US equity futures are flat, trading around 5,252, having rebounded from session lows even as 10Y yields extend their ascent and the USD strengthens as traders further pare expectations for interest-rate cuts in the face of resilient readings on the US economy. As of 8:00am, S&P and Nasdaq fuitures are both unchnaged while major European markets are mostly higher with only Spain/UK in the red. Treasury yields rose to their highest levels of the year across the curve, with the 10-year climbing above 4.45%. Interest-rate swaps imply around 60 basis points of US monetary easing this year, making two cuts the most likely outcome. On Friday, the chance of a third cut was still above 50%. European bond yields are also higher, but yield curves are not moving in tandem. Commodities are mixed with Energy lower, Metals higher, and Ags mixed. Crude oil turned lower after last week’s strong gains after Israel said it will pull some troops from Gaza. Brent futures briefly dropped below $90-handle before reversing losses. Gold also reversed early losses and printed a fresh record above $2,350 before paring gains. Looking at the calendar, Mon/Tues are light macro days ahead of Wednesday's CPI print, Thurs’ ECB mtg, and Fri’s Bank earnings which launch Q1 earnings season; we algo get at least 7x Fedspeakers where investors will see if a hawkish pivot is building if CPI prints hotter than expected. While the market is trimming rate hike estimates both Goldman and JPM still see at least 3x rate cuts.

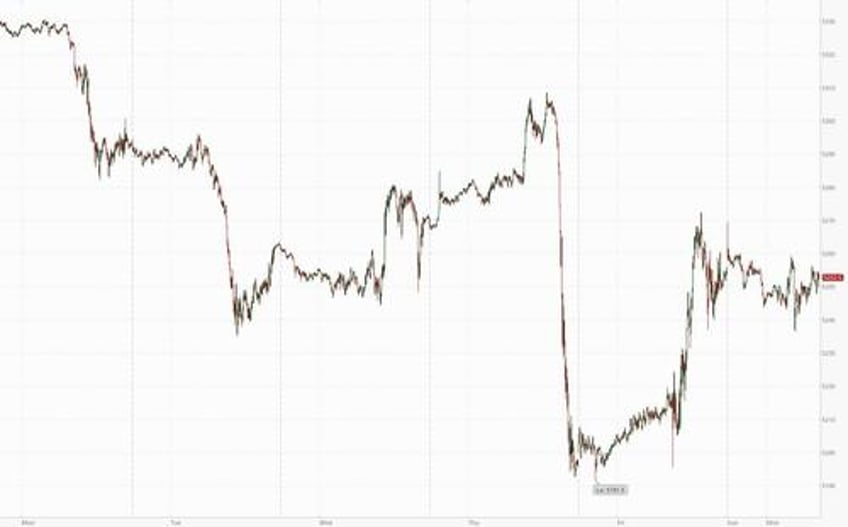

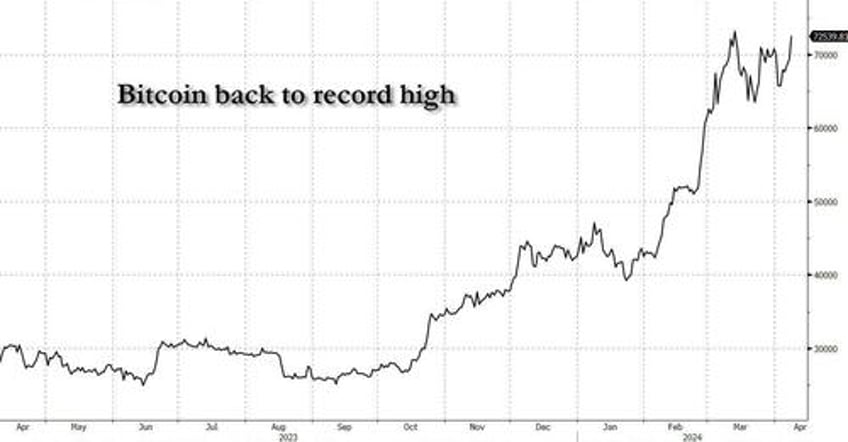

In premarket trading, gigacap tech names are mixed with TSLA, NVDA, NFLX all higher. Tesla rallied as much as 4.2%, set to trim some of its 34% year-to-date slump, after Elon Musk said the carmarket would unveil its new robotaxi on Aug. 8. Amazon.com was on course to open above its all-time closing high for the first time in almost three years. Shares in cryptocurrency-linked companies rose as Bitcoin climbed back over the $72,000 mark as it advanced for a third session. Here are some other premarket movers:

- Boeing and Southwest Airlines (LUV US) fell after the FAA announced it was investigating an incident where the engine cowling of a Boeing plane fell off during take-off.

