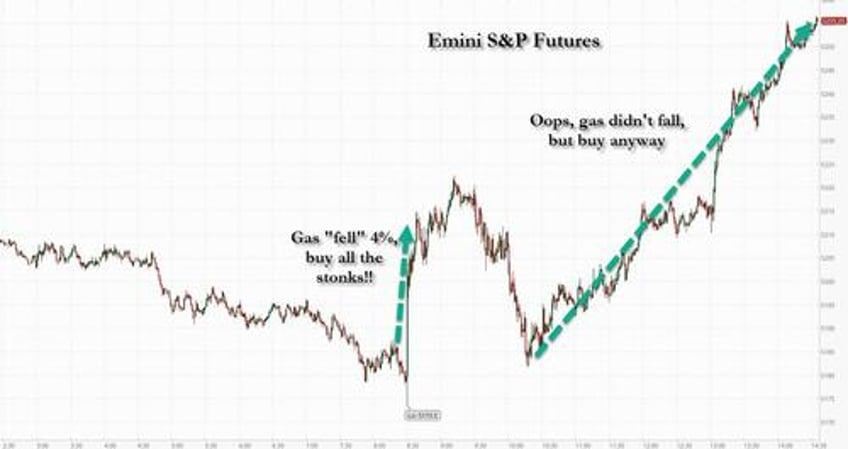

And while anyone with half a brain could quickly see through the PPI bezzle, that clearly did not apply to the algos, such as this one...

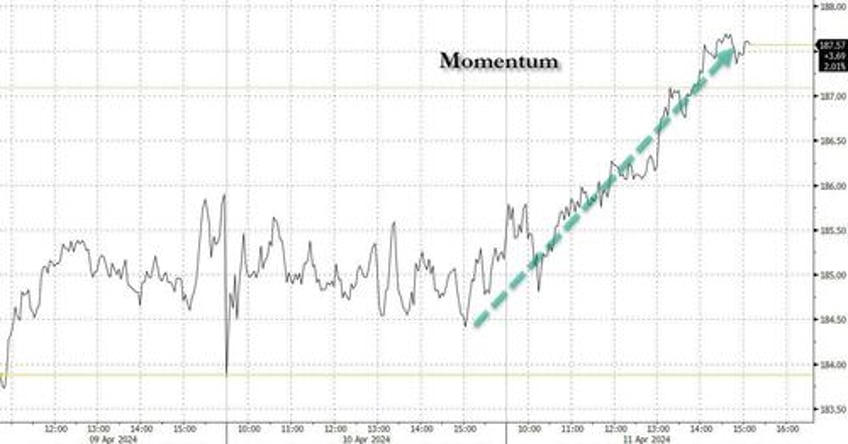

... who instead ramped spoos and even though a few of them realized just how stupid the initial move had been and dumped the early kneejerk ramp, the remainder - even dumber - went with the flow and shortly after the cash open, stocks went on one of their trademark diagonal ramps higher...

... or maybe it wasn't the algos, but rather 0DTE mean-reversion momos, who took advantage of the reversal in the first post-PPI kneejerk move and ramped momentum up in a one-way all day trade, via both 0DTE and total option delta, which was enough to drag the broader market higher.

The meltup was facilitated by low volumes (top of book liquidity dropped to $8.8MM, down 33% from the 5DMA), with Mega cap Tech (+115bps), 12M Winners (+107bps), and AI related names (+84bps) all at the top of the screens today, vs 12M Losers (-64bps) & Rate-sensitives Fins (-51bps) in the red.

One consequence of today's meltup is that stonks which had until recently been left for dead, like AAPL, enjoyed their best day in almost a year: indeed, AAPL's 4% gain at session highs, was the best intraday performance in over a year...

