By Philip Marey, Senior US strategist at Rabobank

On the same day that the fiscal hawks among the House Republicans blocked their own party’s tax and spending bill because it pushes up the budget deficit in the short run, Moody’s downgraded US government debt from Aaa to Aa1. Moody’s said that expanding budget deficits mean US government borrowing will rise at an accelerating rate, pushing interest rates up over the long term. In fact, Moody’s didn’t believe that any current budget proposals under consideration by lawmakers would do anything significant to reduce the persistent gap between government spending and revenues. According to the rating agency, successive US administrations and Congress have failed to agree on measures to reverse the trend of large annual fiscal deficits and growing interest costs.

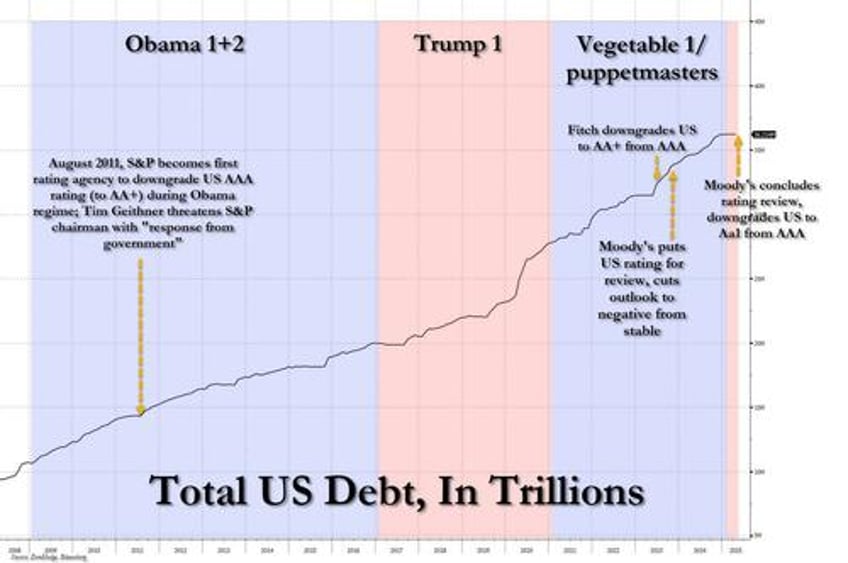

In November 2023, Moody’s lowered the US rating outlook to negative from stable while affirming the nation’s rating at Aaa, so the downgrade was just a matter of time. On Friday, Moody’s shifted its outlook on US debt to stable, noting the nation retains exceptional credit strength such as the size, resilience and dynamism of its economy and the role of the US dollar as global reserve currency. Treasury Secretary Scott Bessent, in Meet the Press, on Sunday, said that Moody’s was a lagging indicator and that this has been caused by the Biden administration. After the downgrade, US treasury yields jumped from about 4.44% to almost 4.50% on Friday. This morning, it climbed further to 4.52%. Moody’s is the last of the three big rating agencies to downgrade US debt. Fitch downgraded the US in August 2023 by one level to AA+, and S&P was the first major credit agency to strip the US of its AAA rating back in 2011. Moody’s downgrade does not tell markets anything they did not know and in fact, recent movements in US treasury yields and the US dollar may be of more concern than the official downgrade by a rating agency.

Earlier on Friday, five Republican members of the House Budget Committee voted against advancing the “one big, beautiful bill”, four because they think it front-loads tax cuts in the next few years and delays spending cuts, causing a rise in the budget deficit in the short run. They want bigger cuts in social programs and a faster removal of clean-energy tax credits. On Sunday, the House Budget Committee resumed its session and finally approved the measure for floor action. The Republicans still hope to get the bill through the full House of Representatives before Memorial Day (May 26). Trump wants the bill passed by both the House and the Senate by Independence Day (July 4).