- Skyworks Solutions fell 2.0% after KeyBanc Capital Markets cut its rating to sector weight from overweight. The broker notes that the semiconductor device company’s ability to drive growth in a maturing smartphone market is becoming more challenging.

- UiPath rose 2.3% after KeyBanc Capital Markets assumed coverage with overweight rating. The broker says the automation software company is well positioned to continue driving share gains.

Among the main overnight news, the US plans to award chipmaker Taiwan Semiconductor Manufacturing $11.6 billion in US grants and loans to build three factories in Arizona, as part of an effort to boost domestic production of critical technology. Meanwhile, Treasury Secretary Janet Yellen wrapped up four days of talks in China with a warning to Beijing’s banks and exporters about the risk of sanctions for providing support for Russia’s war.

For investors, it’s a busy week that includes US inflation data, a European Central Bank rate decision and the start of first-quarter earnings. Last Friday’s US jobs numbers exceeded expectations for a fifth straight month, reinforcing the Fed’s view of being patient about reducing rates. The next key moment for markets is Wednesday’s US consumer-price figures, projected to show further evidence of gradual cooling, although there are risks that the surge in oil prices pushes headline inflation higher than expected.

"There are indeed risks, and seeing the 10-year Treasury yield sustainably surpass 5% would indicate markets pricing in more likelihood of a hike,” Madison Faller, global investment strategist at JPMorgan Private Bank, said on Bloomberg Television. “However, as long as investors perceive a rate cut as the next move, they should be able to navigate this transition."

European stocks gained, lifting the Estoxx 50 up ~0.5% with miners, autos and energy outperform in Europe after a rebound in copper and iron ore prices; the regional Stoxx 600 Index advanced 0.3%. Here are the most notable European movers:

- Nordic Semi gains as much as 11% after JPMorgan initiates on the chipmaker with an overweight recommendation and Carnegie upgrades to buy from hold.

- VBG rises as much as 8.3% in Stockholm after being the subject of Dagens Industri’s “share of the week” feature.

- Zalando shares gain as much as 5.6% after being upgraded to buy from neutral by Citi, which says the German online retailer should see a return to gross merchandise value growth in 2024.

- Wizz Air shares rise as much as 4.8% as BNP Paribas Exane raises its recommendation to neutral from underperform and increases its unit revenue estimates, citing an “improving outlook” for the budget airline.

- Entain shares gain as much as 6% after The Times reported the impending departure of Chairman Jim Gibson could leave the gambling operator vulnerable to a raid by American buyout groups.

- SSAB falls as much as 2.5% after announcing that its long-serving President and CEO Martin Lindqvist is stepping down. Analysts at Citi noted his role in delivering some key strategic initiatives but don’t see much short-term impact from his departure.

- Bayer falls as much as 2% and is the worst performer in Germany’s DAX index, even after a US judge reduced a jury-awarded payout in a Roundup weedkiller claim. Berenberg analysts said the market may have been hoping for a cut to the compensatory damages component of the verdict, which was absent in the ruling.

- Bossard falls as much as 4.3% after reporting sales for the first quarter that missed consensus expectations. The industrial wholesale company omitted the prospect of a recovery in its outlook for the second half of the year, seen as negative by ZKB analysts. It confirmed its medium-term financial goals, however.

- Believe falls as much as 10% to €14.84 after Warner Music Group decided not to acquire the French record label.