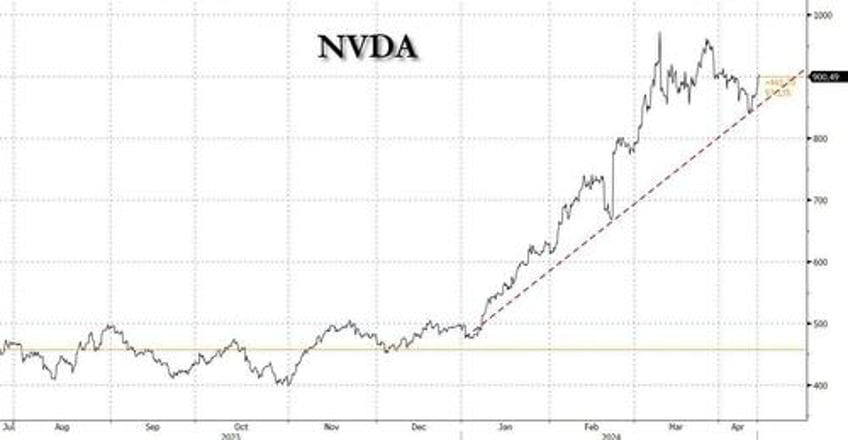

... and while traditionally AAPL had been used a "carry-trade" funder for other Mag 7 longs, today that was not the case, with NVDA also surging more than 3%, following a similar gain yesterday...

.. as the AI revolution leader came dangerously close to tripping both the 50DMA (at $818) yesterday, and the critical rising support line.

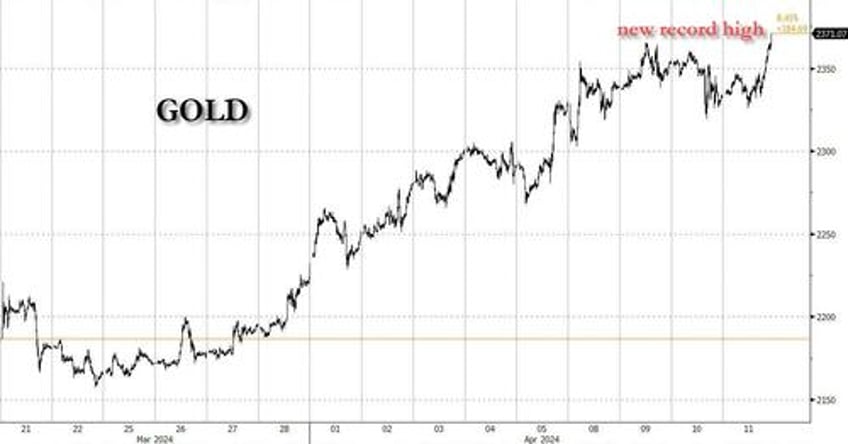

It wasn't just the Mag7s that saw a flood of buying: investors also rushed for what has become the darling trade in recent weeks, gold, which surged to a fresh all time high above $2,370.

And while many have said it's only a matter of time before gold restraces most of its recent gains, Pepperstone's Michael Brown points out that - just like with Bitcoin - there is "still no real spike in news/headline coverage as seen during previous rallies in recent times." Translation: the move can go on for longer until the euphoria finally sets in.

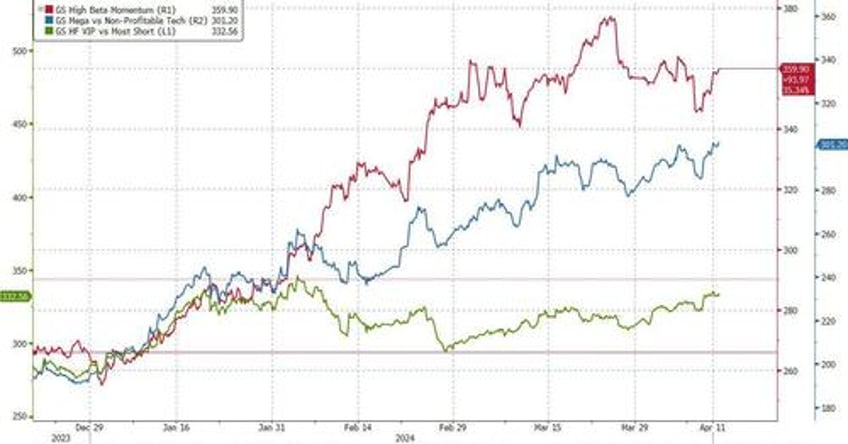

Taking a step back, the market heatmap was a familiar one: overall momentum names exploded higher once again in a desperate attempt to recapture the fading glory of January and February...

