Winnebago Industries issued a profit warning ahead of its presentation at the Baird 2025 Global Consumer, Technology & Services Conference on Thursday, citing weakening demand across the RV market and increased macroeconomic headwinds.

For the third quarter, Winnebago forecasted net revenue of $775 million, falling short of the Bloomberg consensus estimate of $810.4 million. The company also guided adjusted earnings per share in the range of $0.75 to $0.85. Analysts expect the company to report a profit per share of $1.37. All in all, this marked a significant downward revision, highlighting the depth of demand weakness in the RV market.

Preliminary Third Quarter Earnings Results:

Prelim net revenue about $775 million, estimate $810.4 million (Bloomberg Consensus)

Prelim adjusted EPS 75c to 85c, estimate $1.37

"What began as an encouraging selling season in March was hampered by growing macroeconomic uncertainty, resulting in worsening consumer sentiment and an increasingly cautious dealer network in the final two months of our fiscal third quarter," stated Winnebago CEO Michael Happe.

Raymond James analyst Joseph Altobello told clients, "Winnebago Industries announced disappointing preliminary F3Q results this morning that reflect both weaker consumer sentiment and an increasingly cautious dealer base."

Truist analyst Michael Swartz noted that the challenges facing Winnebago are neither new nor unique to the company, but rather indicative of broader, ongoing headwinds across the entire RV industry.

"While the Winnebago Motorized unit is now a much smaller piece of business, today's announcement will likely amplify questions/concerns around the motorized market, in general, and whether larger strategic actions need to be undertaken amid a depressed retail environment," Swartz said.

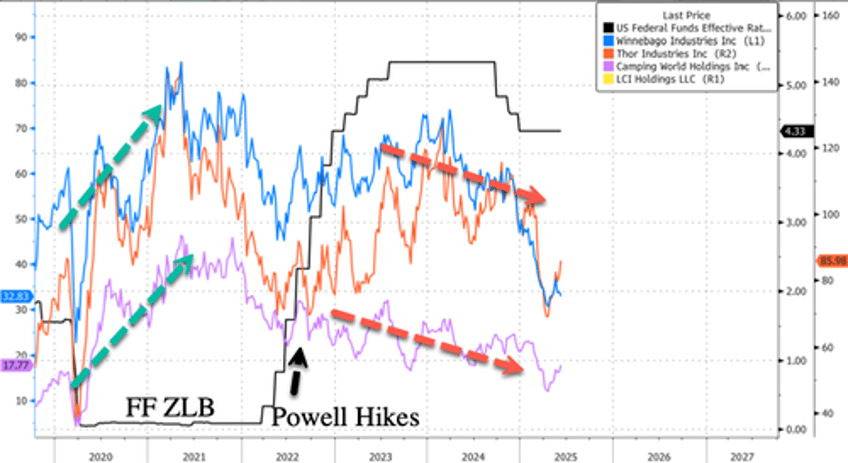

The RV industry experienced a boom during the early pandemic years, fueled by a zero-interest-rate environment ushered in by Fed Chair Jerome Powell that unleashed a flurry of retail demand. However, that demand quickly unraveled once Powell began aggressively hiking rates in early 2022, triggering a sharp pullback in camper sales in the quarters that followed.

Additionally, camper stocks and retail shops that cater to the industry have been in a slump since rates increased.

The RV downturn ends when rates go back down.