U.S. importers who ignored President Trump's first-term warnings about shifting supply chains out of China have been stunned—some into paralysis—by the renewed tariff war in his second term, which includes a 145% levy on Chinese goods entering the U.S. Now, many importers are frantically reassessing product lines and supply chains amid soaring costs, with some desperately needing financial lifelines to stay afloat.

HSBC Holdings Plc has understood this need and launched 'HSBC TradePay for Import Duties' on Wednesday. The platform allows struggling importers to borrow to meet the increased expenses of shipping products to the U.S. market.

"Many corporates are currently facing changing working capital needs and increased upfront commitments," HSBC wrote in a press release, adding, "By settling payments of import duties directly and frictionlessly through HSBC TradePay, businesses can simultaneously access credit and complete payments, leading to more efficient settlement times and better visibility over cash flows."

The new loans allow import payments to be automatically settled through pre-arranged credit with brokers or direct ACH transfers, enabling companies to manage cash flow more effectively and streamline duty payments.

"Clients' working capital needs are evolving – and we're responding swiftly with solutions that deliver the most value to them. By settling import duties directly and frictionlessly through HSBC TradePay, our U.S. clients have more visibility and control over their working capital at the time they need it most," Vivek Ramachandran, Head of Global Trade Solutions at HSBC, stated.

Last week, we provided the example of a Seattle, Washington-based Wyze Labs, a popular seller on Amazon of smart home and wireless camera products from China, revealed on X: "Just got our first tariff bill. We imported $167k of floodlights and then paid $255k in tariffs. That's more than any of our founders were paid last year."

Wyze said their "first tariff bill" has "accelerated" efforts to leave China in two months, and they are seriously considering restoring supply chains in the United States.

Wyze's steep tariff bill is just one example of the tariff bills impacting importers with weaker balance sheets—creating an opening for HSBC to step in with targeted financing options.

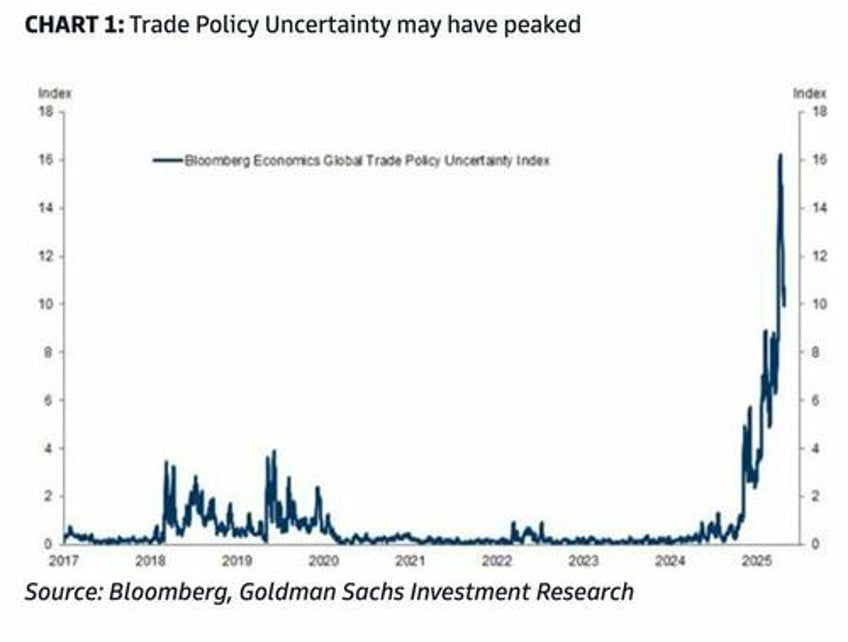

HSBC Chairman Mark Tucker recently warned that global trade faced a "period of deep and profound change" and "the over-arching impact of the changing approach to global trade relations has been to increase economic uncertainty with serious potential risks to global growth."

Goldman offered some good news last week: Peak trade war.

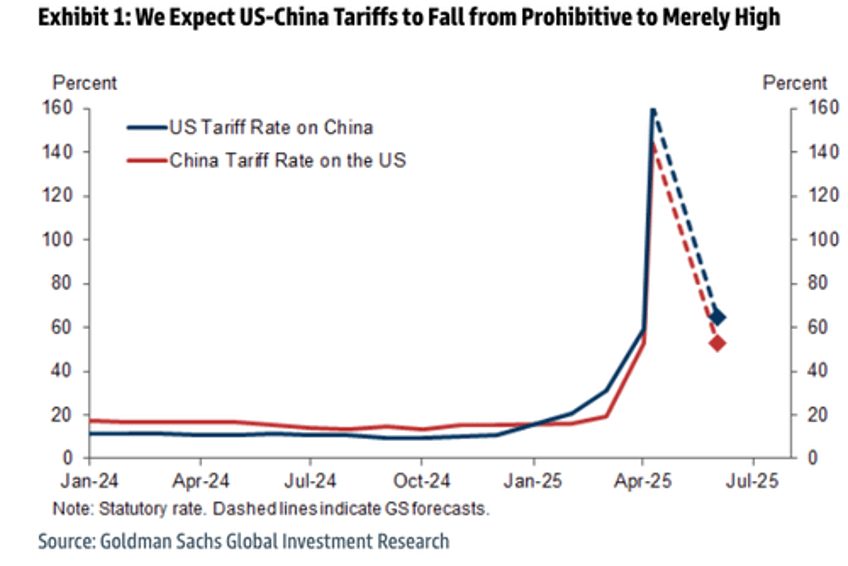

Goldman chief economist Jan Hatzius noted earlier this week: "The mood music with China has improved, and we expect the U.S. tariff rate on China to drop from around 160% to around 60% relatively soon. (China is likely to reduce tariffs on the U.S. by a similar amount.)"

More peak trade headlines appeared in the overnight session:

US, Chinese Delegations To Meet In Switzerland To Launch Trade Talks; S&P Futures Surge https://t.co/8QFfQhOmCb

— zerohedge (@zerohedge) May 6, 2025

In the meantime, HSBC has identified a growing need among importers struggling to manage tariff-related costs—offering working capital solutions to bridge gaps. Some of these importers are now paying the price for not acting sooner on earlier warnings to shift away from China.