Week ahead

Today, the Conference Board’s Leading Economic Index for the US will be published. Atlanta Fed President Raphael Bostic gives welcome remarks at the Atlanta Fed's "Financial Intermediation In Transition" conference in Florida. Fed Vice Chair Philip Jefferson And Dallas Fed President Lorie Logan give keynote remarks at the same event. Probably more relevant for monetary policy is Bostic’s interview on Bloomberg TV today. In an interview released on Friday, Bostic said he expected only one rate cut this year, because the uncertainty about the economic outlook is unlikely to resolve itself quickly, and tariffs may put upward pressure on inflation. Elsewhere, New York Fed President John Williams speaks in a moderated conversation at an event organized by the Mortgage Bankers Association. Minneapolis Fed President Neel Kashkari will take part in a moderated Q&A at the University of Minnesota.

On Tuesday, the German PPI and the Canadian CPI for April will be released. Euro zone consumer confidence for May is also scheduled. ECB Governing Council member Pierre Wunsch delivers a keynote speech, ECB Executive Board member Piero Cipollone appears in pre-recorded video interview, and ECB's Knot presents DNB's Financial Stability Overview. Across the channel, BoE Chief Economist Huw Pill also speaks. Across the pond, Richmond Fed President Tom Barkin gives a speech at the Richmond Fed's Investing in Rural America Conference. Boston Fed President Susan Collins will host a Fed Listens event and offer brief remarks, but no discussion of current monetary policy and the outlook. More interesting is St. Louis Fed President Alberto Musalem’s speech on the economy and monetary policy at the Economic Club of Minnesota, including a Q&A.

On Wednesday, we get Japan’s trade balance for April, and the UK CPI and RPI for April. The ECB's Guindos presents the Financial Stability Review and ECB Chief Economist Philip Lane discusses "Negative interest rates and the impact of monetary policy," perhaps a bit academic at this time. ECB Governing Council member Jose Luis Escriva speaks at an event near Madrid. In Florida, San Francisco Fed President Mary Daly and Cleveland Fed President Beth Hammack participate in a panel discussion at the "Financial Intermediation In Transition" conference. Richmond Fed President Tom Barkin and Fed Governor Michelle Bowman will participate in a Fed Listens event.

On Thursday, a lot of survey data for May will be published: the German Ifo index, the HCOB PMIs for manufacturing and services for the Euro zone and individual countries, and the S&P Global PMIs for manufacturing and services for the UK and the US. We also get US initial jobless claims for the week ending on May 17, and US existing home sales for April. The ECB publishes its account of the April 16-17 policy meeting.

We also get a lot of central bank speakers. Starting with the ECB, Governor Robert Holzmann delivers opening remarks at the OeNB conference on "Monetary policy and structural tectonic shifts." The ECB’s Vujcic delivers an introductory presentation on the topic: "In Uncharted Waters: Macroeconomic Prospects in the Conditions of a Trade War." ECB Executive Board member Frank Elderson gives a speech on World Biodiversity Day in Leiden, the Netherlands. ECB Vice President Luis de Guindos and Spanish central-bank head Jose Luis Escriva speak at a conference on “Global Challenges for a New Era in Economics, Geopolitics.” Finally, ECB Governing Council member Joachim Nagel holds a press conference with the German Finance Minister Lars Klingbeil in Banff, Canada.

On behalf of the BoE, Deputy Governor Sarah Breeden speaks on a panel on "climate liquidity crisis – the rising financial risks of climate change," BoE rate-setter Swati Dhingra speaks on a panel titled "Made in the UK: trade and productivity in British firms 2005-2022," and BoE Chief Economist Huw Pill delivers keynote speech at Austrian central bank conference mentioned earlier.

On Friday, the ECB’s Philip Lane holds a lecture on “Inflation and disinflation in the euro area” at the European University Institute in Florence. On the other side of the Atlantic, Canadian retail sales for March and US new home sales for April will be published. New York Fed President John Williams will give keynote remarks at a New York Fed event. He will have a prepared text and there is a Q&A. By the end of the week, the House Republicans should pass their tax and spending bill in order to meet their self-imposed deadline.