As DB's Jim Reid writes in his weekly preview, "in terms of what the market has been through in recent weeks we could all do with a lie down and there are some hopes of that this week given the scarcity of front line data. However as we know the headlines will keep coming, especially with regards to trade."

Sure enough, it‘s likely that fiscal developments in Washington will take center stage with the House expected to vote on its reconciliation package this week just as Moody's removed the US's last remaining triple-A rating late on Friday night. As DB's economists discussed last week, though the specific components of additional tax cuts on top of the TCJA extension differed from what they had previously outlined, the JCT score of the Ways and Means mark-up was largely in line with top-line deficit assumptions. Assuming House Republicans are able to resolve their outstanding policy disagreements and vote on the tax package this week, the Senate will then start to mark up the bill, where even more policy disagreements await. One thing stands out though, and that is that at this stage there are no signs of any serious deficit restraint.

The flash global PMIs for May released on Thursday will be the main data focal point this week given that it should fully cover a period of trade uncertainty. European numbers are expected to edge up with US numbers broadly flat. Elsewhere inflation in Canada (tomorrow), the UK (Wednesday) and Japan (Friday - preview here) will be of note. Other things to watch are the RBA decision tomorrow, where DB expect a 25bps cut (preview here), the account of the April ECB decision, the German Ifo and US jobless claims, all on Thursday.

This week’s jobless claims corresponds to payrolls survey week so it will allow banks to refine their current forecast for May. The full day-by-day week ahead is at the end as usual but there’s not a lot of high profile releases. There are though plenty of central bank speakers and these are also highlighted in that calendar. Many are speaking at the Atlanta Fed's annual Financial Markets Conference in Amelia Island, Florida which starts today through to Thursday. Other things to note are the UK-EU summit will be in London today. Then tomorrow, G7 finance ministers and central bankers convene in Canada (through May 22) and the EU's foreign and defence ministers meet in Brussels.

Courtesy of DB, here is a day-by-day calendar of events

Monday May 19

- Data: US April leading index, China April retail sales, industrial production, home prices, property investment, Japan March Tertiary industry index

- Central banks: Fed's Bostic, Jefferson, Williams, Kashkari and Logan speak, ECB's Muller speaks

- Earnings: Trip.com, Ryanair

- Other: UK-EU summit in London

Tuesday May 20

- Data: US May Philadelphia Fed non-manufacturing activity, China 1-yr and 5-yr loan prime rates, Germany April PPI, Italy March current account balance, ECB March current account, Eurozone March construction output, May consumer confidence, Canada April CPI, Denmark Q1 GDP

- Central banks: Fed's Bostic, Barkin, Collins and Musalem speak, ECB's Wunsch, Cipollone and Knot speak, BoE's Pill speaks, RBA decision

- Earnings: Home Depot, Palo Alto Networks, Vodafone

- Other: G7 finance ministers and central bankers meeting in Canada (through May 22), EU's foreign and defence ministers meeting in Brussels

Wednesday May 21

- Data: UK April CPI, RPI, March house price index, Japan April trade balance

- Central banks: Fed's Hammack, Daly, Bostic, Barkin and Bowman speak, ECB's Lane and Guindos speak

- Earnings: TJX, Medtronic, Snowflake, Target, Baidu, SSE, XPeng, Marks & Spencer

- Auctions: US 20-yr Bonds ($16bn)

Thursday May 22

- Data: US, UK, Japan, Germany, France and the Eurozone May flash PMIs, US April Chicago Fed national activity index, existing home sales, May Kansas City Fed manufacturing activity, initial jobless claims, UK April public finances, Japan March core machine orders, Germany May Ifo survey, France May business confidence, April retail sales, Canada April industrial product price index, raw materials price index

- Central banks: Fed's Williams speaks, ECB account of the April meeting, Holzmann, Vujcic, Elderson, Guindos, Escriva and Nagel speak, BoJ's Noguchi speaks, BoE's Pill, Breeden and Dhingra speak

- Earnings: Intuit, Analog Devices, Workday, Generali, Lenovo

- Auctions: US 10yr TIPS (reopening, $18bn)

Friday May 23

- Data: US April new home sales, May Kansas City Fed services activity, UK May GfK consumer confidence, April retail sales, Japan April national CPI, France May consumer confidence, Canada March retail sales

