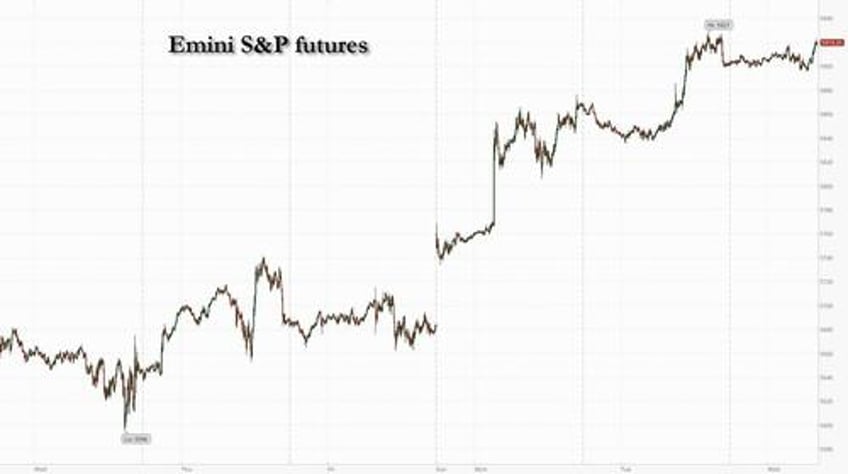

US equity futures are modestly in the green with tech/AI stocks leading and small caps lagging as equities may see some profit-taking given the relentless strength of the rally. Stocks has now erased their YTD losses, and the recovery pace of the past 6 weeks is the fastest since the 1980s. As of 8:00am ET, S&P futures are up 0.2%, near session highs after reversing earlier losses; Nasdaq futures gain 0.4% with chips higher on new deals being made by Trump in the Middle East regarding chips/AI infra build. Pre-mkt, NVDA/TSLA are higher with the rest of Mag7 mixed but Semis are higher though other Cyclicals are slightly weaker. AI theme is higher, too. The yield curve is twisting steeper as USD strength fizzles sparked by concerns Trump may turn to dollar strength next (following overnight Bloomberg report there was discussion between US and SKorea on dollar strength). Commodities are lower as Energy sells off, and gold is flat around $3220. The macro data focus is on mortgage applications (up 1.1%) and XHB is +5% over the last two days.

In premarket trading, magnificent seven stocks are mixed: Nvidia leads gainers as the semiconductor giant is on track to extend gains after a deal to supply chips to Saudi Arabian AI company Humain for a massive data center project (Nvidia +3%, Tesla +2%, Alphabet +0.6%, Meta +0.7%, Amazon +0.2%, Apple -0.3%, Microsoft -0.3%). Super Micro Computer (SMCI) rises 14%, set to extend Tuesday’s 16% rally, after Saudi Arabia-based data center company DataVolt signs a multi-year partnership agreement with the beleaguered US company. Here are some other notable premarket movers:

- American Eagle (AEO) slumps 12% after the retailer withdrew its fiscal year 2025 guidance due to macroeconomic uncertainty.

- Aurora Innovation (AUR) plunges 18% after Uber, a leading backer, said it plans to sell $1 billion of senior notes exchangeable into shares of the self-driving technology developer.

- Cboe Global Markets Inc. (CBOE) slips 1.5% after Morgan Stanley double downgraded the stock, recommending lower defensives exposure on the back of greater than expected tariff de-escalation between China and the US.

- Dynatrace (DT) rises 3% after the analytics platform company forecast 1Q revenue that beat the average analyst estimate.

- Exelixis (EXEL) climbs 4% after the maker of cancer drug Cabometyx raised its projection for revenue this year.

- Grail Inc. (GRAL) tumbles 13% after the cancer-detection firm posted 1Q revenue that fell short of expectations.

- KKR (KKR) rises 1.8% after Morgan Stanley upgraded the private equity firm to overweight, recommending it as a way to play the anticipated capital markets recovery.

- Nu Holdings Ltd. (NU) slips 2% after the company posted 1Q results that showed higher spending to attract new clients and protect against potential bad loans.

- Septerna (SEPN) soars 62% after the biotech said it’s partnering with Novo Nordisk A/S on the development of oral pills for obesity and type-2 diabetes.

