Readers are already familiar with the mass migration from the Democratic strongholds of California and New York, known for high crime and tax rates. We have delved into this in our article, "Americans Continue To Flee High-Tax New York And California," highlighting Texas and Florida as preferred destinations.

California and New York have sustained population declines during Covid and after, that have long-term implications for local economies. The exodus means workers with six-figure salaries in technology, finance, real estate, and entertainment are going elsewhere, which will reduce tax revenue for the state.

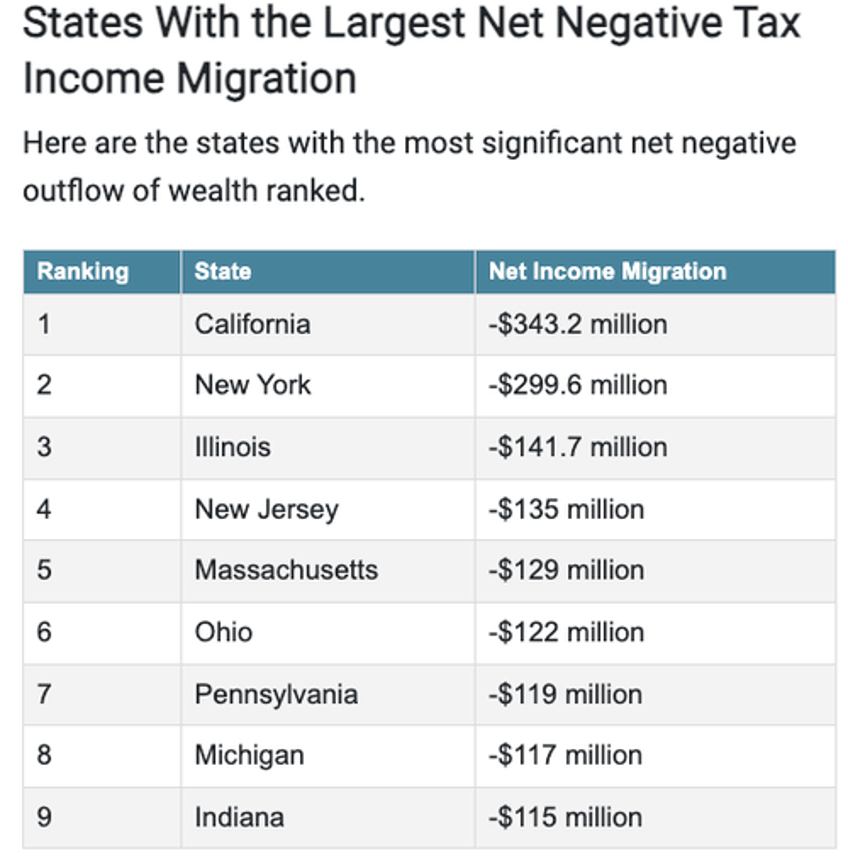

MyEListing.com, an online real estate portal, used IRS migration data to reveal California and New York lost $343 million and $299 million in 2021, respectively, due to the surge in migration outflows.

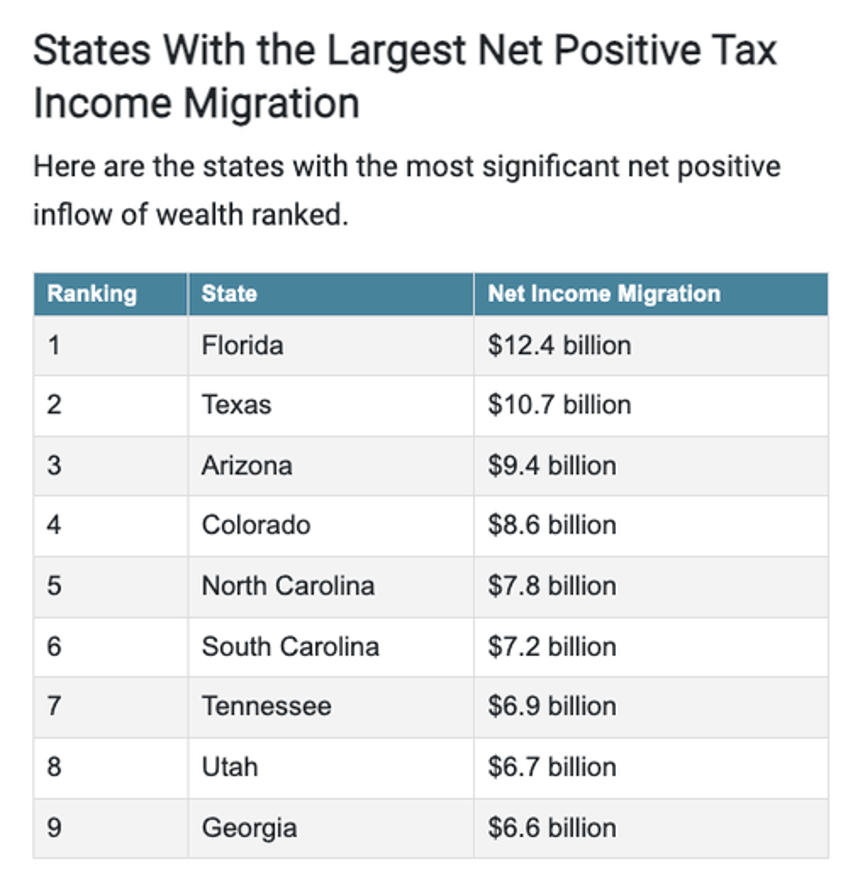

The beneficiaries of the outflow are Florida and Texas, which took in $12.4 billion and $10.7 billion, respectively.

"Despite its numerous attractions, from the booming tech industry and world-class universities to beautiful landscapes and cultural richness, California's high personal income tax rates seem discouraging for many high-wealth individuals. This, coupled with the state's high cost of living, will likely fuel a wealth migration out of California," MyEListing wrote in the report.

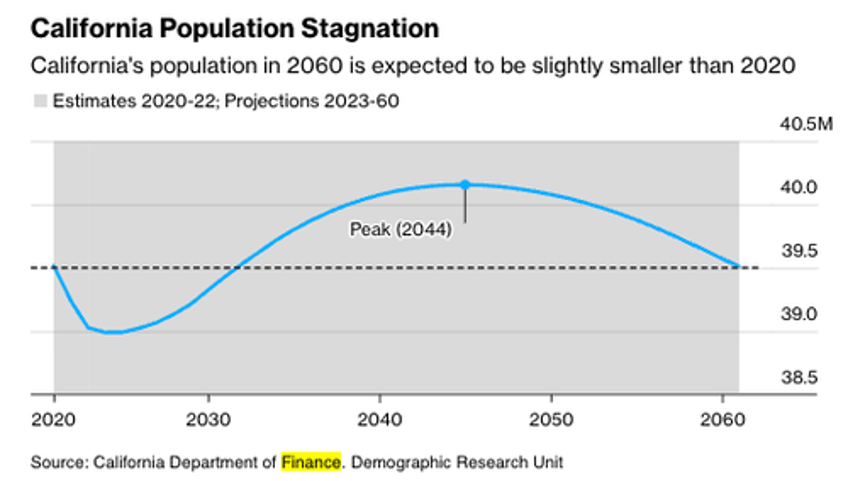

The exodus from California is so severe that state demographers forecasted the total population will be the same today as in 2060.

If left unchecked, the largest outflows of residents from specific metro areas could experience a fiscal crisis. Such a development would be tragic for Democrat-controlled cities already plunging into crisis as progressive politicians fail to enforce law and order.