- Central banks: ECB's Lane speaks

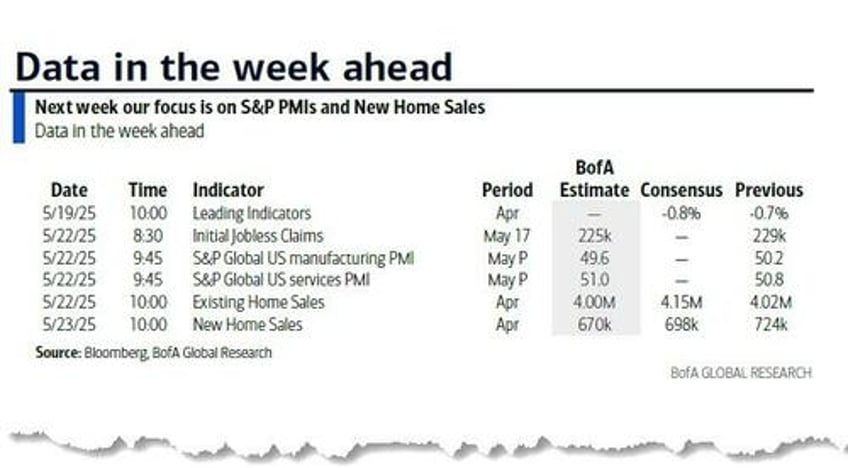

Finally, looking at just the US, Goldman notes that the key economic data releases this week are initial jobless claims on Thursday and new home sales on Friday. There are many speaking engagements by Fed officials this week, including Chair Powell, Vice Chair Jefferson, and Governors Kugler and Cook.

Monday, May 19

- There are no major economic data releases scheduled.

- 08:30 AM Atlanta Fed President Bostic (FOMC non-voter) speaks: Atlanta Fed President Raphael Bostic will give welcome remarks at the Atlanta Fed's "Financial Intermediation In Transition" conference in Fernandina Beach, Florida.

- 08:45 AM Fed Vice Chair Jefferson speaks: Fed Vice Chair Philip Jefferson will give keynote remarks at the Atlanta Fed's "Financial Intermediation In Transition" conference. Atlanta Fed President Raphael Bostic will moderate. Speech text and Q&A are expected. On May 14, Jefferson said that he will be "watching for signs that the labor market could cool as tariff increases," and that tariffs "are likely to interrupt progress on disinflation and generate at least a temporary rise in inflation." He later said that "With the increased risks to both sides of our mandate, I believe that the current stance of monetary policy is well positioned to respond in a timely way to potential economic developments."

- 08:45 AM New York Fed President Williams (FOMC voter) speaks: New York Fed President John Williams will speak in a moderated conversation at an event organized by the Mortgage Bankers Association. Q&A is expected. On April 11, Williams said, "The current modestly restrictive stance of monetary policy is entirely appropriate given the solid labor market and inflation still above our 2 percent goal." He added that the current stance of policy "gives us the opportunity to assess incoming data and developments and ultimately positions us well to adjust to changing circumstances that affect the achievement of our dual mandate goals."

- 01:15 PM Dallas Fed President Logan (FOMC non-voter) speaks: Dallas Fed President Lorie Logan will give remarks and will moderate a panel titled "The increasing role of nonbank institutions in the Treasury and money markets" at the Atlanta Fed's "Financial Intermediation In Transition" conference. Speech text is expected. On April 10, Logan said, "To sustainably achieve both of our dual-mandate goals, it will be important to keep any tariff-related price increases from fostering more persistent inflation. For now, I believe the stance of monetary policy is well positioned."

- 01:30 PM Minneapolis Fed President Kashkari (FOMC non-voter) speaks: Minneapolis Fed President Neel Kashkari will take part in a moderated Q&A at the Minnesota Young American Leaders Program at the University of Minnesota. On April 22, Kashkari said that the two sides of the Fed's dual mandate are "in tension right now because of the nature of this policy change that’s hitting the economy." He also said that "There’s a very logical argument to be made that a tariff is a one-time increase in prices and then inflation should be low going forward. The challenge is that we’ve had four years of high inflation. So, with that backdrop, are we running the risk of allowing inflation expectations to become unanchored?"

- 02:45 PM Atlanta Fed President Bostic (FOMC non-voter) speaks: Atlanta Fed President Raphael Bostic will be interviewed on Bloomberg TV.

Tuesday, May 20

- There are no major economic data releases scheduled.

- 09:00 AM Atlanta Fed President Bostic (FOMC non-voter) speaks: Atlanta Fed President Raphael Bostic will give welcome remarks at the Atlanta Fed's "Financial Intermediation In Transition" conference.