Earlier in the session, Asian stocks tracked US peers higher, as strong jobs data in the world’s biggest economy helped lift sentiment on the global outlook. The MSCI Asia Pacific Index rose as much as 0.7%, paring last week’s loss, with TSMC and Toyota among the biggest contributors. Japan, India and Taiwan led gains around the region, after better-than-expected US payrolls data showed the economy remains resilient in the face of high interest rates. On the other end, mainland China stocks fell, reopening after holidays, and Hong Kong gauges were mixed. While strong holiday spending data was seen as encouraging, investors also weighed signs of risk elsewhere in the economy. A Chinese state bank called for the liquidation of defaulted developer Shimao Group. Still, the “winding-up” petition against Shimao and other negatives such as US Treasury Secretary Janet Yellen’s comments on Chinese overcapacity “should be digested by the market soon and not have much material impact on sentiment,” said Shen Meng, a director at Chanson & Co. in Beijing.

In FX, the Bloomberg Dollar Spot Index rose 0.1% with SEK and NOK are the strongest performers in G-10 FX, CHF and JPY underperform. “Upside momentum is struggling to form even as another robust payrolls emphatically showcases the no landing narrative on the economy and USD yield support approaches 6-month highs,” Richard Franulovich, head of foreign-exchange strategy at Westpac Banking Corp. wrote in a note. “A likely 0.3% core CPI this week and a set of FOMC minutes that likely sound more hawkish than Powell’s benign press conference should nonetheless keep USD upside potential intact”

In rates, treasury yields gained across the curve after yields gapped higher at the open, following no major escalation to the Israel-Hamas war and reports of Gaza cease-fire talks, which also weighed on oil prices. Yields rose to session highs, cheaper by 2bp-5bp across the curve with intermediates lagging, widening 2s10s spread by nearly 2bp on the day; 10-year TSY yield peaked over 4.45%, highest since November, outperforming bunds by around 1bp in the sector. Front-end yields joined rest of curve at YTD highs as Fed-OIS contracts price in less cumulative easing this year; the yield on two-year Treasuries advanced three basis points to 4.78% as Friday’s US employment report, when taken with the pickup in key inflation numbers at the start of 2024, raises the possibility of later or fewer interest rate cuts by the Federal Reserve this year. Pricing for a full 25 basis-point rate cut has been pushed out to September from July, with the market now expecting two cuts for the rest of the year, down from the three rate cuts forecast by the market. The next coupon auction cycle begins Tuesday with $58b 3-year note; $39b 10-year note and $22b 30-year bond reopenings follow Wednesday and Thursday.

In commodities, oil retreated from a five-month high after Israel said it would remove some troops from Gaza. Crude has rallied recently on escalating geopolitical tensions and supply shocks, raising the prospect of prices for global benchmark Brent reaching triple figures and muddying the outlook for inflation. Spot gold rises roughly $6 to trade near $2,336/oz, having trimmed some of earlier gains that saw it set a fresh record. Spot silver gains 1.2% near $28. Spot gold rises roughly $6 to trade near $2,336/oz. Spot silver gains 1.2% near $28.

“Currently, we foresee the conflict continuing without significant spillover in the next few months, but the risk remains significant, and we’re closely monitoring the situation,” Lizzy Galbraith, political economist at Abdrn Plc, said on Bloomberg TV.

Bitcoin continues to rise, surpassing the $72k mark and on pace to rise above the mid-March record highs.

Looking at today's calendar, US economic data slate includes March NY Fed 1-year inflation expectations (11am). The Fed speaker slate includes Goolsbee (1pm) and Kashkari (7pm); Bowman, Williams, Collins, Bostic and Daly are slated later this week, with March FOMC meeting minutes to be released Wednesday.

Market Snapshot

- S&P 500 futures down 0.1% to 5,245.50

- STOXX Europe 600 up 0.2% to 507.43

- MXAP up 0.4% to 175.88

- MXAPJ up 0.2% to 537.89

- Nikkei up 0.9% to 39,347.04

- Topix up 1.0% to 2,728.32

- Hang Seng Index little changed at 16,732.85

- Shanghai Composite down 0.7% to 3,047.05

- Sensex up 0.7% to 74,733.88

- Australia S&P/ASX 200 up 0.2% to 7,789.08

- Kospi up 0.1% to 2,717.65

- German 10Y yield little changed at 2.45%

- Euro little changed at $1.0830

- Brent Futures down 1.0% to $90.23/bbl

- Gold spot up 0.3% to $2,336.11

- US Dollar Index little changed at 104.37

Top Overnight News

- China Construction Bank has filed a winding-up petition in Hong Kong against property developer Shimao in a rare case of a major state-owned financial institution initiating offshore legal action against a mainland Chinese real estate company. FT

