US equity futures are higher with small caps leading after the White House appeared to dial back speculation that Washington was on the verge of joining Israel’s strikes on Iran, while Reuters reported that Iran is ready to discuss limitations on its Uranium enrichment (if not going anywhere near close to what the US/Israel bid is for complete enrichment halt). As of 8:00am, S&P futures rose 0.2% and traded at session highs, while Nasdaq 100 futures gained 0.3% with Mag 7 stocks mixed and TSLA (+1.4%) outperforming. The big highlight today is a record (for June) $5.9 trillion option expiration which will see dealer gamma tumble and "unclench", allow the market to move much more freely. Bond yields are 2-3bp higher while the USD is lower even as the USDJPY approaches a 1 month high. Commodities are lower: oil drops on renewed hopes for Iran deescalation; aluminum and precious metals are also down. Headline focus continues to be on Middle-East tensions after Trump disclosed he will decide within two weeks whether to strike Iran. Elsewhere, Japan in focus with hotter inflation data overnight (driven by continued surge in rice prices) and reports of larger-than-expected planned cutback to superlong JGB issuance. WTI reached $77 briefly on Thursday before coming down to $73 this morning. It's a quiet end to the week: US economic data slate includes June Philadelphia Fed business outlook (8:30am) and May Leading Index (10am). No Fed speakers are scheduled.

In premarket trading, Magnificent Seven stocks rebound alongside index futures but are mixed with TSLA outperforming (Tesla +1.3%, Amazon -0.1%, Meta Platforms -0.1%, Apple -0.3%, Microsoft -0.3%, Alphabet -0.4%, Nvidia -0.5%).

- Accenture shares (ACN) are down 3.9% in premarket trading, after the IT services company reported its third-quarter results and gave an outlook.

- Capricor Therapeutics shares (CAPR) fell 4.4% in premarket trading after Nicole Verdun, super office director at Center for Biologics Evaluation and Research, was placed on administrative leave.

- Circle Internet Group shares (CRCL) are set to extend gains, rising 11% in premarket trading. The stablecoin issuer rallied almost 34% on Wednesday after the US Senate passed stablecoin legislation setting up regulatory rules for crypto currencies pegged to the dollar.

- GMS shares (GMS) rise 28% in premarket trading on Friday after the Wall Street Journal reported that Home Depot has made an offer for the building materials firm, potentially setting off a bidding war with QXO which made a $5 billion offer earlier in the week.

- Johnson Controls International Plc shares (JCI) fell 1% in premarket trading after Oppenheimer cut its recommendation on the building products company to perform from outperform.

- Mondelez (MDLZ) advances 0.5% in premarket trading following an upgrade to overweight at Wells Fargo, which sees its bull case for the Oreo-cookies maker becoming “more tangible.”

- Tesla (TSLA) is outperforming fellow Magnificent Seven stocks in premarket trading on Friday, rising 1.7%.

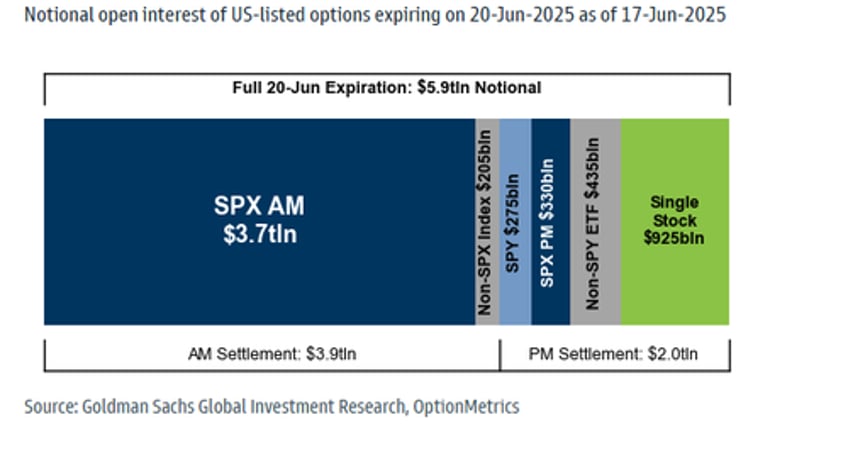

While markets remains focused on geopolitics, the big event for markets today is today's $5.9 trillion option expiration, including $4.0 trillion of SPX options and $925 billion notional of single stock options. This options expiration will be the largest June expiration on record...

