No-good, terrible, bad news about the US labor market (coupled with a tumble in consumer confidence and uptick in inflation expectations) sparked chaos across multiple asset-classes today.

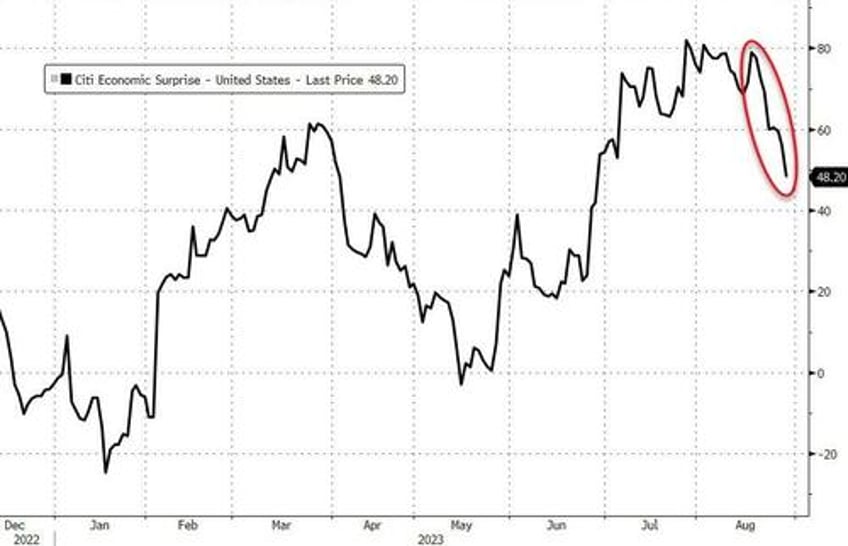

US Macro data has disappointed for 8 straight days, its biggest serial disappointment since June 2022...

Source: Bloomberg

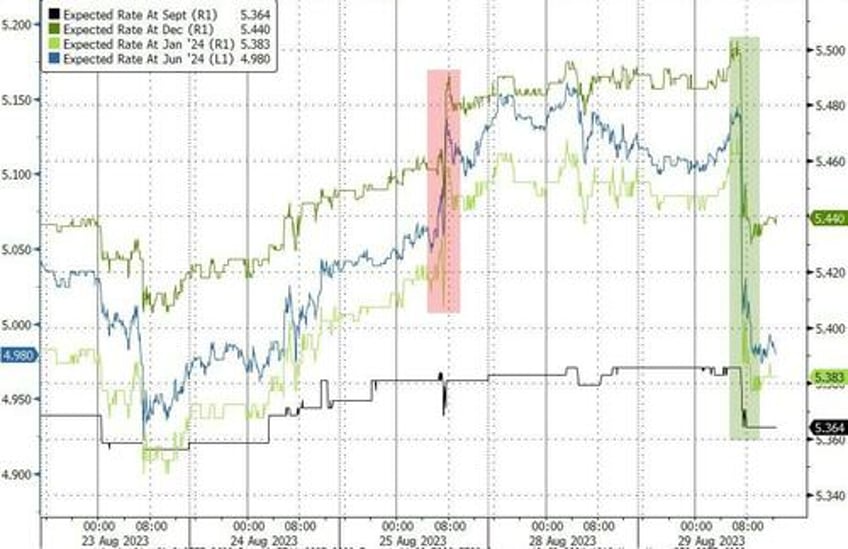

The bad news sent the market's expectations for Fed rate changes dramatically (dovishly) lower, erasing all of the post-Powell hawkish shift...

Source: Bloomberg

Stocks were already lifting at the cash open, then ripped higher after the dismal jobs data with long-duration equities outperforming...

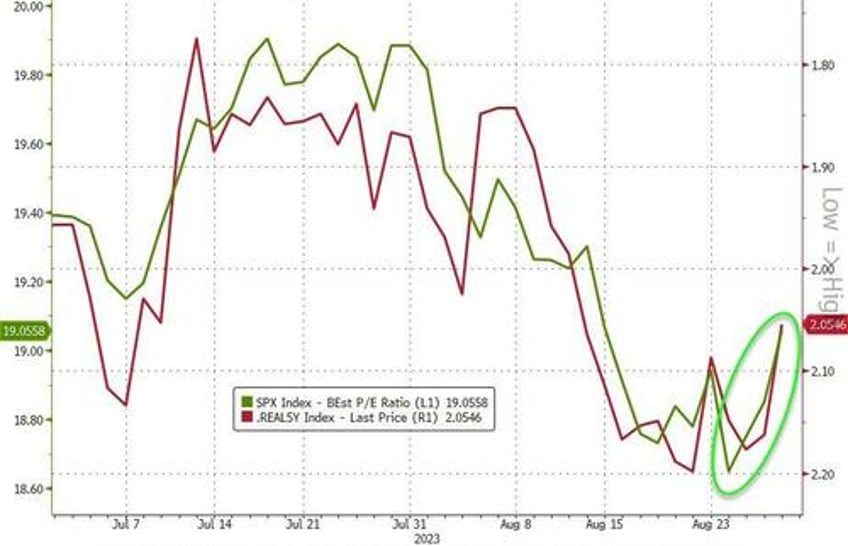

The decline in real yields supported a higher valuation for stocks...