... while mega tech quietly breaks out to a new 2024 high vs unprofitable tech, while the HF VIP names less the most shorted names are barely up on the year.

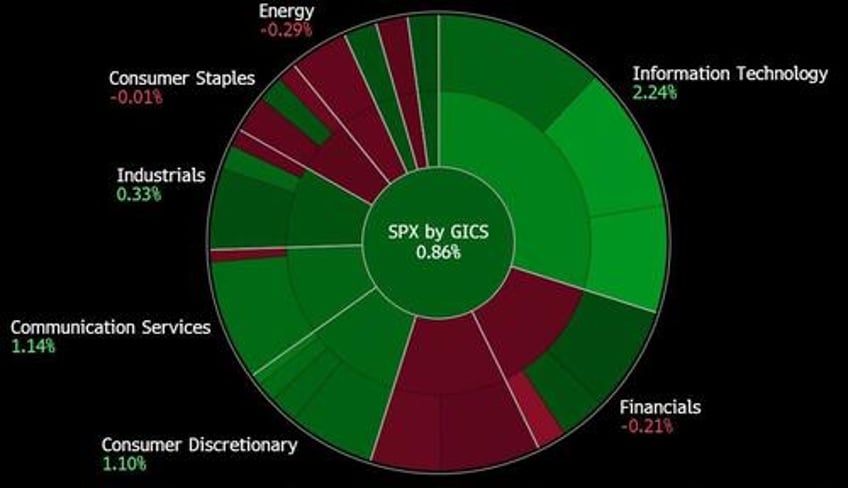

... while the classical cyclical sectors - energy, banks, healthcare - lagged once again.

A closer look at some sector level highlights:

- Consumer: KVUE: Big move (-4%) on a sell initiation. Feedback from most is story is clearly not perfect, with some organic sales whiffs since coming public, which has kept many on the sidelines, but pushback to an outright sell rating given the valuation/level. Goldman's desk is very active in this one.

- TMT: SEMIS ACTIVE- MRVL -2% in focus amidst AI event...traded 1mm+ 2-ways yesterday. other Semis flow + px action mixed w/ MRVL event ongoing. Still seeing demand in QUALITY cohort although magnitude is less than yesterday... Seeing buy tix early in GOOG/L & AMZN

- RV: ALPN the focus today. A quick turnaround from a rumored deal yesterday to a definitive situation overnight with Vertex acquiring the business in a nearly $5bn transaction (67% premium; ~4.8x 2023 consensus sales). The transaction is expected to trade fairly tight to deal terms.

It is possible that one catalyst behind today's meltup is to avoid what could be a cascade lower: as Goldman writes in its mid-day market recap, "CTA trigger levels continue to be back in focus.. short term = 5130, med term = 4862, long term = 4607. Over the next 1 month, CTA's are large sellers of a down tape ($201.5B)." Naturally, the best way to prevent CTAs from selling is to prevent stocks from dropping the first place...

In this context, we found this stat from Goldman Prime interesting: Yesterday’s notional short selling in Macro Products was the largest in over 3 years. ETF shorts increased +4.3%, the largest 1-day increase since Feb '23. Translation: we were this close to the bottom falling off from below the market.

Yet one place where there was little buying interest is arguably the most important asset for the market: 10Y yields rose as high as 4.59 and continue to trade in the redzone. Any breakout here and the next stop is 4.75%,

Some more stats from Goldman's trading desk (full analysis available to pro subs):

- Volumes tracking -7% vs the 20dma with macro volumes higher for the second day in a row, capturing 32% of the overall tape.

- The floor is skewed -3% better for sale, with HF’s leading the way (-5.8% net sellers). HF’s are selling HC and Consumer Discretionary names, + interesting to note their ETF’s short ratio continues to be very elevated, at 75%. HF’s are buying Info Tech.

- LO’s are also skewed -2% better for sale, led by Supply in HC, Info Tech, and Macro Products. They are buyers of Consumer Discretionary but overall notional across the group is very light.

And with today's pandemonium in the books, we now await the official start of earnings season tomorrow when the big banks report Q1 results.