Going back to geopolitics, sentiment was boosted after the White House said on Thursday that Trump would decide within two weeks whether to attack Iran, and there was still a “substantial chance” of a negotiated settlement. Israel, meanwhile, struck more of Iran’s nuclear sites and warned it could bring down Tehran’s leadership as both sides awaited the US president’s decision. Iran maintained Friday it won’t negotiate with the US while Israel’s assault continues. With the weekend in sight, traders appear to be staying on the sidelines, unsure about the trajectory of the conflict.

“One must of course be aware of the potential for significant gapping risk at the Sunday night open, depending on how geopolitical tensions evolve over the weekend,” said Michael Brown, senior research strategist at Pepperstone Group Ltd. “Some trimming of risk, and squaring of positions, seems likely as today goes on.”

Some extreme scenarios resulting from increased US involvement in the Israel-Iran war could push oil prices as high as $130 to $150 a barrel, particularly if Iran retaliates in a major way, said Jennifer McKeown, chief global economist at Capital Economics Ltd. Such a development would pause further policy easing by central banks, she said. Brent futures have been pricing in a geopolitical premium of about $8 a barrel since Israel and Iran began attacking each other last week, according to a survey of analysts and traders. US intervention in the conflict would bolster that further, but exactly how much would depend on the nature of the involvement, the nine respondents said.

“The recent air strikes pose risks to the new energy market landscape; however, further fallout for global energy prices seems, for now at least, limited,” said Kieran Calder, head of Asia equity research at Union Bancaire Privee in Singapore. “Markets tend not to price in geopolitical risks until there is a conflagration, and they are currently showing little sign of factoring in a worst-case outcome.”

Markets were rattled earlier in the week after the Fed downgraded its estimates for growth this year and projected higher inflation. “Even though central banks would like to think that would be a temporary impact, I think it would be a brave central bank that would cut interest rates,” McKeown said on Bloomberg TV.

European stocks also rose as the White House downplays the likelihood of imminent US military action against Iran. The Stoxx 600 snapped a three-day losing streak, up 0.5%. Travel, banks and tech outperform as almost all sectors climb, barring energy. Among individual movers in Europe, TUI AG gained the most in two months after Barclays Plc double-upgraded the stock, citing robust demand for packaged travel. Berkeley Group Holdings Plc slumped after the homebuilder announced management changes and cited persistent regulatory headwinds as it reported earnings. Here are some of the more notable European movers:

- TUI shares gain as much as 5.7%, the most in two months, as Barclays double-upgrades the stock. Analysts see a unique, though complex business with earnings momentum, supported by robust demand for packaged travel

- Akzo Nobel shares rise as much as 2.5% after the specialty chemicals firm was placed on a positive catalyst watch at JPMorgan, which now has stronger conviction in earnings upgrades resulting from the group’s upcoming results

- Zealand Pharma shares gain as much as 2.5%, paring this week’s drop to 13%. The recent selloff following early data for Eli Lilly’s rival amylin drug eloralintide is “overdone,” according to KBC

- Eutelsat shares rise as much as 27% after announcing a plan to raise €1.35 billion in new equity, offering the satellite firm crucial financial resources to expand its low-earth orbit constellation

- Thyssenkrupp Nucera shares rise as much as 5.8% after the German company announced the acquisition of key assets from Danish firm Green Hydrogen Systems, which said it will seek bankruptcy protection after its restructuring process failed

- Demant shares climb as much as 1.9% after Barclays upgraded the stock to equal-weight from underweight, citing the Danish hearing aid maker’s “more achievable guidance,” as well as growing optimism around market share dynamics

- Berkeley’s shares fall as much as 9.9%, their worst one-day drop since March 2020. While the homebuilder’s earnings were in line with expectations, the company flagged persistent regulatory headwinds, with analysts saying prospects for a recovery are unclear