After the recent faceripping rally left the S&P 500 flat for the year, Wall Street strategists - who were skeptical stocks would rebound at all - are now skeptical about how much further stocks can run. Goldman Sachs strategist Peter Oppenheimer warned that equities remain vulnerable if deteriorating economic data reignites recession worries.

“Investors got very bearish in April, missed the market rebound and then were forced to chase it,” said Lilian Chovin, head of asset allocation at Coutts & Co. With focus shifting to the impact of tariffs, he’s using the rebound to take some profit and reduce his equities overweight.

After its recent rally, the dollar weakened 0.4% after Bloomberg reported that the US and South Korea discussed their currency policies in early May, fueling speculation President Donald Trump’s administration is open to a weaker greenback. The won jumped more than 1% and neighboring currencies, including the Japanese yen, also rose against the dollar.

Investors took news of the talks between South Korea and the US as reason to suspect foreign governments may accept strength in their exchange rates to smooth the way to trade deals with the US. Trump and other administration officials have argued weakness in Asian currencies versus the dollar have handed an unfair advantage for regional exporters over US rivals.

In Europe, the Stoxx 600 dipped 0.2% as stocks paused for breath after the rally spurred by trade optimism. Insurance, utility and telecoms stocks outperform, while autos and consumer products lag. Among individual stocks, Burberry surges after the luxury group’s fourth-quarter retail sales beat estimates and the company announced plans to cut almost a fifth of its workforce. Shares in tour operator TUI slide after summer bookings showed a negative inflection. Here are some of the more notable movers:

- Burberry shares rise as much as 9.9% after the British luxury group’s 4Q retail sales beat estimates, sparking hopes among analysts that the company is seeing the early signs of a turnaround.

- EON shares advance as much as 1.6% after the German utility reported strong first-quarter figures, with analysts saying consensus estimates are likely to rise after the report.

- ABN Amro shares outperform as the lender reports a 1Q profit that was bigger than expected, while strong capital fueled share buyback optimism. Lending revenue was disappointing, RBC analysts said.

- Imperial Brands shares drop as much as 8.3%. The tobacco firm’s earnings missed expectations amid declines in volumes and its CEO’s decision to retire caught investors off-guard.

- FLSmidth shares gain as much as 13% to a two-month high after posting a “whopping” 24% beat on first-quarter adjusted Ebitda, according to Jefferies.

- Compass shares fall as much 4.8% as organic growth at the catering firm is slightly below some estimates, with some concern over North America revenue. Panmure Liberum questions the current valuation.

- TUI shares slide as much as 11%, most in three months, after the tour and travel operator signaled a negative bookings inflection for the key summer season.

- Experian shares fall as much as 1.8% after the UK credit and marketing firm reported in-line earnings and offered organic revenue guidance slightly below expectations.

- Alcon shares slide as much as 9.5%, the most since March 2020, after first-quarter results from the Swiss eyecare firm missed estimates across the board.

- Alstom shares slump as much as 17% after the French transport system company’s earnings. Morgan Stanley says the quarterly print is ahead “but the softer guidance will likely be the focus.”

- InPost shares drop as much as 8.3% after the parcel locker operator guided for softer volumes in Poland in 2Q.

- Spirax shares fall as much as 5.6% after a first-quarter update from the UK engineering services firm that Morgan Stanley says contained both positives and negatives.

Earlier in the session, Asian stocks rose, on track for a fourth-straight session of gains, as Chinese tech firms climbed ahead of earnings announcements. The MSCI Asia Pacific Index advanced as much as 1.1%, with Tencent and Alibaba among the biggest boosts. Chipmakers TSMC and SK Hynix also drove gains, following US peers higher after news that Nvidia and Advanced Micro Devices will supply semiconductors for a large Saudi Arabian data-center project. Hong Kong, South Korea, Taiwan and Indonesia led gains in the region. Japanese stocks bucked the trend, with the benchmark Topix snapping a 13-day win streak, as worries about the nation’s continued lack of a tariff deal with the US and weak earnings from the auto sector drove profit-taking. Traders are looking to China’s tech earnings as another possible catalyst for stocks after this week’s US-China tariff cuts. The results could provide clues on whether the sector’s artificial intelligence-driven rally is back on track, which may offset lingering doubts over the potential for final deals between US and its trading partners.