Source: Bloomberg

The S&P 500, Nasdaq, and Dow all managed to close back above their 50DMAs...

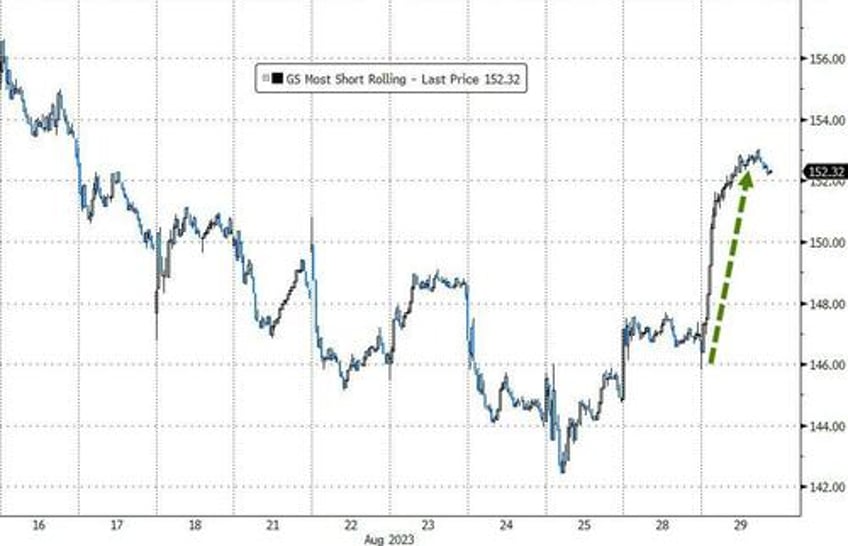

'Most Shorted' stocks squeezed higher - the biggest surge in a month...

Source: Bloomberg

0-DTE traders faded the early gains (and covered) and then faded the rally in the S&P after Europe closed (and covered)...

NVDA did its thing, surging back above pre-earnings close highs (topping $490) before sliding back

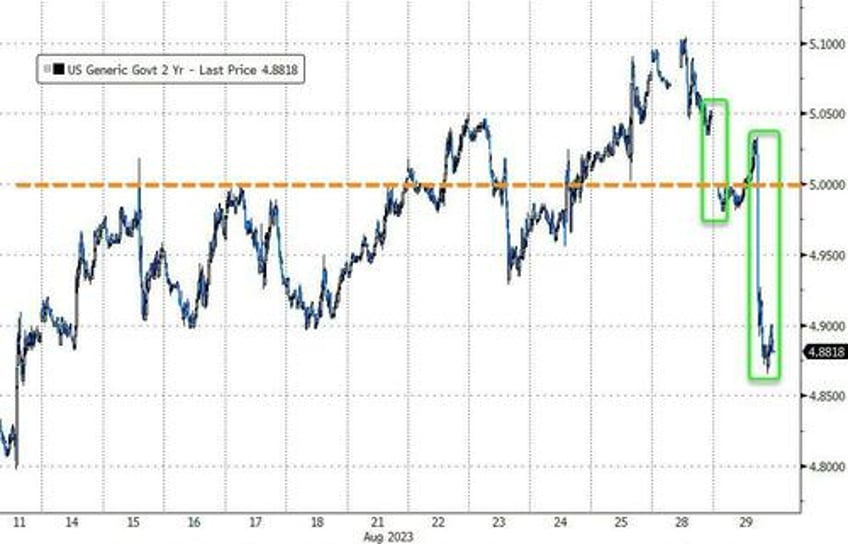

Bonds were aggressively bid with the short-end outperforming...

Source: Bloomberg

2Y Yields tumbled back below 5.00%...