Earlier in the session, Asian equities advanced after news that President Donald Trump will decide within two weeks whether to strike Iran, allaying some concerns over immediate US involvement. The MSCI Asia Pacific Index gained 0.5%, with chip-related stocks SK Hynix and Advantest among the biggest boosts. South Korea’s Kospi closed above 3,000 points for the first time since December 2021, and a gauge of Chinese shares listed in Hong Kong rose 1.4%. Stocks fell in Japan and Australia. The MSCI Asian benchmark is still poised to end the week lower after a two-week streak of gains. Middle East tensions have put risk sentiment back in check as investors eye the potential impact on oil prices in particular.

The Bloomberg Dollar Spot Index fell 0.2%, extending its losses into a second day. The yield on benchmark 10-year Treasuries was little changed as cash market reopened following a holiday. USD/JPY rose 0.1% to 145.62; Japan’s key consumer inflation measure accelerated more than expected to 3.7% from a year earlier in May. GBP/USD up 0.2% to 1.3495; UK retail sales suffered the sharpest fall since 2023, a sign the economy could be struggling in the second quarter.

In rates, treasuries are steady as US markets reopen post-holiday. European yields erase earlier drop are are now little changed across the curve, while the euro and pound both gain. JGB futures turn lower and USDJPY trades near 145.50 after Japan proposes to cut the issuance of super-long bonds this year by more than earlier reported.

In commodities, Brent crude falls 2% to around $77.20, giving back gains from earlier in the week. Gold is down some $16 to around $3,354/oz. Bitcoin climbs.

Looking to the day ahead now, data releases include UK retail sales which had their sharpest fall since 2023 in May, slumping 2.7%, more than the estimated 0.5% decline, Euro Area money supply for May, preliminary consumer confidence for June, and the US Conference Board’s leading index for May. From central banks, we’ll hear from BoJ Governor Ueda, and the ECB will publish their Economic Bulletin.

Market Snapshot

- S&P 500 mini +0.1%

- Nasdaq 100 mini +0.2%

- Russell 2000 mini +0.1%

- Stoxx Europe 600 +0.5%

- DAX +0.9%

- CAC 40 +0.6%

- 10-year Treasury yield +4 basis point at 4.43%

- VIX -1.6 points at 20.57

- Bloomberg Dollar Index -0.2% at 1207.39

- euro +0.3% at $1.1527

- WTI crude +0.7% at $75.66/barrel

Top Overnight News

- Oil prices eased and stock futures pared some losses after President Trump signaled he would give some time for negotiations before deciding on potential strikes on Iran, and after a Senior Iranian Official said Iran was ready to discuss limitations on its uranium enrichment: RTRS

- Israel will complete the task of preventing Iran from gaining nuclear weapons whether or not the US joins the operation, its energy minister said. Iranian President Masoud Pezeshkian said the only way to end the war is to “unconditionally” stop Israel. BBG

- China sent the highest number of warplanes toward Taiwan since October, the island’s defense ministry said. BBG

- China’s record 1.18 billion-barrel oil stockpile is cushioning refiners from potential supply shocks in the Middle East. The high buffer, soft margins and seasonal demand weakness means they’re in no rush to replace Iranian crude. BBG

- US tariff hikes on small packages from China caused a 40% drop in shipments in May from a year ago, with the value of small parcels falling to just over $1 billion. BBG

- Japan's consumer inflation measure accelerated to a fresh two-year high, with consumer prices excluding fresh food rising 3.7% from a year earlier in May. BBG

- Japan is planning to cut the issuance of super-long bonds this year by more than earlier reported as it tries to restore calm to a market spooked by recent record highs in yields. The Finance Ministry proposed reducing the issuance of 20-, 30- and 40-year bonds by a total of ¥3.2 trillion ($22 billion) through the end of March 2026. BBG

- UK retail sales had their sharpest fall since 2023 in May, slumping 2.7%, more than the estimated 0.5% decline. BBG

- EU Economy Commissioner Dombrovskis said the EU was ready to take measures with the US if a solution could not be found, but noted that progress was being made in trade talks with Washington: RTRS