- The US relationship with China is “on a stronger footing” than this time last year, Treasury secretary Janet Yellen said as she ended a six-day visit designed to ease tensions with the US’s main economic rival. FT

- U.S. demands that chipmaking giant ASML, opens new tab stop servicing some equipment it has sold to Chinese customers are a diplomatic and business headache for the Dutch government, but signs are it will continue to align with Washington on export restrictions. RTRS

- The US will award TSMC $6.6 billion in grants and as much as $5 billion in loans to ramp up domestic production. The chipmaker will construct a third factory in Phoenix relying on 2-nm process technology, key for AI and the military. BBG

- Alibaba Group Holding Ltd. is cutting prices for cloud customers from the US to Singapore by as much as 59%, mirroring deep discounts at home as the once high-flying division struggles to fend off rivals and revive growth. BBG

- Israel said it has reduced its ground troop presence in southern Gaza Strip after concluding its operation in Khan Younis (this means Israel has now largely withdrawn its troops from Gaza’s major populated areas as the active invasion stage of the war concludes). WSJ

- Speaker Johnson is preparing to unveil his bill for providing aid to Ukraine, but its details are a mystery (there will likely be two separate bills in the House, one for Ukraine and another for Israel, along with provisions to seize certain Russian assets and resume approval for LNG export facilities). WSJ

- Brazil’s top court ordered an investigation into whether Elon Musk is spreading misinformation, and added him to a criminal inquiry investigating anti-democratic acts. Earlier, Musk said he would defy court orders and lift restrictions imposed on some X accounts in Brazil, even if it leads to the platform’s closure there. BBG

- Investors close to Elon Musk are in talks to help xAI raise $3 billion in a round that would value the tycoon’s artificial-intelligence startup at $18 billion, people familiar with the matter said. The venture-capital firm Gigafund and Steve Jurvetson, a prominent Musk backer and co-founder of another venture firm, are among the backers considering investing in the round, the people said. WSJ

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were ultimately mixed as markets digested Friday's strong NFP report and US-China talks. ASX 200 eked mild gains amid strength in mining and tech, while there were some M&A-related headlines. Nikkei 225 outperformed with the help of recent currency weakness, while wage data matched estimates. Hang Seng and Shanghai Comp. swung between gains and losses with an early boost in Hong Kong after mainland markets and Stock Connect trade reopened from a 4-day weekend and with some encouragement from Yellen's meetings in China. However, stocks failed to sustain the early optimism with sentiment clouded by developer concerns after a winding-up petition was filed against Shimao Group.

Top Asian News

- PBoC is to set up a USD 70bln tech re-lending programme to support the science and technology sectors.

- US Treasury Secretary Yellen told Chinese Premier Li Qiang that the US-China relationship is now on a more stable footing and that US-China relations have improved because the two sides can have tough conversations. while Yellen also noted that Chinese officials feel more confident about their steps on the property market and financial stability. It was separately reported that the US Treasury and China’s Finance Ministry agreed to launch new exchanges on balanced growth in domestic and global economies, while the US Treasury also agreed with the PBoC to launch a new exchange on combating money laundering in their financial systems.

- Chinese Premier Li Qiang said constructive progress was made in US Treasury Secretary Yellen’s meeting in Guangzhou, while he added that the US and China need to respect each other and should be partners, not adversaries. Premier Li also stated that they hope the US and China can meet each other halfway and implement the consensus reached by their heads of state, according to Reuters.

- Chinese Vice Premier He Lifeng and US Treasury Secretary Yellen had an in-depth, candid, pragmatic and constructive exchange of views in Guangzhou talks, while China expressed serious concerns about US economic and trade curbs on China, as well as fully responded to the production capacity issue. Furthermore, the US and China agreed to continue communication, according to CCTV.