In FX, the Bloomberg Dollar Spot Index is down 0.5% as the greenback falls across the board after Bloomberg reported the US and South Korea discussed their currency policies in early May and agreed to continue talks, according to a person familiar with the matter. The South Korean won rises 1.7%. The Japanese yen is the best performing G-10 currency with a 1.1% gain.

In rates, the 10-year Treasury yields are higher by 1basis point at 4.48%, reversing an earlier drop. US 2- to 10-year yields are 1bp-2bp cheaper on the day led by the 5-year, with long-end little changed, steepening 5s30s by about 1bp. UK gilts lag Treasuries slightly after an auction of 10-year debt.

In commodities, WTI drops 1% to $63 a barrel. Spot gold falls $20 to around $3,230/oz. Bitcoin falls over 1% toward $103,000.

The US economic data slate is blank; scheduled Fed speakers include Jefferson (9:10am) and Daly (5:40pm)

Market Snapshot

- S&P 500 mini +0.2%

- Nasdaq 100 0.4%

- Russell 2000 mini -0.1%

- Stoxx Europe 600 -0.4%

- DAX -0.6%

- CAC 40 -0.7%

- 10-year Treasury yield little changed at 4.46%

- VIX +0.1 points at 18.34

- Bloomberg Dollar Index -0.5% at 1224.7

- euro +0.7% at $1.1259

- WTI crude -0.8% at $63.18/barrel

Top Overnight News

- House Republicans may reach a SALT deduction compromise today, House Speaker Mike Johnson said. A proposal is being debated to increasing the cap to $30,000 from $10,000. BBG

- Trump’s tariff policies are projected to cut California’s tax revenue by $16 billion in the next fiscal year, Governor Gavin Newsom’s finance department said. BBG

- Qatar Airways is set to announce that it secured an agreement to purchase 150 aircraft from Boeing while President Trump is in Doha on Wednesday, a source familiar with the matter confirmed to NewsNation. The Hill

- China criticizes the US-UK trade deal, warning that Washington shouldn’t pursue agreements that isolate Beijing. FT

- Companies expected to rush inventory to the US from China ahead of the holidays to capitalize on the 90-day détente between the two countries. FT

- Japan’s PPI slowed more than expected to 0.2% in April. BBG

- Trade talks between India and the US are progressing smoothly, with the first tranche of a deal expected by fall, according to people familiar with the discussions. However, it’s unclear if India can secure an interim deal by early July, when Trump’s reciprocal tariffs are expected to kick in. BBG

- Joachim Nagel said markets were close to a meltdown after last month’s US trade announcements. The ECB’s Governing Council member said he couldn’t see how raising barriers to free trade would produce positive outcomes for the US. BBG

- The BOE’s Catherine Mann told CNBC she flipped her vote from a bumper interest-rate cut to a pause because sharp moves on markets had lowered borrowing costs and provided enough easing of financial conditions. BBG

- Fed's Goolsbee (2025 Voter) says some part of April inflation represents the lagged nature of data and the Fed is still holding its breath. It will take time for current inflation trends to show up in data. Right now is a time for the Fed to wait for more information and try get past the noise in the data. Cannot jump to conclusions about long-term trends given all the short term volatility.

Tariffs/Trade

- White House economic adviser Hassett said the administration has more than 20-25 deals on the table with deals close to being finalised and when President Trump returns, he will announce the next deal, according to a Fox interview.

- US-China trade ceasefire is to drive early Black Friday and Christmas stockpiling with ports and shipping companies expecting a surge in demand as retailers take advantage of lower tariffs on Chinese imports, according to the FT.

- China criticised a trade deal between the UK and US that could be used to squeeze Chinese products out of British supply chains, according to the FT.

- Mexico's Economy Minister said they hope to start the USMCA review as soon as possible to give consumers and investors clarity.

Top Overnight News

- White House economic adviser Hassett said the administration has more than 20-25 deals on the table with deals close to being finalised and when President Trump returns, he will announce the next deal, according to a Fox interview.

- US-China trade ceasefire is to drive early Black Friday and Christmas stockpiling with ports and shipping companies expecting a surge in demand as retailers take advantage of lower tariffs on Chinese imports, according to the FT.

