Single-family permitting data provides a real-time pulse check on housing market conditions, and the latest figures indicate a softening of demand, despite the peak selling season. Elevated mortgage rates and persistent macroeconomic uncertainty continue to dampen builder activity and suppress homebuyer confidence ahead of the summer months.

Goldman analysts Susan Maklari, Charles Perron-Piche, and Rhea Bhatia provided clients on Thursday with multiple heat maps for the housing market based on single-family building permits, which offer a forward-looking signal about future housing supply, builder confidence, and anticipated demand.

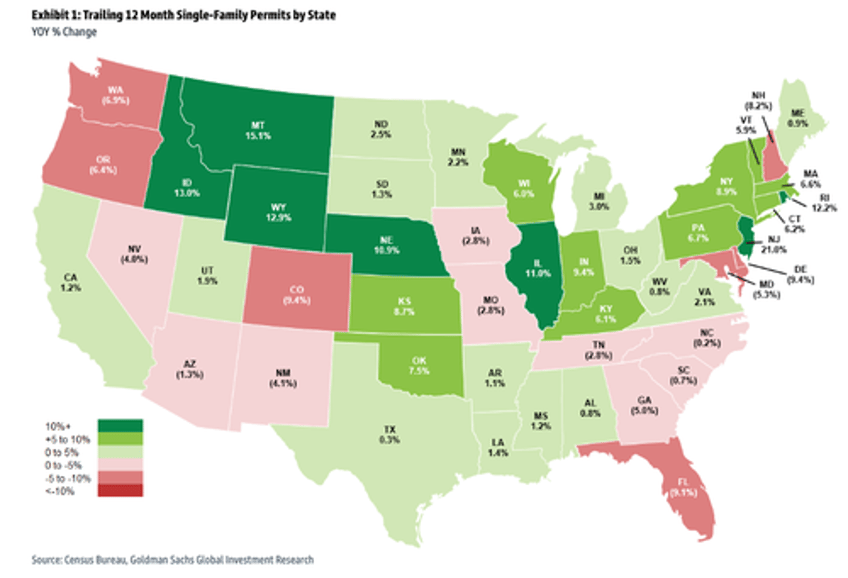

Maklari noted that, on a trailing 12-month basis, single-family permits across the U.S. declined in April…

Activity Decline as Builders Look to Align to Weaker Demand: On a trailing 12-month basis, single-family permits contracted 1% YOY in April, vs +2% in March and off a 14% increase a year ago, marking the first decline since January 2024.

Single-family home values grew 2% YOY nationally according to Zillow, in line with the prior month, with 5 states seeing gains of 5+% vs 12 in March, while 38 rose 0-5%, up from 34 sequentially. Florida and Arizona saw home values contract 2% YOY while Texas, Georgia and Colorado were also down slightly. That said, Nevada and Virginia rose 3-4% each, along with California and Utah, both up 2%.

The deceleration in permits comes as the selling season was weaker than expected as macro uncertainty and elevated rates weigh on consumer sentiment. Builders across price points are moderating starts in response, as they seek to adjust inventories to meet demand and support their margins.

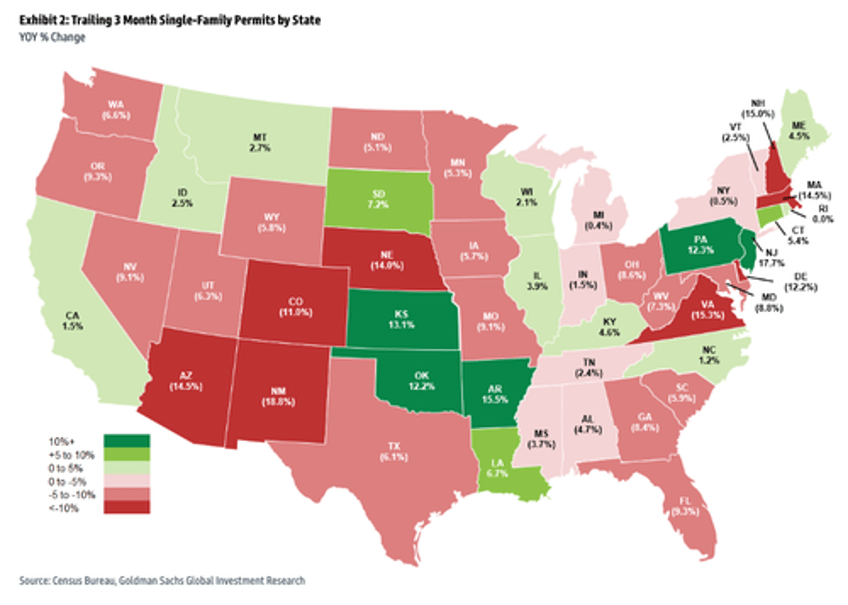

The 12-month change in single-family building permits reflects the broader trend, smoothing out seasonal fluctuations and short-term volatility. In contrast, the 3-month change captures near-term inflection points, highlighting sharp accelerations or sudden slowdowns in permitting activity.