- Canadian Prime Minister Carney said Canada would introduce a series of countermeasures to help it respond to Trump-era tariffs. He stated that Canada would adjust its existing counter-tariffs on US steel and aluminium products on 21 July: RTRS

- QXO Inc proposed to acquire interior-construction-products distributor GMS Inc for $95.20 a share. Roofing-products distributor QXO said Wednesday the proposal implies a total value of $5 billion and is a 27% premium over GMS’s 60-day volume-weighted average price. BBG

- Democratic staffers are meeting with the parliamentarian’s office today, GOP aides will also have their own meetings. After that, full Byrd Bath arguments with GOP and Democratic staffers will start Sunday: Punchbowl

Trade/Tariffs

- EU Economy Commissioner Dombrovskis said the EU was ready to take measures with the US if a solution could not be found, but noted that progress was being made in trade talks with Washington, according to Reuters.

- Canadian Prime Minister Carney said Canada would introduce a series of countermeasures to help it respond to Trump-era tariffs. He stated that Canada would adjust its existing counter-tariffs on US steel and aluminium products on 21 July. The level of Canadian counter-tariffs would depend on the progress of talks with the US on a new economic deal. He added that only Canadian producers and producers from trading partners offering Canada tariff-free reciprocal access would be eligible to compete for federal government procurement of steel and aluminium. Canada would adopt additional tariff measures to address risks associated with persistent global overcapacity and unfair trade in the steel and aluminium sectors. He also announced that Canada would establish new tariff rate quotas at 100% of 2024 levels on imports of steel products from non-free trade agreement partners, according to Reuters.

- Chinese Commerce Ministry says its Minister held a video meeting with EU Trade Commissioner on Thursday; had "in-depth" talks on remedy cases such as EVs

A more detailed look at global markets courtesy of Newsquawk

APAC stocks initially saw directionless trade following a non-existent lead from Wall Street amid the Juneteenth market holiday. Nevertheless, geopolitics remained in the spotlight as US President Trump now has to decide whether or not to join Israel’s offensive against Iran’s nuclear facilities within the next two weeks, contingent on negotiations. Sentiment eventually turned mostly firmer with notable Israel-Iran newsflow on the lighter side. ASX 200 was subdued with miners dragging on the index whilst losses in financials also kept upside capped. Nikkei 225 was buoyed by recent JPY weakness but came off best levels in tandem with USD/JPY after Japanese Core CPI topped expectations, whilst stale BoJ minutes (from two meetings ago) were also released. Hang Seng and Shanghai Comp were initially choppy with the indices trimming modest earlier gains despite relatively quiet newsflow. The PBoC LPR setting was a non-event, with the central bank maintaining the 1-year and 5-year LPRs as expected.

Top Asian News

- The PBoC maintained its 1-year Loan Prime Rate (LPR) at 3.00% and its 5-year LPR at 3.50%, as expected, according to Reuters.

- Japanese Finance Minister Kato said they had observed spikes in super‑long JGB yields recently, according to Reuters.

- Minutes from the BoJ's 30 April – 1 May meeting showed that many members said they must carefully scrutinise each nation's trade policy and its developments, given the heightening downside risks to the economy and prices, according to Reuters.

- PBoC injected 161.2bln via 7-day reverse repos with the rate maintained at 1.40%.

- BoJ Governor Ueda says Japan's economy is recovering moderately albeit with some weakness, underlying inflation to gradually heighten after a pause.

European bourses (STOXX 600 +0.4%) opened firmer, and are attempting to build on gains, benefiting from the positive mood surrounding geopolitical optimism. European sectors are almost entirely in the green, Energy is the sole loser, due to lower oil prices, which is to the benefit of travel and leisure, which gains. Banking stocks lead the charge, buoyed by fresh EU developments that see the European Investment Bank's annual lending ceiling raised to EUR 100bln.

Top European News

- BoE's Bailey says "we are living in a world of much larger economic shocks which have their origins outside economic causes".