- China criticised a trade deal between the UK and US that could be used to squeeze Chinese products out of British supply chains, according to the FT.

- Mexico's Economy Minister said they hope to start the USMCA review as soon as possible to give consumers and investors clarity.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded somewhat mixed but with the region predominantly in the green following the momentum from the constructive performance on Wall St, where most major indices closed higher in the aftermath of the softer-than-expected US CPI data, although demand was contained overnight amid a lack of fresh major catalysts and as participants digested earnings releases. ASX 200 lacked firm direction as strength in energy and tech was counterbalanced by weakness in utilities and consumer stocks, while financials were rangebound despite Australia's largest bank CBA reporting an increase in profits. Nikkei 225 wiped out opening gains and briefly reverted to a sub-38,000 level with the list of worst performers in the index dominated by companies that had just reported earnings results. Hang Seng and Shanghai Comp gained amid strength in Chinese healthcare stocks and tech names leading the upside in Hong Kong ahead of Tencent and Alibaba earnings results scheduled for today and tomorrow, respectively, while the upside in the mainland was limited amid a lack of major fresh catalysts.

Top Asian News

- South Korea is preparing support measures for small and medium-sized firms expected to be hit by tariffs, according to Reuters citing the government.

- CATL (300750 CH/3750 HK) is reportedly to set a price of HKD 263/shr for its upcoming Hong Kong listing, via Reuters citing sources; to increase the HK listing size by 17.7mln shares.

- Foxconn (2317 TW) Q1 (TWD): net 42.12bln (exp. 37.9bln); operating 46.5bln (exp. 46.3bln), revenue 1.64tln (exp. 1.65tln); expects 2025 revenue to see significant growth Y/Y (prev. exp. to grow "strongly").

- Tencent (700 HK) Q1 (CNH) Revenue 180.02bln (exp. 175.6bln), Op. Profit 57.57bln (exp. 59.2bln), Adj. Net Income 61.33bln (exp. 59.68bln).

European bourses (STOXX 600 -0.2%) opened modestly mixed and on either side of the unchanged mark; since, the risk tone has deteriorated to display a mostly negative picture in Europe. European sectors opened mixed and with no clear theme or bias, and with the breadth of the market fairly narrow. Real Estate takes the top spot, joined closely by Telecoms and then Utilities to complete the top three. Autos sit towards the foot of the pile, driven by post-earning weakness in Daimler Truck (-1.1%). US equity futures are flat/modestly lower, attempting to hold onto the gains seen yesterday, strength which was in-part spurred by the plethora of deals announced/reported on during the Saudi event. Barclays raises its 2025 year-end price target for STOXX 600 to 540 (prev. 490, currently 545.09). Barclays European Equity Strategy downgrades Consumer Staples to Underweight; upgrades Consumer Discretionary to Market Weight (prev. Underweight). Goldman Sachs lifts its Stoxx 600 target for the next 12-months to 570 (prev. 520).

Top European News

- BoE's Mann says the UK labour market has been more resilient than expected. Worried that household inflation expectations have increased. Need to see a loss of pricing power by firms, however, goods price inflation is increasing. Trade aversion will result in lower global good prices. Firms will look for the opportunity to rebuild their margins. "Dollar is still king".

- BoE's Breeden: "A macro-prudential approach to the supervision of CCPs is essential given their central role in the financial system".

- ECB's Nagel says there is a good probability the inflation target will be maintained; current uncertainty will be the new "normal", central banks have to get used to manage it Very supportive of the new (German) fiscal debt brake, however, it is clear that Germany will need to return to fiscal rules in the future. USD is very important, but the EUR's role will become stronger as a reserve currency in the next few years.

- Hapag Lloyd (HLAG GY) CEO says they have seen an increase in orders for China-US shipments by more than 50% W/W; demand is considerably higher compared with the time before US tariffs.

FX

- DXY began the European session on a modestly weaker footing, continuing to pare back some of the US-China induced upside. As the session progressed, some hefty Dollar pressure was seen, as the risk tone deteriorated and with some traders pointing towards a technical driven move. Some focus may also be on Deputy Finance Minister Choi's meeting with Kaproth of the US Treasury on May 5th to discuss FX. DXY currently towards the lower end of a 100.28-101.02 range. Data docket ahead is thin, focus will be on commentary from Fed Vice Chair Jefferson and Fed's Daly (2027 voter) - do note that in prepared remarks from Waller, he did not comment on monetary policy.

