A better than expected headline payrolls print has sparked a surge in stocks and bond yields this morning as the long-await (and hoped for by some) recessionary collapse in the labor market remains elusive.

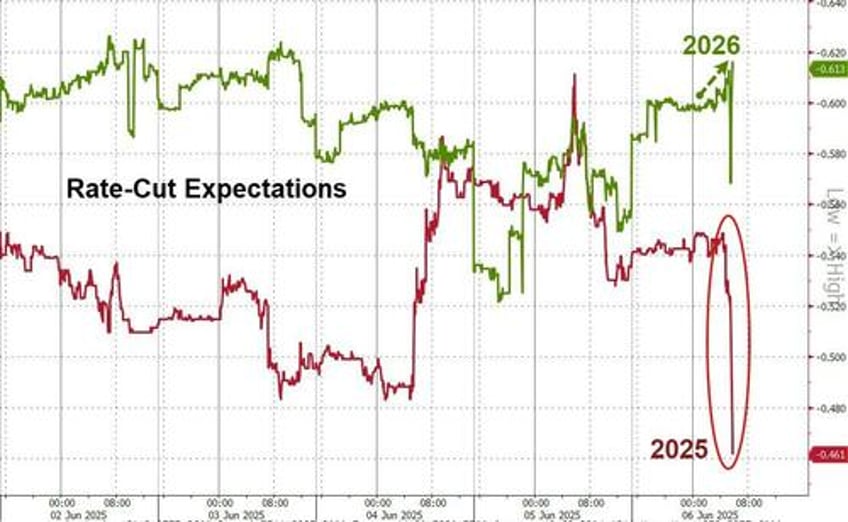

Even if below the surface things are not so healthy, rate-cut expectations for 2025 have plunged to less than two total cuts (2026 expectations up marginally)...

Never one to miss an opportunity - even on a day when he should probably take a break from social media - President Trump dropped some more advice for Fed Chair Powell:

Strong unemployment, falling inflation, and no signs (except in partisan survey responses) of economic weakness from Trump's tariff-nado. One has to wonder what it is that Powell is waiting for... unlike in September of last year?

Finally, one thought - is this Trump pivoting his rage from Musk to Powell - a far easier, and less wealthy, opposition.