FX

- DXY is flat and trading in a very tight 98.53-98.70 range, after falling a touch overnight on geopolitical updates which has seen the Dollar lose its risk premia a little. In the prior session, the Dollar slipped after US President Trump offered Iran a two-week window to monitor negotiations before deciding on military action. This sparked a risk-on mood, as it helps to ease some nerves of an imminent attack on Iran and hence an escalation in the Middle East. Data docket today includes US Philly Fed Business Index and Leading Index Change.

- EUR is at the top of the G10 leaderboard, but ultimately just a little stronger vs the Dollar. No specific European-driver for the strength today, so likely on the geopolitical updates from Trump on Thursday (see above) – in brief, should the US choose not to attack Iran, this would be net-negative on crude prices and as such has lifted the Single-Currency today; gains are of course capped given the continued uncertainty. EUR/USD currently trading around the mid-point of a 1.1491-1.1532 range.

- JPY is essentially flat/modestly firmer today but did catch a slight bid following the region’s inflation report. Headline Y/Y printed in-line with expectations whilst the Core metric was a touch above expectations, and in-fact printed the fastest Y/Y pace since January 2023. Following the release of the Japanese CPI report, USD/JPY fell from 145.29 to a session trough of 145.16, but now trades around 145.30.

- GBP is incrementally firmer vs the USD but posts modest losses vs the EUR. Cable saw was mildly pressured on the release of a very weak Retail Sales report, whereby the M/M metrics fell beneath the most pessimistic of analysts’ forecasts; printing at -2.7% (exp. -0.5%). GBP/USD fell around 0.2% to make a fresh trough at 1.34470 in the hour after the Retail Sales report. Thereafter, the Pound has been trading relatively steady for most of the morning. Upside levels include its 21 DMA at 1.3518.

- Antipodeans are incrementally firmer/flat vs the Dollar in what has been a lacklustre session so far. Specifics for the Aussie and Kiwi have been on the lighter side overnight.

- PBoC set USD/CNY mid-point at 7.1695 vs exp. 7.1801 (prev. 7.1729); strongest CNY fix since March 17th

Fixed Income

- JGBs are essentially flat but did see some marked action in a 139.32 to 139.50 band as draft reporting and commentary emerges from the Ministry of Finance Meeting. In brief, Bloomberg citing a draft reported that Japan intends to cut super long issuance by JPY 3.2tln, by cutting JPY 100bln from 30yr and 40yr auctions and 200bln from the 20y; consensus was for 100bln in each tenor.

- USTs incrementally firmer/flat as it returns to Cash trade following Thursday's holiday. Contained overnight, but was then pressured in the European morning, potentially as traders continue to digest and factor in the latest geopolitical optimism. Downside limited so far, and USTs remain above Thursday’s 110-22+ base.

- Bunds were modestly firmer for much of the morning. Lifted by around 30 ticks on the UK retail metrics this morning (see Gilts). Peaked at a 131.33 high but has since been drifting and now finds itself back marginally below the figure, and by extension in proximity to the earlier 130.88 low; now essentially unchanged on the session.

- Gilts gapped higher by 18 ticks, following an abysmal set of retail data. The series saw sales volumes fall across the board, the most pronounced move was in food and while that is somewhat skewed by an unfavourable prior, the series is nonetheless dire. While bid initially, and to a 93.05 peak, the move proved somewhat short-lived as Gilts also digested the latest PSNB data. A series that featured the highest May borrowing on record, ex-COVID; metrics that offset the dovish impulse from Retail Sales. Overall, Gilts now near-enough flat and at the lower-end of the day’s limited 92.83 to 93.05 band.

- Japan plans to cut FY25 superlong JGB issuance by JPY 3.2tln, via Bloomberg citing a plan; Japan to cut 20yr bond issuance by JPY 200bln (exp. JPY 100bln); cut 30yr by JPY 100bln (exp. JPY 100bln); cut 40yr by JPY 100bln (exp. JPY 100bln), per auction. Japan to offset cuts by boosting the issue of 5yr and 2yr notes and T-bill.

- Japan Finance Ministry Official does not deny the possibility of considering buying back some JGBs; not in the process of implementing buybacks right now; will need to consider various factors if steps are decided.

