Submitted by QTR's Fringe Finance

It’s an interesting juxtaposition when a black swan that you expected crosses your path but looks a bit different than you had previously suspected it would.

This was exactly the case yesterday when the Department of Justice brought its “landmark” antitrust lawsuit against Apple. At first, I wrote it off as just yet another antitrust case that would eventually be settled and become ancient history. After all, antitrust headlines hit the wire what seems like every single day. As a market observer, it is pretty routine, and I don’t pay much attention to them. Here’s yesterday’s story from CNBC:

The Department of Justice sued Apple on Thursday, saying its iPhone ecosystem is a monopoly that drove its “astronomical valuation” at the expense of consumers, developers and rival phone makers.

The government has not ruled out breaking up one of the largest companies in the world, with a Justice Department official saying on a briefing call that structural relief was on the table if the U.S. were to win.

The lawsuit claims Apple’s anti-competitive practices extend beyond the iPhone and Apple Watch businesses, citing Apple’s advertising, browser, FaceTime and news offerings.

“Each step in Apple’s course of conduct built and reinforced the moat around its smartphone monopoly,” according to the suit, filed by the DOJ and 16 attorneys general in New Jersey federal court.

Forgive me for asking, but isn’t ‘winning’ at the expense of rival product makers what the business world is all about?

This is a sprawling suit that didn’t raise any issues I personally found alarming. But maybe this is just because I am a happy iPhone user and former Apple employee who generally likes their products. I know that I certainly never felt as though I was using Apple products because they had some type of monopoly; I always just used them because I thought they were better than whatever else was out there.

But I’m not here to argue the merits of the case or play judge and jury. That will play out in court and in a long legal battle that will likely end in some type of settlement several years from now after both sides jostle back and forth and make their respective arguments.

🔥 50% OFF SUBSCRIPTIONS FOR LIFE: If you are not yet a subscriber, you can take 50% off for life by using this link: GET 50% OFF

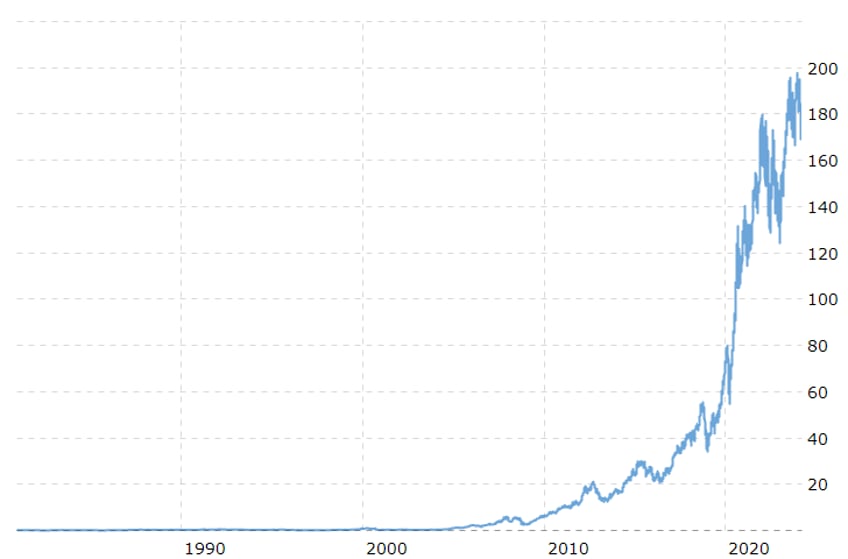

I am, however, really interested in this case due to the chilling effect it could put on Apple as an investment. It was revealed yesterday that, as part of the potential outcomes for the case, Apple could be forced to subdivide its businesses or split off portions of its business. This reminded me a lot of the famed antitrust suit lodged against Microsoft back in 2001. I went back to read about that suit, which ultimately saw its decree take 10 years to pass, and noticed that Microsoft stock hardly moved in the decade from the time the suit was brought until the time the decree expired. While Microsoft was busy resolving the suit, Apple and Google took flight as competitors:

The case marks one of the most important turning points in Microsoft’s history, up there with its first agreement to build an operating system for IBM and the introduction of the first version of Windows that featured graphic icons.