- Russian Foreign Minister Lavrov is to visit China on April 8th-9th.

- Japan's Keidanren Chief says current JPY weakness is excessive; elsewhere, Japan's former top FX official Nakao says in relation to recent speculative JPY weakening that if moves are rapid enough it could trigger intervention at any moment.

European bourses are mostly firmer after a contained open, Stoxx 600 +0.2%, upside which occurred despite a lack of fresh fundamental drivers and amid ongoing hawkish fixed income action; DAX 40 +0.5% the outperformer given its Auto exposure and after strong German Industrial Output data. Sectors have a slight anti-defensive bias with Media, Food/Beverage and Healthcare names in the red while Basic Resources and Autos outperform on the return of China. Stateside, futures are near the unchanged mark, ES -0.1%, with specifics light as participants look to the NY Fed SCE later before Wednesday's CPI and FOMC Minutes for further insight into the Fed's calculus amid recent hawkish price action.

Top European News

- German chancellor to begin visit to China next Saturday, according to Sky News Arabia; spokesperson adds that Scholz is sceptical on EU tariffs.

- Concern among large British companies about economic uncertainty has fallen to its lowest since mid-2021 although the improved sentiment is not yet converting to stronger investments, according to a survey by Deloitte.

- Recruitment and Employment Confederation survey found that starting salaries for permanent staff in the UK increased by the slowest rate in more than three years during March, according to Reuters.

- Slovak pro-Russian nationalist-left government candidate Peter Pellegrini emerged victorious in the country’s presidential election on Saturday, according to CNN.

- Moody’s affirmed the EU on Friday at AAA; Outlook Stable.

FX

- DXY steady and towards the top-end of 104.24-104.43 bounds, further upside potentially capped as we await CPI on Wednesday.

- EUR and GBP both steady against the USD, single currency not significantly swayed by German data points with the 50- & 200-DMA in proximity alongside OpEx at 1.0790-00 while GBP is entirely flat with specifics light thus far.

- USD/JPY slightly firmer. eyeing the 151.97 YTD peak while overnight light jawboning had no real effect.

- Antipodeans contained overall as the NZD awaits the RBNZ later in the week while the AUD ekes some modest support from iron ore.

- PBoC set USD/CNY mid-point at 7.0947 vs exp. 7.2230 (prev. 7.0949).

- Turkish Central Bank released a statement on simplification of the macroprudential framework on Friday and decided to stop banks’ bond holding requirement according to credit growth rates.

Fixed Income

- Newsflow focused on geopols and US-China with the positive tone in Europe giving fixed benchmarks another reason to continue Friday's bearish action but with the US yield curve current lower across the board as opposed to Friday's flattening.

- Bunds dipped on German Industrial Output and have continued to drift to a 131.65 trough with USTs down to 109-04 thus far. No real reaction to the EZ NGEU supply.

- Gilts pressured in tandem with USTs/Bunds; UK specifics non-existent ahead of BoE's Breeden who last spoke in February at which point she was focussed on how long rates needed to be on hold for.

Commodities

- Crude benchmarks pressured as geopolitical tensions did not materially escalate over the weekend and progress was initially reported in ceasefire talks but clarification since makes clear that gaps remain.

- WTI and Brent at the middle of circa. USD 0.80/bbl parameters holding around USD 86.10/bbl and USD 90.30/bbl respectively. Modest pressure occurred on the RTRS reports around the Iraq-Turkey pipeline.

- Spot gold pressured overnight but has managed to recuperate this and has since lifted to a fresh record high above USD 2.35k/oz Base metals also off lows and into the green with catalysts light and the action seemingly a function of China's return to market.

- Odds for oil to reach USD 100/bbl are reportedly increasing amid supply shocks impacting the market, according to Bloomberg.

- Azerbaijan oil output 7.3mln/T in January-March (4.8mln/T January-February), via Energy Ministry.

- Iraq has completed the first stage of repairing oil export pipeline to Turkey, according to the Deputy Oil Minister cited by Reuters; to be operational by the end of April; ready to export 350k BPD from the northern oilfields.