Commodities

- Brent suffers losses of around USD 2/bbl on optimism of Middle-East negotiations, with Iran-E3 meetings today, and primarily after the two-week window Trump has provided. Note, while Brent is lower, WTI posts gains of USD 0.40/bbl, a discrepancy due to the lack of settlement amid the US holiday on Wednesday. Geopolitical updates this morning light, aside from, US Secretary of State Rubio telling his French counterpart that the US is ready for direct contact with the Iranians at any time, however the Iranian Foreign Minister noted that the nation would not speak with the US, while Israeli attacks continue.

- Spot gold is suffering from the generally positive risk environment, currently holding around the USD 3350/oz mark but has been USD 10/oz lower; given the geopolitical relief, mentioned in the crude section. XAU has taken out the 21-DMA at USD 3345/oz, the next level comes via the June 12th low of USD 3338/oz.

- Base metals are in the red and failing to benefit from the positive European mood after the red metal failed to coat-tail on the broadly firmer European risk tone. Copper currently tests the USD 9,600 mark, and resides within USD 9,565.45-9,654.6/t bounds.

- Citi said that if 1.1mln BPD of Iranian oil exports were disrupted—using May exports as a baseline—it estimated prices should rise by about 15–20%, compared with an average of USD 65/bbl in the month before the Iran-Israel conflict escalated on 12 June. A 1.1mln BPD disruption implied Brent prices should be in the USD 75–78/bbl range. Citi added that prices reaching USD 90/bbl—its current bullish case, short of a major escalation in oil transit—would imply a disruption of 3mln BPD over a multi-month period, according to Reuters.

- India restricted the import of alloys of palladium, rhodium, and iridium containing over 1% gold by weight, according to Reuters.

Geopolitics: Middle East War

- Israel will complete the task of preventing Iran from gaining nuclear weapons whether or not the US joins the operation, its energy minister said. Iranian President Masoud Pezeshkian said the only way to end the war is to “unconditionally” stop Israel, according to Bloomberg

- E3/EU-Iran meeting in Geneva expected to occur "this afternoon", via WSJ's Norman.

- Israeli Defence Minister Katz has ordered the military to increase attacks on Iranian regime targets within Tehran.

- Iran's Foreign Minister says they will only hold nuclear talks in the E3 meeting.

- Russia's Kremlin says dialogue with Ukraine continues expect to agree next week on a date for the next round of talks Ukraine is unpredictable, continue "special military operation", though would prefer to reach goals by diplomatic needs.

US Involvement

- The White House said, “message directly from the President – based on the fact that there is a significant chance of negotiations with Iran in the near future – I will make a decision on whether to launch [an attack] in the next two weeks.”

- US President Trump had been briefed on both the risks and benefits of bombing Fordow and his mindset was that disabling it was necessary due to the risk of weapons being produced in a relatively short period of time, according to CBS.

- Broadcasting Authority, citing an Israeli source, reported that the US had asked Israel to defer its attack on the Fordow nuclear facility.

- Kann News reported that there was a "possible attack at Fordow": according to sources, the US had asked Israel to wait until negotiations with Iran had been exhausted.

- US President Trump is to attend a National Security Meeting at 11:00 EDT on Friday.

- US law enforcement officials had stepped up surveillance of Iran-backed operatives in the US, according to CBS sources.

- The White House said Iran was able to produce a nuclear bomb within "a couple of weeks".

- A White House official told Fox's Heinrich that the US military had no doubt about the efficacy of bunker busters in eliminating the site at Fordow, and also denied that any options—including tactical nuclear weapons—had been taken off the table.

- The White House Press Secretary said there were no signs that China was getting involved militarily in Iran, according to Reuters.

- The US reportedly believed Iran would build a nuclear bomb if Supreme Leader Khamenei were assassinated and the Fordow facility was attacked, according to The New York Times.

Strikes

- There were reports of Israeli strikes in the Lavizan area of Tehran, where Iranian Supreme Leader Khamenei was reportedly hiding in a bunker, according to i24 journalist Stein.

- An Israeli military spokesman said Israel had attacked the special forces headquarters of the internal security apparatus in Tehran within the last 24 hours, according to Reuters.

- Journalist Horowitz said on X that opposition sources were circulating "unconfirmed" reports claiming that the head of Iran's military, Abdolrahim Mousavi, had been killed in an Israeli strike.