Source: Bloomberg

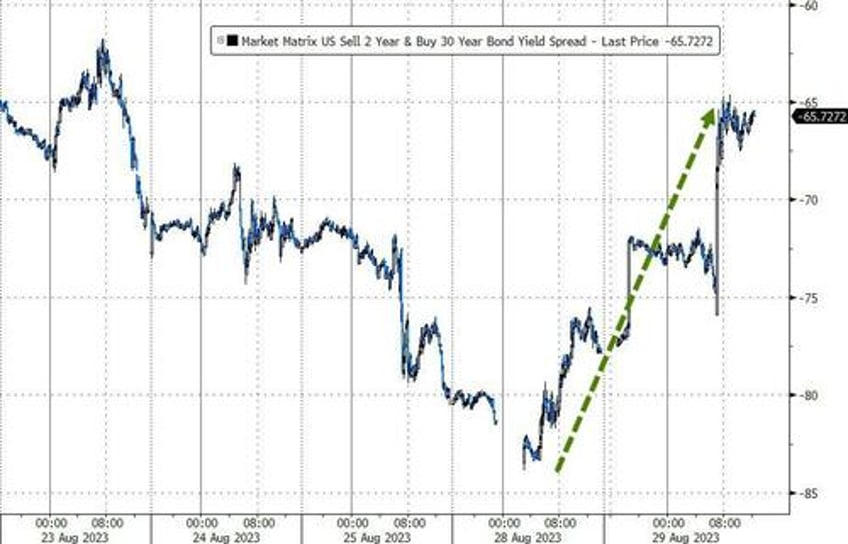

...and the yield curve (2s30s) steepened significantly...

Source: Bloomberg

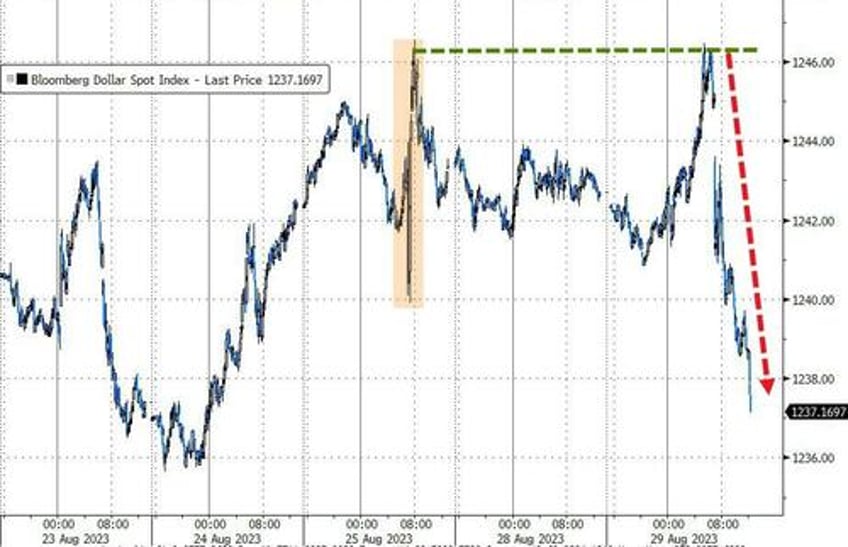

The dollar puked today, its biggest daily drop since mid-July...

Source: Bloomberg

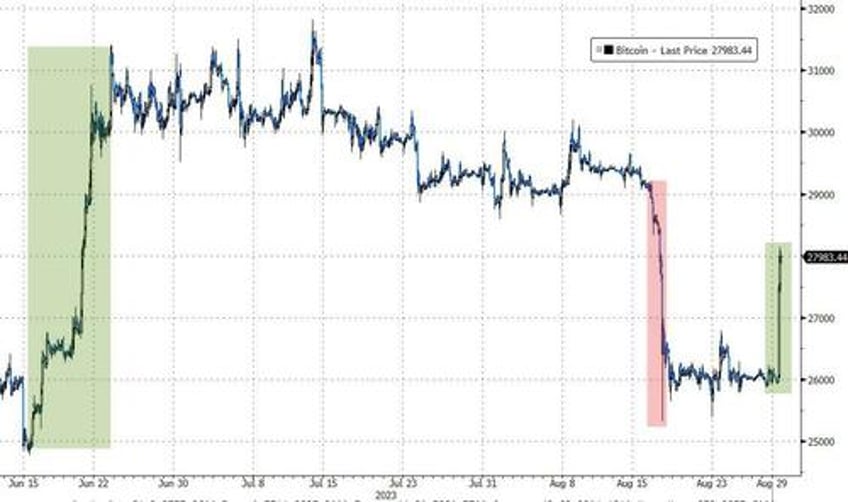

Bitcoin started to rally when the dollar fell and then exploded higher (topping $28,000) on the SEC loss in court...