- EUR is on a firmer footing, largely benefiting from the broader Dollar weakness, rather than any EZ-specific updates, which have been lacking in today’s session. To recap, Spanish and German Final inflation figures were unrevised. Elsewhere, ECB's Nagel said "there is a good probability the inflation target will be maintained; current uncertainty will be the new "normal", central banks have to get used to manage it" - remarks which had little impact on the pair. The Single Currency has made a fresh WTD high at 1.1264.

- JPY is the best-performing G10 currency thus far; early morning strength was thanks to the broadly softer US yield environment, and with some modest deterioration in the risk tone (leading to broader Dollar weakness) USD/JPY managed to dip back below the 147.00 mark to a fresh low at 145.76, taking out the 50 DMA at 146.18.

- GBP is modestly firmer vs the broadly weaker Dollar, but is a little weaker vs EUR. Today has seen a few appearances from BoE members; starting with arch-hawk Mann, she noted that “UK labour market has been more resilient than expected. Worried that household inflation expectations have increased”. Elsewhere, Breeden released a text publication, but that focused more on supervision matters rather than on monetary policy. There was little price action sparked by both members.

- Antipodeans are modestly firmer vs the weaker Dollar; AUD/USD currently trading at the upper-end of a 0.6464-0.65 range; NZD/USD in a 0.5931-0.5968 parameter.

- PBoC set USD/CNY mid-point at 7.1956 vs exp. 7.1813 (Prev. 7.1991)

Fixed Income

- A similar setup to Tuesday morning as USTs find themselves marginally in the green while peers across the pond are a touch in the red. USTs find themselves at the upper-end of a very thin 110-01 to 110-09 band. Fed's Waller did not comment on monetary policy in prepared remarks; next up, Jefferson and Daly.

- Bunds are in-fitting with action at this time on Tuesday, a touch softer in narrow parameters with specifics for the bloc fairly light. No move to a handful of final data points from Germany and Spain. Elsewhere, ECB's Nagel said "there is a good probability the inflation target will be maintained; current uncertainty will be the new "normal", central banks have to get used to manage it" - remarks which had little impact on the pair. Some modest upside was seen as the risk tone was hit a little in European trade and currently trades in a 129.29-59 band. Some modest upside was seen following a well received Bund auction.

- Again, echoes of the dynamic on Tuesday as Gilts find themselves the modest fixed underperformer. Specifics for the UK are a touch light, remarks from BoE’s Breeden this morning largely stayed clear of monetary policy. Before Breeden, “activist” Mann was on the wires and expressed concern that the labour market has been more resilient than forecast and that household inflation expectations have increased; overall, her commentary was hawkish and may be factoring into the bearish bias for Gilts, but nothing overly surprising from the dissenter.

- UK to sell GBP 4.25bln 4.50% 2035 Gilt: b/c 3.13x (prev. 2.85x), average yield 4.673% (prev. 4.638%) & tail 0.3bps (prev. 0.4bps).

- Germany sells EUR 1.313bln vs exp. EUR 1.5bln 1.25% 2048 Bund and EUR 0.818 vs exp. EUR 1bln 2.50% 2054 Bund.

Commodities

- The crude complex is failing to benefit from the weaker dollar, as it gives back a little of Tuesday’s strength with today’s focus on US President Trump in Riyadh, where commentary has weighed on benchmarks, currently down by around USD 0.40/bbl on the day. Crude edged lower this morning amid constructive language regarding the Middle East from the US President, who announced the lifting of sanctions on Syria, expressed interest in normalizing relations, and emphasized a vision for a peaceful and prosperous region. WTI and Brent are just above session lows, in respective USD 62.86-63.68 and 65.82-66.59/bbl ranges.

- OPEC MOMR will be released at 13:00 BST (08:00 EDT).

- Spot Gold, like Crude, is failing to benefit from the weaker dollar, which sees the Dollar index lower by 0.4%. While pressured, the benchmark is in a thin c. USD 30/oz band and one that is essentially a repeat of the confines from Tuesday.