- The Fars News Agency said Iran had used a new generation of precision missiles in its attack on Israel on Thursday morning, according to Fars.

- The Norwegian Foreign Ministry said an explosion had occurred on Thursday evening in Tel Aviv at the residence of the Norwegian ambassador to Israel, according to Reuters.

- The Jordanian army said an explosives-laden drone had fallen in the Azraq area after it “fell short of its range,” according to Al Hadath.

- Iranian media reported that air defences were activated in Isfahan, according to Al Arabiya.

Diplomacy

- Britain, France, and Germany are to hold talks with Iran’s Foreign Minister on Friday in a last-ditch effort to avert an escalation of conflict in the Middle East and a possible US intervention, according to FT.

- Iran's Foreign Minister had reached out to European foreign ministers, requesting a meeting with them on Friday, Jerusalem Post reported.

- Trump administration officials are pitching the president’s two-week timeline as an opportunity to allow diplomacy to play out. Special Envoy Witkoff and Iran’s Foreign Minister Araghchi had been in communication in recent days, though there were no plans for the two to meet yet, according to ABC.

- Trump's special envoy to the Middle East Witkoff will not attend the UK/France/Germany talks with Iran in Geneva on Friday, according to White House officials cited by NBC.

- An Iranian source denied reports of a phone call between Iranian Foreign Minister Araghchi and US presidential envoy Witkoff following Israel’s aggression, according to Iran Nuances.

- The White House Press Secretary said they would see how the EU meeting with the Iranians went tomorrow, according to Reuters.

- US officials said no date had been set for a meeting between US and Iranian officials yet, according to Axios.

US Military and Deployment

- Over the next 10 to 14 days, there were expected to be two aircraft carriers in the Middle East and a third operating in the Mediterranean Sea, according to ABC.

Iranian Actions

- A senior IRGC official said that before the Israeli airstrikes, all enriched uranium had been transferred from the nuclear sites to secret hiding locations, according to i24 journalist Stein.

- Iran’s Tasnim News Agency, quoting an Iranian official, said intelligence had thwarted a major Israeli plot against Iranian Foreign Minister Araqchi in Tehran, according to Sky News Arabia.

- Iraq’s Hezbollah threatened to target US bases and close the Strait of Hormuz if Washington joined strikes on Iran, according to Al Hadath.

- An Israeli official said Iran could likely sustain the current rate of missile fire at Israel for up to five months, provided their missile launchers were not destroyed, according to NBC.

- Israel anticipated attacks from Iran’s proxies across the Middle East, according to Israel Channel 14.

- An Israeli intelligence official said the imminent collapse of the Iranian regime was far from the truth, according to NBC.

Geopolitics: Other

- A Japanese destroyer sailed through the Taiwan Strait after a Chinese jet approached it, according to Nikkei.

- China President Xi met with New Zealand PM Luxon in Beijing, according to CCTV.

US Event Calendar

DB's Jim Reid concludes the overnight wrap

Markets are recovering a bit this morning after White House spokeswoman Leavitt last night said that Trump had dictated a message saying that "based on the fact that there's a substantial chance of negotiations that may or may not take place with Iran in the near future, I will make my decision whether or not to go within the next two weeks".

Prior to this, several sources had pointed to a US strike on Iran possibly happening as soon as this weekend which led to a risk-off mood yesterday in the quiet US-holiday influenced session.

So this should reduce the event risk ahead of the weekend and Brent futures, after closing the European session (+2.80%) and at the highest level since January at $78.85/bbl, are back down -2.44% to $76.93/bbl this morning. Even though US markets were closed yesterday, S&P 500 futures slid throughout the day and closed in Europe -0.93% lower with the Nasdaq equivalent -1.10%. This morning they have clawed back much of this lost ground to both be 'only' around -0.2% lower.

Even with the falls this morning, Brent crude has now risen +20.52% since the start of the month, which would make this the biggest monthly jump since November 2020, back when the vaccine announcements offered a path out of the pandemic. So this is still a substantial move.

