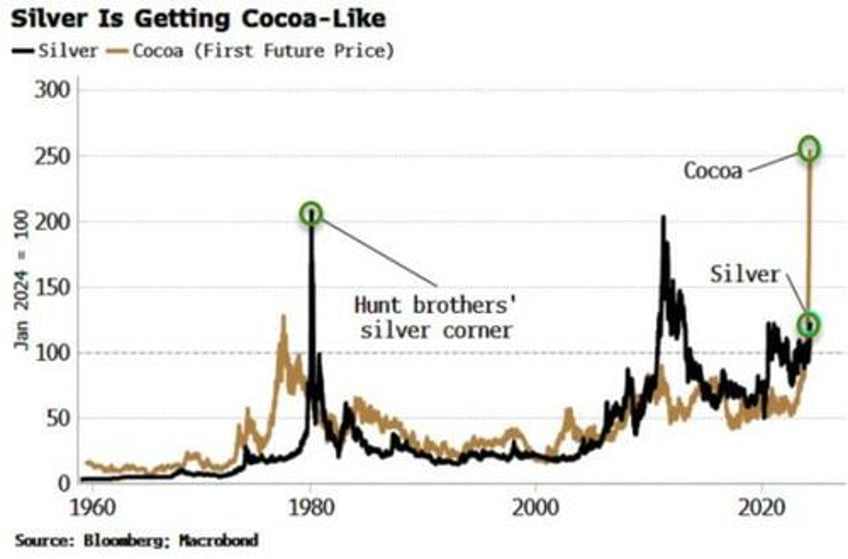

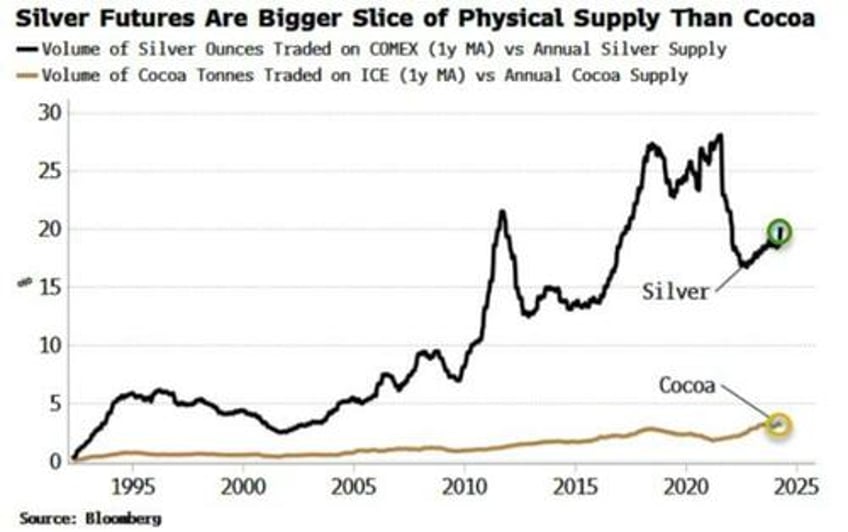

Silver prices have rocketed higher in recent days, and they have been surging today (with great volatility). As a futures market, more of it trades on exchange relative to its annual physical supply compared to cocoa. Therefore it’s not inconceivable silver could deliver a similar sort of move to cocoa’s recent mega-rally.

Silver is notoriously volatile and is considerably smaller than the gold market. It has experienced the sort of rallies cocoa recently experienced before: the Hunt brothers’ infamous corner in 1980, and in 2011.

With the futures market being bigger relative to annual supply compared to cocoa, that further increases the chance surging demand could cause prices to spike even more.

In a further demonstration of the small size of the silver market, the rally in 2011 did not really have a single factor.

Instead, loose monetary policy, the US’s debt downgrade and other factors conspired to drive demand that the market simply could not handle.

China and inflation are probably driving silver demand.

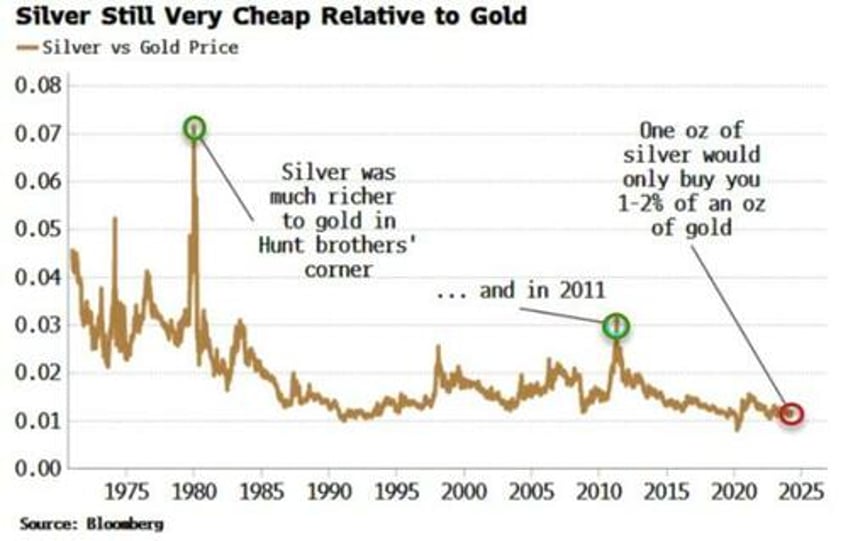

On the latter front, silver positioning has risen sharply in recent weeks, perhaps as latecomers looking for an inflation hedge feel they have missed the boat on gold (discussed here at the beginning of the month).

Either way, silver is still very cheap relative to gold, another factor that could help drive its price to cocoa-like extremes.

Of course, given its extreme volatility, prices could fall as quickly as they have risen.