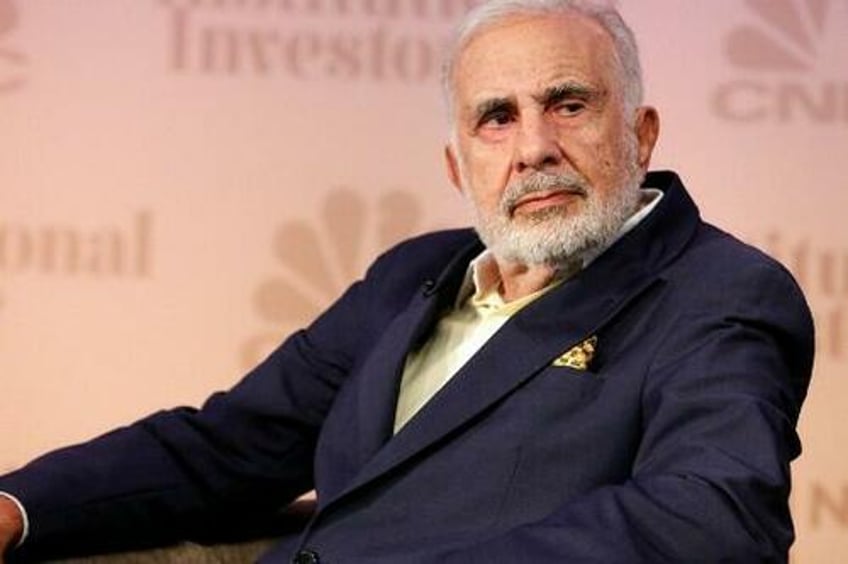

Shares of Icahn Enterprises are getting rocked by 25% in the pre-market session after activist investor Carl Icahn slashed the dividend for his unitholders amidst continued poor financial performance.

For the second quarter, Icahn enterprises posted revenue of $2.5 billion and a net loss of $269 million. It also cut its dividend from $2 per unit to $1 per unit. Icahn Enterprises has been the target of a short campaign by Hindenburg Research since May.

Icahn came right out in his quarterly press release and blamed short seller Hindenburg Research for his results: "I believe the second quarter partially reflected the impact of short-selling on companies we control or invest in, which I attribute to the misleading and self-serving Hindenburg report concerning our company. It also reflected the size of the hedge book relative to our activist strategy."

Speaking about IEP's dividend, Icahn said:

"IEP has issued distributions for 73 continuous quarters. The payment of future distributions will be determined by the board of directors quarterly, based upon current economic conditions and business performance and other factors that it deems relevant at the time that declaration of a distribution is considered. We do not intend to let a misleading Hindenburg report interfere with this practice. This quarter, IEP is declaring a $1.00 per depositary unit distribution, which represents a 12% annualized yield based on yesterday's closing price and unitholders will continue to have the right to elect whether to receive cash or additional depositary units."

Hindenburg Research said on Twitter Friday morning that they remained short.

On May 2nd, we predicted that "Icahn Enterprises will eventually cut or eliminate its dividend entirely, barring a miracle turnaround in investment performance."

— Hindenburg Research (@HindenburgRes) August 4, 2023

Today, $IEP reported further investment losses and slashed its dividend by 50%.

We remain short. https://t.co/uacxg1yEBG

Recall, in late May, Icahn said he was planning a "counterattack" to the short seller, while grappling with margin loans, having borrowed billions against his stock in the company. He was able to re-finance some of his loans in July.

However, as Hindenburg Research's Nathan Anderson noted on Twitter in July, the "breathing room" that Icahn is being offered could also resemble his air supply getting thinner. Anderson commented: "Basically, lenders have required Icahn to max out his collateral, including almost all $IEP units, while forcing full loan repayment over 3 years."

Back in early May we noted that Icahn had seen $10 billion in wealth evaporate as a result of Hindenburg's report.

Hindenburg Research's original report accused Icahn of "throwing stones from his own glass house".

"Our research has found that IEP units are inflated by 75%+ due to 3 key reasons: (1) IEP trades at a 218% premium to its last reported net asset value (NAV), vastly higher than all comparables (2) we’ve uncovered clear evidence of inflated valuation marks for IEP’s less liquid and private assets (3) the company has suffered additional performance losses year to date following its last disclosure," Hindenburg wrote at the time.

The research firm also called out the alleged unsustainability of IEP's dividend, stating:

"The company’s outlier dividend is made possible (for now) because Carl Icahn owns roughly 85% of IEP and has been largely taking dividends in units (instead of cash), reducing the overall cash outlay required to meet the dividend payment for remaining unitholders."

Hindenburg took exception with IEP needing to raise cash to pay its dividend, calling it a "ponzi-like" economic structure. Hindenburg asserts:

"The dividend is entirely unsupported by IEP’s cash flow and investment performance, which has been negative for years. IEP’s investment portfolio has lost ~53% since 2014. The company’s free cash flow figures show IEP has cumulatively burned ~$4.9 billion over the same period."

And the report concluded that Icahn will eventually have to cut its dividend: "Given limited financial flexibility and worsening liquidity, we expect Icahn Enterprises will eventually cut or eliminate its dividend entirely, barring a miracle turnaround in investment performance." Short interest in IEP soared beginning in May.

Looks like Hindenburg has won this round.