- Copper is modestly firmer, and trading at session highs as base metals are broadly benefitting from Dollar weakness. 3M LME Copper currently in a USD 9,562.6-9,638.45/t range.

- US Private Inventory Data (bbls): Crude +4.3mln (exp. -1.1mln), Distillate -3.7mln (exp. 0.1mln), Gasoline -1.4mln (exp. -0.6mln), Cushing -0.9mln.

Geopolitics: Middle East

- Iranian Foreign Ministry spokesman said they have made it clear that no agreement will be reached with the US without concrete guarantees, according to Iran International. It was also reported that Iran is to hold talks with European parties on Friday in Istanbul, according to European and Iranian sources cited by Reuters.

- Israel's military said it identified the launch of a missile towards Israeli territory from Yemen which was intercepted.

- Jordanian army said a rocket of unknown origin landed in a desert area in the Ma'an, according to a source via X.

- US President Trump is meeting Syrian President al-Sharaa, via AP.

- US President Trump says the US wants to do a deal with Iran. Reiterates that Iran cannot have a nuclear weapon. Lifting sanctions on Syria. Exploring normalising relations with them. Wants a peaceful and prosperous Middle East. Special relationship with Saudi Arabia.

- Syria's President told US President Trump that they are inviting US firms to invest in Syria's oil and gas sector.

Geopolitics: Other

- Senior Russian Lawmaker says the makeup of the Russian delegation to Istanbul for the Ukraine talks will be known on Wednesday evening, via Telegram

- China's Defence Minister met with the UN Secretary General on Tuesday and said that China will put forward new peacekeeping commitments, while China will support the reform and transformation of UN peacekeeping. Furthermore, the Minister said China is always a staunch supporter and constructive force for UN peacekeeping operations, according to Xinhua.

US Event Calendar

- 7:00 am: May 9 MBA Mortgage Applications, prior 11%

Central Banks (All Times ET):

- 5:00 am: Fed’s Goolsbee Appears on NPR

- 5:15 am: Fed’s Waller Speaks on Central Bank Research

- 9:10 am: Fed’s Jefferson Speaks on Economic Outlook

- 5:40 pm: Fed’s Daly Speaks in Fireside Chat

DB's Jim Reid concludes the overnight wrap

It's been another 24 hours where the Trump administration continues to hog the headlines. With the President in the Middle East, various stories on AI supported a huge tech-led rally, which helped the S&P 500 (+0.72%) move back into positive territory for the year. That got a further boost thanks to a softer-than-expected CPI print (the third in a row), and it now means the index is now up +18.1% since the low on April 8. Indeed, the last time the index surged that fast in just over a month was back in April 2020, when markets were roaring back from the initial Covid slump. In the meantime, several other post-Liberation Day moves unwound further, with the VIX closing at 18.22pts, whilst US HY spreads (-6bps) fell to 299bps.

The Nasdaq (+1.61%) and the Mag-7 (+2.24%) led the gains yesterday, elevated by Nvidia’s +5.63% rise on the news they’d help build Saudi Arabia’s AI infrastructure, as part of an Economic Partnership that President Trump struck with Saudi Crown Prince Mohammed bin Salman yesterday. The White House framed the deal as a $600bn investment commitment from Saudi Arabia, while Trump and MBS touted a pledge of $1trn in commercial deals. The deal includes a $142bn defense agreement between the US and Saudi as well as tech firms like Google, Oracle and AMD pledging to invest $80bn in tech across both countries. So it was another win for tech stocks which helped push the S&P 500 +0.72% higher.

Trump’s visit is the first of a four-day trip to the Middle East, as the President seeks to form a series of financial deals with Qatar and the UAE. He's clearly in a mood to do deals so watch out for more on his trip. In fact, Bloomberg reported yesterday that the administration is weighing a deal that would allow the UAE to import 500k of Nvidia’s advanced chips annually, far exceeding limits for AI chip exports set under Biden. Meanwhile on trade, NEC Director Kevin Hassett suggested that Trump will announce the next trade deal upon his return to the US, and there were more than 20-25 deals on the table.

