Over the weekend we speculated that between the near-record hedge fund shorting - the second largest in the past five years - last week, and the Trump put in bitcoin announced on Sunday, we would see a powerful short squeeze (Goldman certainly did). And while we did see a spike in risk overnight and in the first minute of trading, that promptly reversed as stocks have sunk all day, hitting session lows in the afternoon, nearly 100 points off intraday highs.

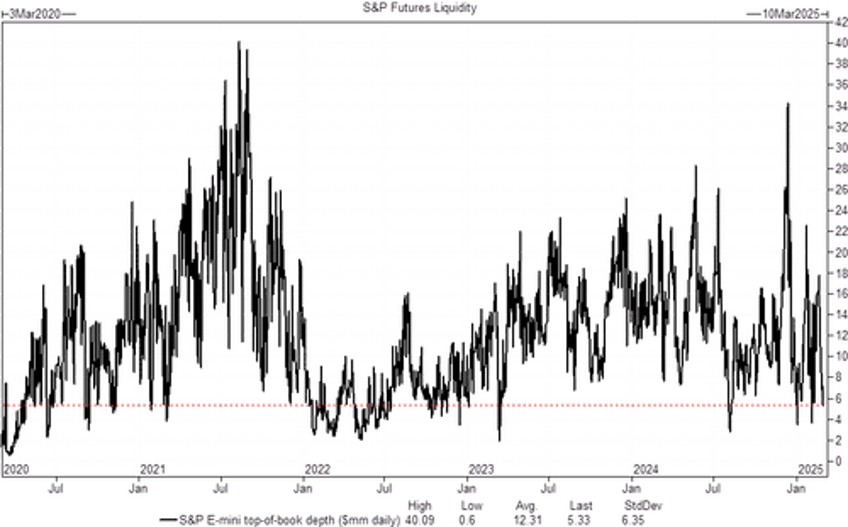

What is behind this latest bearish reversal? Two things: first, the market remains extremely illiquid, with top of book depth in the Emini, and any sizable blocks can quickly set momentum, whether higher or lower.