That inflationary backdrop and earlier fears of a weekend US attack meant it was a tough environment for European markets yesterday, with equities and bonds both losing ground. So that meant the STOXX 600 (-0.83%) fell to a one-month low, with the more cyclical sectors leading the decline. Unsurprisingly, energy stocks were the main outperformer given the rise in oil prices, and the STOXX 600 Energy Index was up +0.79%. But otherwise there was a weak performance across the continent, with the DAX (-1.12%) and the CAC 40 (-1.34%) also losing ground. European equity futures are back up around +0.75% so far this morning.

Elsewhere in Europe, the main headlines yesterday came from several central bank decisions, including the Bank of England. They left their policy rate on hold at 4.25%, as widely expected, but the vote was 6-3 to hold, with the minority preferring a 25bp cut. Looking forward, they maintained their language about a “gradual and careful approach” to easing policy, and markets continue to price another cut at the August meeting as likely. So if realised, that would continue the pattern of quarterly rate cuts since the easing cycle began last summer. In his recap (link here), our UK economist also expects the next rate cut in August, and thinks that the disinflation path remains on track, despite the recent energy news.

In other central bank news, there was a surprise from the Norges Bank yesterday, who cut rates by 25bps, despite widespread expectations for a hold beforehand. Unlike a lot of other central banks, they hadn’t yet cut rates from their peak after the tightening cycle of 2021-23, so it was an important move, and the statement said they felt it was “appropriate to begin a cautious normalisation of the policy rate.” With the decision coming as a surprise, that led to a noticeable weakening in the Norwegian Krone, which fell around a percent against the US Dollar. Otherwise, the Swiss National Bank also cut rates by 25bps yesterday (the sixth consecutive move), but that was in line with expectations. They are now back at zero with the SNB seemingly more likely than not to move into negative territory in the autumn to try to stem the rise in the Swiss Franc and to try to prevent ultra-low inflation from being embedded. There was some relief they didn't do this yesterday though.

Those policy decisions didn’t have too much of an effect on European sovereign bonds, with investors more concerned about the prospect of higher inflation. So that pushed yields higher across the continent, including for 10yr bunds (+2.4bps), OATs (+5.9bps) and BTPs (+7.5bps). There was also a clear widening in sovereign bond spreads, consistent with the wider risk-off move, and the +5bps jump in the Italian spread over bunds was actually the biggest daily jump since early April.

Asian equity markets are mostly trading higher this morning after hopes that US involvement won't come as early as this weekend and that diplomacy still has a chance. Across the region, the KOSPI (+1.15%) is leading gains, climbing to its highest level since early 2022 while being closely followed by the Hang Seng (+1.13%). Elsewhere, the CSI (+0.24%) and the Shanghai Composite (+0.08%) were relatively unaffected by the PBOC’s decision to leave its benchmark loan prime rate unchanged. Meanwhile, the Nikkei (-0.02%) is struggling to gain traction lagging most of its Asian peers after slightly higher consumer inflation data increased expectations that the BOJ will hike interest rates further in the coming months.

Japan's inflation data included a headline figure of 3.5% YoY (3.6% in April), a core CPI excluding fresh food of 3.7% (3.5%), and a core-core CPI excluding fresh food and energy of 3.3% (3.0%). The YoY increases in both the core and core-core CPI exceeded consensus expectations by 0.1 percentage point. However, as our economist has pointed out, the actual YoY increases in the core and core-core CPI were 3.654% and 3.259%, respectively, so the reality is that they only slightly exceeded consensus. The seasonally adjusted MoM increases were 0.5% for the core CPI and 0.3% for the core-core CPI. Short-term inflation momentum does remains strong and you can review these numbers in more details here with our economists' view on how they influence BoJ policy. He remains on the hawkish side and expects a hike next month.

Meanwhile, the Chinese yuan (+0.09%) is gaining ground for the second straight day against the dollar, after the PBOC set fixing at the strongest level since March.

To the day ahead now, and data releases include UK retail sales for May, the Euro Area money supply for May, preliminary consumer confidence for June, and the US Conference Board’s leading index for May. From central banks, we’ll hear from BoJ Governor Ueda, and the ECB will publish their Economic Bulletin.