- Iraq sets May 2024 Basrah Medium Crude OSP to Asia at par with Oman/Dubai Average (vs prev USD -0.60/bbl), Europe at USD -5.15/bbl vs dated Brent (prev. USD -5.85/bbl), US at USD -0.90/bbl vs ASCI (prev. USD -0.95/bbl).

- Chinese Gold Reserves (USD)(Mar) 161.1B (Prev. 148.6B).

- UBS lifts all of their gold forecasts by USD 250/oz. Forecast gold at USD 2.3k/oz in June, USD 2.5k/oz at end-2024 and March-2025.

- Shanghai Gold Exchange says it is to increase trading limits for some silver future contracts to 11% from 9% and and increase the margin requirement for some contracts to 12% from 10%.

Geopolitics: Middle East

- "Hamas leading source to Al Jazeera: No progress in negotiations in Cairo and the Israeli delegation did not respond to any of Hamas' demands". Furthermore, "Israeli media: Senior official says gap between Israel and Hamas over possible deal remains large", according to Al Arabiya.

- Israeli Broadcasting Authority says "any Israeli movement in Rafah will not begin before the end of the talks with Washington", according to Sky News Arabia.

- "Israeli sources involved in the negotiations: By Tuesday evening we will know if it is possible to proceed with the negotiations and wait for Hamas' response", according to Sky News Arabia

- Israeli PM Netanyahu said Hamas hopes to make Israel give in to its demands but that will not happen, while he added that Israel is ready to reach a hostage release deal in Gaza but not ready to give in to Hamas’s extreme demands, according to Reuters.

- Israel's delegation was given the green light to attend Gaza truce and hostage release talks in Cairo, according to a government official cited by Reuters. It was later reported that Hamas and Qatar delegations left Cairo and will return within two days to agree on terms of a final agreement, while there was progress in discussions and agreement on the basic points between all parties. Furthermore, Israel and US delegations were reportedly to leave Cairo and consultations will continue during the next two days, according to Egypt's Al Qahera News citing a senior Egyptian source.

- Israel’s military said it has completed another phase of the Northern Command’s readiness for war. There were also comments from a spokesperson that the Israeli military had withdrawn all ground troops from southern Gaza except for one brigade while Israel later confirmed it had withdrawn its troops from Khan Younis in southern Gaza to prepare for operations in Rafah. Furthermore, White House’s Kirby commented that the Israeli troop reduction appears to be a ‘rest and refit’ for some Israeli forces, according to Reuters.

- Israel launched strikes on Lebanon’s Bekaa, according to two Lebanese security sources cited by Reuters. It was later reported that three people were killed including a field commander in Hezbollah elite forces following an Israeli strike in southern Lebanon.

- Israel’s Defence Minister said preparations are completed to respond to any scenario that develops vis-a-vis Iran. It was also reported that Israel’s military chief Halevi said the IDF can handle Iran and can act forcefully against Iran in places near and far, while he added Israel is cooperating with the US and strategic regional partners, as well as noted that Israel’s military still has many forces in Gaza and it is a long war.

- Senior adviser to Iran’s Supreme Leader said Israeli embassies are no longer safe, according to TASNIM. It was also reported that Iran’s ISNA news agency published names and pictures of nine Iranian missiles that could reach Israel, according to Reuters.

- US Central Command said US forces destroyed one mobile surface-to-air missile system in Houthi-controlled territory of Yemen on April 6th and shot down an unmanned aerial vehicle over the Red Sea, while a coalition vessel also detected, engaged and destroyed one inbound anti-ship missile on April 6th, according to Reuters.

- UKMTO received a report of an incident 60NM southwest of Yemen’s Hodeidah in which a missile was intercepted by coalition forces and a second one impacted the water at a distance from a vessel, although there was no damage and the crew were reported safe, according to Reuters.

- Yemen’s Houthis said they launched rockets and drones targeting one British ship, two Israeli ships and a number of US frigates in the Red Sea, according to Reuters.

Geopolitics: Other

- Ukrainian President Zelenskiy said Ukraine awaits and needs a big US aid package, while he continues to believe that the US Congress will vote for it. Zelenskiy said they may run out of missiles if the intensity of recent Russian attacks continues and 25 Patriot systems are needed to cover Ukraine fully. Zelenskiy also said Ukraine has enough defence stockpiles for now but is having to choose what to protect and Ukraine does not have artillery ammunition to conduct counteroffensive actions but is receiving artillery rounds under foreign initiatives that are enough for defence, according to FT.