Source: Bloomberg

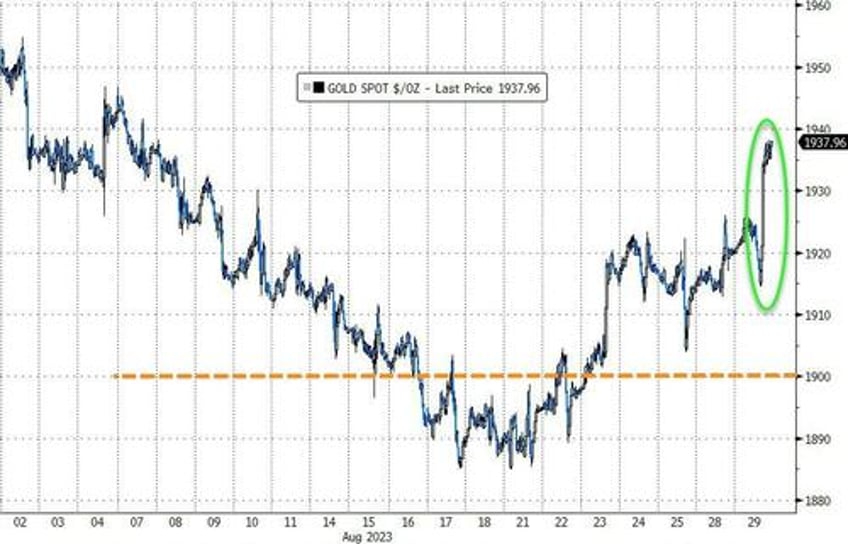

Spot Gold spiked around 1%, its best day since mid-July, nearing $1940...

Source: Bloomberg

Oil prices rallied ahead of tonight's API data, with WTI back above $81 (after finding intraday support around $80)...

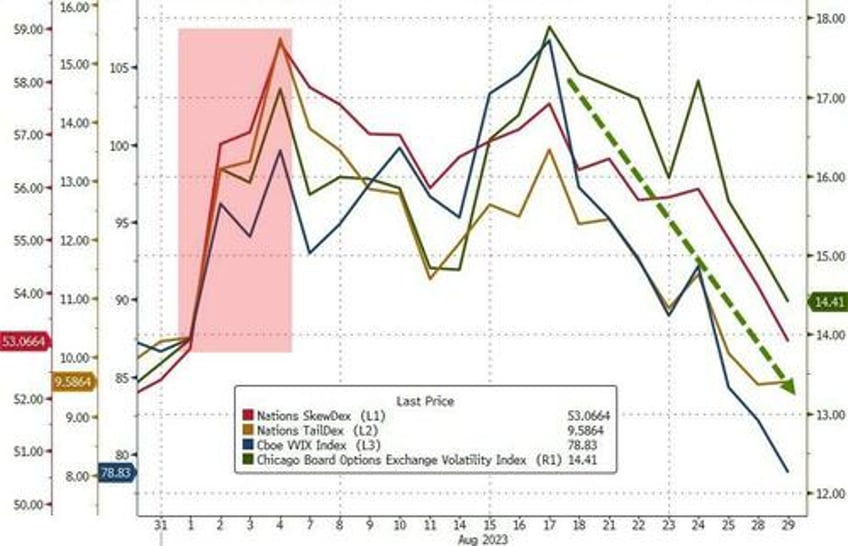

Finally, we note the market has swiftly gone from fear to greed as VIX, VVIX, and Skews are all tumbling. VVIX (vol of vol) is is its lowest since March...

Source: Bloomberg

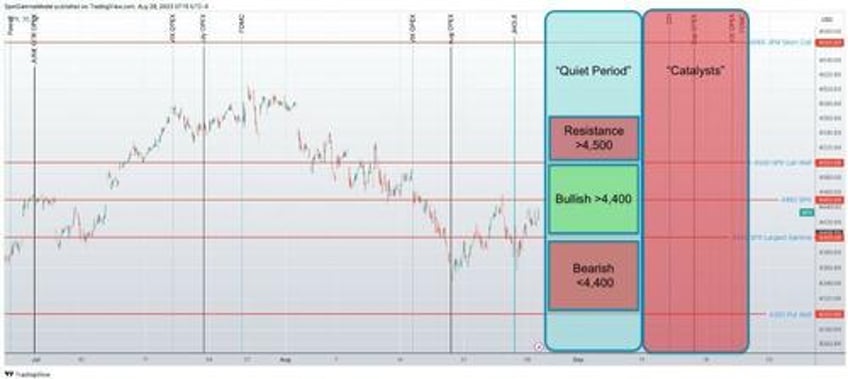

After all, what is there to worry about? As SpotGamma notes, from today until the end of next week, there are a few data points (jobs, ISM) but, (based on IV's) they are fairly low risk. Added into this window is the Labor Day holiday (next Monday).

Entering into the week of 9/11, there are a litany of catalysts including: CPI, large Sep OPEX, VIX Exp & FOMC. This suggests to us vol may be under pressure another ~2 weeks, and then risks pick up.

While there is no particular reason to be bearish, we note that a strong rally into OPEX/VIX Exp would certainly clear up the downside "padding" that we've been enjoying (and discussing) over the last few weeks. This could make downside into end of September/October "more available".