While the technology landscape has left the browser wars at the heart of the dispute far behind, and Microsoft continues to make billions from Windows and Office, the case left deep scars.

When the settlement of the landmark antitrust lawsuit against the company was proposed Nov. 2, 2001, the stock traded at $27.63 a share. On Wednesday the stock closed at $25.36 per share.

Meanwhile, competitors like Apple have soared and new rivals like Google have taken flight. — Seattle Times, May 11, 2011

Granted, it was a time which encompassed the post-2000 bubble crash and the 2008 housing crisis. But it started to make me think more about the case I had previously made about Apple potentially being a black swan back in September of last year: A Second Black Swan For Markets Emerges

As I noted on this blog, Apple is as close to being the quintessential American stock as you can possibly get. It’s a component in almost any ETF you can think of and is held so widely that even entities like the Swiss National Bank hold it on their balance sheet. It is a dividend payer, it is replete with cash, it makes products that almost everybody owns, and has simply become the king of technology and the king of smartphones.

Again, this is a position I believe it has earned for itself by creating a superior product. I worked for Apple during the first iPhone launch, and I remember using one for the first time and having my hair blown back. I thought to myself, “This is unlike anything the world has ever seen.”

And so, because the product was so exceptionally innovative, Apple has earned its place at the top as the king of the mountain. Following suit, Apple stock has also earned its place at the top of the heap.

Now, what would be a better proxy for putting a chill on the entire stock market than Apple stock?

If you had to pick one name right now that could cool sentiment in the market, across dividend payers, index ETFs, technology ETFs and blue chips, wouldn’t it be Apple?

As I noted in my September article, which raised concerns about the Vision Pro being an innovation flop and essentially the anti-iPhone for Apple going forward, I noted that the stock was robustly valued, along with pretty much anything else that trades publicly in the United States right now.

This significant multiple expansion means the market expects significant growth.

This means that eventually, growth is going to have to come from new segments of the business.

And, it’s common sense that finding aggressive growth in new segments is going to be a difficult task with antitrust regulators breathing down your neck and pushing for a breakup of the business.

How can you position yourself for new segment growth and innovation when you don’t even know what the company will look like post anti-trust settlement?

This uncertainty, combined with the fact that every single fucking thing not nailed down to the floor is overvalued right now, and the fact that euphoria is everywhere in markets while rates are at 5 1/2% and liquidity is drying up before our eyes, means that a stall in Apple could wind up becoming a stall for the broader market.

And it is going to be difficult to conjure up animal spirits when 1/7th of the magnificent 7 is bedridden with fleas.

The way the market is priced now, everything needs to be excellent or beyond excellent. All growth targets need to be hit, and companies need to exceed expectations. On top of that, liquidity needs to continue to mysteriously fall from the sky as the inevitable drying up of liquidity continues with rates at multi-decade highs.

Apple stalling out and essentially trading like the Japanese stock market over the next couple of years, due to this antitrust suit, could wind up being one of numerous wet blankets that finally smothers the animal spirits the market somehow continues to pull out of thin air. And so, aside from basically every fundamental overvaluation argument you could possibly make, I continue to watch Apple as a potential black swan indicator for the sentiment of the broader market going forward.

QTR’s Disclaimer: I am an idiot and often get things wrong and lose money. I may own or transact in any names mentioned in this piece at any time without warning. I didn’t double check any numbers or figures in this piece and am generally lazy with my research. Contributor posts and aggregated posts have not been fact checked and are the opinions of their authors. Contributor posts and curated content are posted either with the author’s permission or under a Creative Commons license. This is not a recommendation or solicitation to buy or sell any stocks or securities, just my opinions. I often lose money on positions I trade/invest in. Sometimes I just lose money by misplacing it. I’m generally irresponsible. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. These positions can change immediately as soon as I publish this, with or without notice. You are on your own. Do not make decisions based on my blog. Do your research elsewhere. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. Also, I just straight up get shit wrong a lot. I mention it numerous times because it’s that important that you know.