- 09:00 AM Richmond Fed President Barkin (FOMC non-voter) speaks: Richmond Fed President Tom Barkin will give a speech at the Richmond Fed's Investing in Rural America Conference. Speech text is expected.

- 09:30 AM Boston Fed President Collins (FOMC voter) speaks: Boston Fed President Susan Collins will host a Fed Listens event and offer brief remarks. Speech text is expected. On April 10, Collins said "Maintaining the current monetary policy stance seems appropriate for the time being, as we learn more about the scope of changes in government policy and their impact on the economy." She added that "It may still be appropriate to lower the federal funds rate later this year. But renewed price pressures could delay further policy normalization."

- 01:00 PM St. Louis Fed President Musalem (FOMC voter) speaks: St. Louis Fed President Alberto Musalem will speak on the economy and monetary policy at the Economic Club of Minnesota. Speech text and Q&A are expected. On May 9, Musalem said, "It is possible that higher inflation will be short lived and mostly concentrated in the second half of 2025, [but]... It is equally likely that inflation could prove to be more persistent." He added that "The risks of higher and more persistent inflation are currently elevated because: the pre-tariff starting point for inflation is above target; the recent period of elevated inflation likely has raised the public’s sensitivity to it; some measures of inflation expectations have risen; and tariffs apply broadly to intermediate inputs, prompting global supply chains’ rearrangement."

- 05:00 PM Fed Governor Kugler speaks: Fed Governor Adriana Kugler will give a commencement address at the Spring 2025 Berkeley Economics Commencement Ceremony. Speech text is expected. On May 12, Kugler said that, as a result of the effects of tariffs on the economy, "Ultimately, I see the U.S. as likely to experience lower growth and higher inflation."

- 07:00 PM Cleveland Fed President Hammack (FOMC non-voter) and San Francisco Fed President Daly (FOMC non-voter) speak: San Francisco Fed President Mary Daly and Cleveland Fed President Beth Hammack will participate in a panel discussion moderated by Atlanta Fed President Raphael Bostic at the Atlanta Fed's "Financial Intermediation In Transition" conference. On April 24, Hammack said, "I think it’s too soon [to make policy decisions]... We want to make sure we’re moving in the right direction, rather than moving quickly in the wrong direction." She added that "If we have clear and convincing data by June, then I think you’ll see the committee move, if we know which way is the right way to move at that point." On May 14, Daly said that policy is in a "good position" to respond to the evolving outlook, adding that when considering the path of policy, "patience is the word of the day."

Wednesday, May 21

- There are no major economic data releases scheduled.

- 12:15 PM Richmond Fed President Barkin (FOMC non-voter) and Fed Governor Bowman speak: Richmond Fed President Tom Barkin and Fed Governor Michelle Bowman will participate in a Fed Listens event.

Thursday, May 22

- 08:30 AM Initial jobless claims, week ended May 17 (GS 230k, consensus 228k, last 229k); Continuing jobless claims, week ended May 10 (last 1,881k)

- 09:45 AM S&P Global US manufacturing PMI, May preliminary (consensus 49.8, last 50.2); S&P Global US services PMI, May preliminary (consensus 51.1, last 50.8)

- 10:00 AM Existing home sales, April (GS -2.0%, consensus +2.7%, last -5.9%)

- 02:00 PM New York Fed President Williams (FOMC voter) speaks; New York Fed President John Williams will give keynote remarks at a New York Fed event. Speech text and Q&A are expected.

Friday, May 23

- 09:35 AM St. Louis Fed President Musalem (FOMC voter) and Kansas City Fed President Schmid (FOMC voter) speak: St. Louis Fed President Alberto Musalem and Kansas City Fed President Jeff Schmid will participate in a fireside chat on the Fed and the economy. Q&A is expected.

- 10:00 AM New home sales, April (GS -3.0%, consensus -4.7%, last +7.4%)

- 12:00 PM Fed Governor Cook speaks: Fed Governor Lisa Cook gives a speech on financial stability at the Seventh Annual Women in Macro Conference. Speech text is expected. On May 9, Cook said, "I expect to see a drag on productivity in the near term stemming from the recent changes to trade policy and the related uncertainty [because]... uncertainty around trade policy is likely to reduce business investment going forward; protectionist trade policies, while intended to support domestic industries, may inadvertently lead to a less competitive environment, if they prop up less efficient firms; and any supply-chain disruptions resulting from the policy changes would make production slower and less efficient."

Source: BofA, Goldman