Here's more from Maklari:

Permits Further Contract on Rolling 3-Month Basis With Underperformance in Key Builder States: Single-family permits for the 3-months ended April fell 5% YOY, compared to a 4% decrease in March and off +21% a year ago. They grew 22% vs the comparable pre-pandemic period. In line with broader conditions, 5 states saw gains of more than 10%, down from 6 in March. We note the relative underperformance of key builder states, notably Florida, and Nevada followed by Georgia as builders look to reduce inventories while balancing profitability and supporting cash generation against the ongoing headwinds.

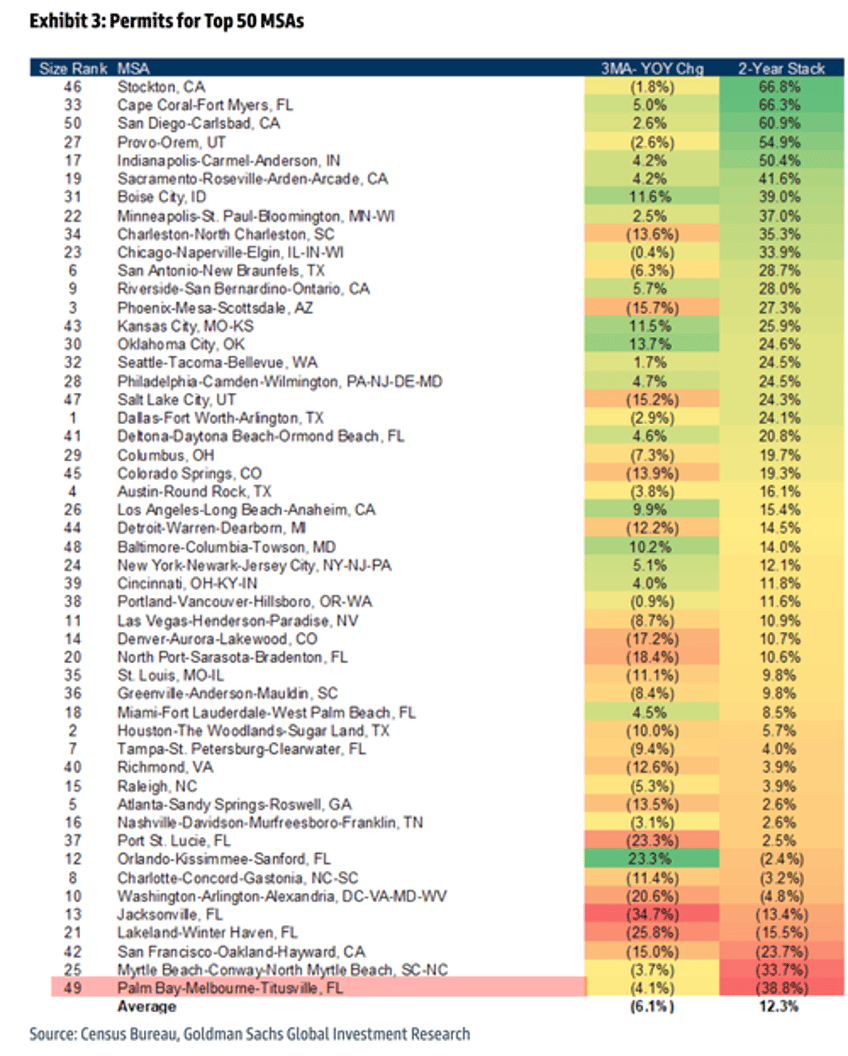

The analysts then showed permitting data on a city-by-city basis, highlighting that the Southwest region exhibits the weakest activity.

Southwest Markets Lag on MSA Basis: Permits in the top 50 MSAs decreased 6% YOY for the 3 months ended April, vs -5% in March and off +20% a year ago. On a YOY basis, Orlando, FL (+23%), Oklahoma City, OK (+14%) and Boise, ID (+12%), showed the greatest gains while Jacksonville, FL (-35%), Lakeland, FL (-26%), and Port St. Lucie, FL (-23%) lagged. On a 2-year stacked basis, growth was led by Stockton, CA (+67%), Cape Coral, FL (+66%) and San Diego, CA (+61%). On a 2-year stack, we note 7 of the top 10 MSAs are in the South or West.

Permits reflect the builder's psychology, which is shaped by the sales outlook, inventory levels, construction cost inflation, and interest rates.

Last week, with U.S. 30-year mortgage rates around 7%, existing home sales in the U.S. in April were at the weakest pace since April 2009.

Interestingly, the increase in housing supply has had little effect in easing pricing pressure. The median sales price rose 1.8% year-over-year to $414,000—a record high for April.