GM shares are flat but the company raised its full year guidance for the second time today and has announced a deeper plan for cutting costs.

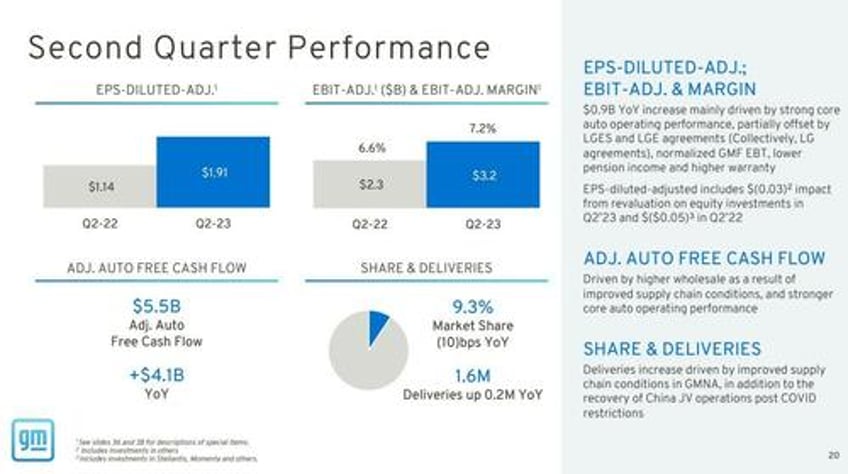

The legacy automaker reported earnings on Tuesday that exceeded expectations, posting adjusted EPS of $1.91 and revenue of $44.75 billion versus estimates of $42.64 billion, per consensus estimates. Revenue was up 25% from a year prior.

GM also announced "net income attributable to stockholders of $2.57 billion, or $1.83 per share, up nearly 52% from a year earlier when it earned $1.69 billion, or $1.14 per share", per CNBC.

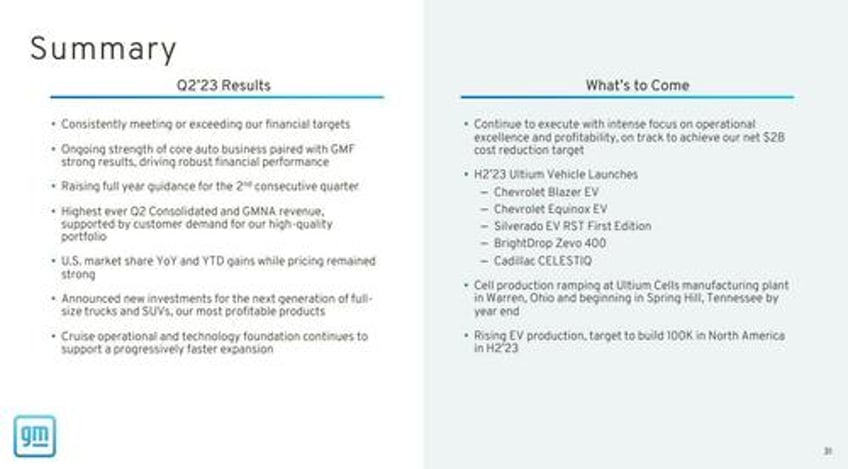

In a shareholder letter, the company raised its guidance: "The impact on our bottom line and our outlook is clear, so we are raising our full-year EBIT-adjusted guidance by $1 billion and our adjusted automotive free cash flow guidance by $1.5 billion. We now expect earnings per share to be between $7.15 - $8.15 per share."

Other metrics from the earnings report, as wrapped up by Goldman Sachs this morning:

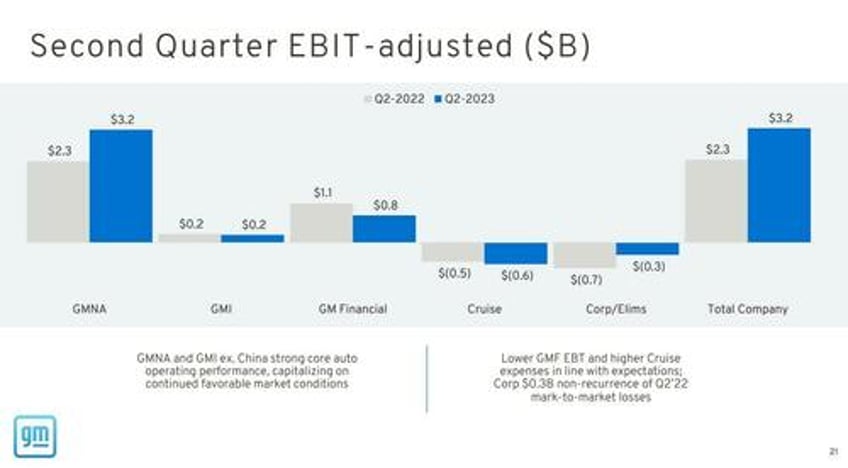

Automotive revenue of $41.3 bn (up 13% qoq and up 26% yoy) compares to GS at $41.1 bn. GM Financial revenue of $3.5 bn (up 5% qoq and up 11% yoy) compares to GS at $3.1 bn.

The company also slightly decreased its capital and battery JV spend guidance to $11bn to 12bn ($11 bn to 13 bn prior).

Consolidated wholesales were up 20% yoy to 979K, about in line with GS at 978k, with North America wholesales up 26% yoy to 833k compared to GS at 808k and consolidated GM International wholesales down 5% yoy to 147k vs. GS at 171k. Non-consolidated China JV wholesales were up 27% yoy to 599k compared to GS at 530k. The North America ASP was ~$44.7K, down about 2% qoq and up ~3% yoy. This was below our estimate of $45.6K.

Goldman is maintaining a "BUY" on the name with a 12 month price target of $49, which is says is based on 7X applied to our normalized EPS estimate of $7.00.

GM said it would be ramping its cost cutting measures through next year, with plans now to cut $3 billion in expenditures, versus its previous guidance of $2 billion. The company will add cuts in sales and marketing spending, as well as with salary employment, company CFO Paul Jacobson said.

GM wound up taking an unexpected $792 million charge as part of sharing costs related to "a recall of its Chevrolet Bolt EV models". The charges came as part of a commercial agreement with LG Electronics and LG Energy, who had previously been expected to bear the costs of the agreement.

"The charge reflects the conscious decision we made during the Chevrolet Bolt EV and Bolt EUV recall to serve our customers in ways that go beyond traditional remedies, and we are taking new steps that will reduce GM’s costs and improve our EV margins over time," CEO Mary Barra said in her letter.

In her letter to shareholders, Barra pointed out robust demand and international growth: "The biggest driving force behind our financial results is customer demand for our vehicles, which have now led the U.S. industry in initial quality for two consecutive years. We have earned four consecutive quarters of higher retail market share in the U.S. versus a year ago with continued strong pricing and incentive discipline, we’re leading in both commercial and total fleet deliveries calendar year to date, and we’re growing profitably in international markets such as Brazil and Korea."

She also ramped up the company's EV production expectations: "In the electric vehicle market, we met our target to produce 50,000 EVs in North America in the first half of the year. With both cell and vehicle production increasing, we continue to target production of roughly 100,000 EVs in the second half of this year and we’ll grow from there."

As she notes, next on the horizon for the company is labor negotiations with the UAW. Barra said: "We have a long history of negotiating fair contracts with both unions that reward our employees and support the long-term success of our business. Our goal this time will be no different."

Goldman sees the risks ahead for GM as "the auto cycle, market share, margins, FCF, and GM's ability to profitably pivot to growth areas such as EVs and AVs".