The ongoing rally was also helped by the US April CPI report, which came out weaker than predicted, with monthly headline and core CPI each up +0.2% (vs. +0.3% expected for both). From a market point of view, the main relief was also that tariffs weren’t showing up in a major way in consumer prices, even though April included the 10% universal baseline tariffs, and much higher tariffs on China. Admittedly, there were some categories likely showing tariff-related jumps, like an +8.8% monthly rise for audio equipment, but the broad impact was muted. And in turn, the year-on-year CPI rate fell to just +2.3%, which is the weakest since February 2021. Our US economists think the April data is still too early for the Liberation Day tariffs to show up in the aggregate numbers, and they don’t expect the effects to show up in consumer prices until June.

When it comes to the Fed, markets continued to dial back their expectations for cuts this year, but that was driven by the broader risk-on tone and lower recession fears, rather than the soft inflation print. So by the close, futures were only expecting 53bps of cuts by the December meeting, which was -3.2bps lower on the day, and the fewer cuts priced for this year since February. President Trump continued to call for lower rates, saying in a post that “THE FED must lower the RATE, like Europe and China have done.” Looking forward, our US economists will be watching tomorrow’s PPI data closely for categories that feed through into core PCE, the Fed’s preferred inflation gauge. They now see April core PCE tracking at +0.23% m/m, which would be consistent with the year-over-year rate remaining at 2.6%. See their full CPI reaction note here.

As investors dialled back their pricing of Fed cuts, that in turn helped to bring down front-end Treasury yields, with the 2yr yield falling -1.0bps on the day to 4.00%. By the close, the 10yr yield was also down -0.6bps to 4.47%, but the 30yr yield moved up +0.1bps to its highest closing level since January, at 4.91%. That’s still beneath the intraday peak above 5% just before the 90-day tariff extension, but still up from 4.68% at the end of April.

Back in Europe, markets posted moderate gains, with the STOXX 600 (+0.12%), DAX (+0.31%) and CAC (+0.30%) all moving higher. For the DAX it marked a new all-time high, with the index now up almost +19% YTD, so still well ahead of the S&P 500 which has only just turned positive for 2025 again. The gains came as Germany’s ZEW survey for May was stronger than expected, with the expectations component up to +25.2 (vs +11.3 expected) reaffirming a more bullish sentiment for the country’s economy. Against that backdrop, 10yr bund yields inched up +3.1bps to 2.68%, and sovereign spreads continued to tighten amidst the risk-on mood. For instance, the 10yr Italian spread over bunds tightened to just 102bps, the lowest since 2021.

Meanwhile in the UK, there were signs of an ongoing loosening in the labour market, with the unemployment rate ticking up a tenth to 4.5%, whilst wage growth in March softened to +5.5% year-on-year, the weakest since October. The news helped 2yr gilts to outperform yesterday, falling -2.0bps to 3.97%, unlike 2yr German yields which moved up +1.2bps.

In the commodity space, oil prices moved higher as Trump threatened to ramp up sanctions against Iranian oil if a nuclear deal weren’t reached, and Brent crude rose +2.57% to $66.63/bbl. The likes of gold (+0.43%) and copper (+2.25%) also advanced, in part helped a new decline in the dollar index (-0.77%), which retreated after posting its best day since Trump’s election win on Monday.

Overnight, markets have generally held on to their gains, with futures on the S&P 500 up +0.08%. Similarly in Asia, most of the major equity indices have moved higher as well, with a strong gain for the Hang Seng (+1.43%) and the KOSPI (+1.18%), alongside advances for the CSI 300 (+0.27%), the Shanghai Comp (+0.19%). The one exception to that has been Japanese equities however, with the Nikkei down -0.42%, whilst the TOPIX (-0.64%) has lost ground after advancing for 13 consecutive sessions. Otherwise this morning, data showed Japan’s PPI inflation coming in at +4.0% in April as expected, whilst Australia’s Q1 wage index was a bit stronger than anticipated, up +0.9% quarter-on-quarter (vs. +0.8% expected), and yields on 10yr Australian government bonds are up +4.1bps this morning.

To the day ahead now, data releases include Canada March building permits. For Central Bank speakers, expect Fed’s Waller, Jefferson and Daly speak, ECB’s Nagel and Holzmann speak, and BOE’s Breeden speak. Earning releases include Tencent, Cisco, Sony, and Coreweave.