- Ukrainian drones reportedly attacked the Zaporizhzhia Nuclear Station, according to RIA. However, a Ukrainian intelligence spokesman denied that Ukraine was involved in the “provocations” at the nuclear plant, while IAEA’s Chief Rossi said the drone attacks at the plant resulted in one casualty and the damage at one of the six reactors did not compromise nuclear safety but added that this a serious incident with the potential to undermine the integrity of the reactor’s containment system. Furthermore, Grossi said such reckless attacks significantly increase the risk of a major nuclear accident and must stop immediately, according to Reuters.

- Russian Security Council Deputy Chairman Medvedev called the leaders of the US, France, Great Britain and Germany accomplices of the terrorist attack in Crocus City Hall, according to RIA citing a post on social media platform X.

- US President Biden will warn China about its increasingly aggressive activity in the South China Sea during a summit this week with Japanese PM Kishida and Philippines’s President Marcos, according to FT.

- AUKUS is considering expanding a security pact to deter China in the South Pacific, according to FT.

- Philippines Defence Ministry announced maritime cooperative activity between the combined defence and armed forces of the US, Japan, Australia and the Philippines, according to Reuters.

- Philippines Coast Guard spokesperson said two Chinese Coast Guard vessels ‘harassed’ Filipino fishing boats on Thursday in which they went as far as pretending to man their water cannons and threaten the Filipino fisherman, while the harassment occurred in Iroquois reef within the Philippines’ exclusive economic zone, according to Reuters.

- Chinese Coast Guard spokesperson said the Philippines organised ships to “illegally conduct” activities in waters adjacent to a reef in the Nansha Islands and alleged that Philippine government ships have continued to undermine stability in the South China Sea under the guise of fishing protection, according to Reuters.

- Ecuador is facing condemnation over a raid on Friday at the Mexican embassy in Quinto where the former Ecuadorian Vice President Jorge Glas, according to CNN and FT.

US Event Calendar

- 11:00: March NY Fed 1-Yr Inflation Expectat, prior 3.04%

Central Banks

- 13:00: Fed’s Goolsbee on WBEZ-FM

- 19:00: Fed’s Kashkari Participates in Town Hall Meeting

DB's Jim Reid concludes the overnight wrap

Markets had a rough start to Q2 last week, with the S&P 500 (-0.95%) posting its worst weekly performance in 3 months, whilst the US 30yr yield (+21.0bps) saw its biggest weekly rise since October. Several factors were driving the selloff, but geopolitical tensions played a key role, as fears mounted about some sort of escalation in the Middle East. That meant Brent crude oil prices rose for a 4th consecutive week, surpassing $90/bbl for the first time since October. And in turn, that’s led to growing concern about inflation, with investors continuing to price out the chance of rate cuts from the Fed. Indeed, as of this morning, just 62bps of rate cuts are priced in by the December meeting, which is a long way from the 158bps expected at the start of the year.

Those questions about rate cuts gathered pace on Friday, as the US jobs report showed nonfarm payrolls grew by +303k in March (vs. +214k expected). And unlike the previous month, the upside surprise didn’t come with sharp downward revisions. In fact, the January and February prints were revised up by a total of +22k. So even though futures are still pricing a rate cut by June as the most likely outcome, it was down to just a 54% chance by the close on Friday. That also meant that Treasury yields have reached new highs for the year, with the 10yr yield ending last week at 4.40%, and the 10yr real yield rising to 2.03%. And this morning they’ve continued to rise, with the 10yr yield up another +2.0bps to 4.42%.

Looking forward, that question on the timing of rate cuts will be on the agenda this week, as the US CPI release for March is out on Wednesday. So far this year, core CPI has proven stronger than expected, with the January and February prints both at a monthly +0.4%. But for now at least, the Fed hasn’t been too alarmed, and Chair Powell said last week that “ it is too soon to say whether the recent readings represent more than just a bump.” So this week’s releases will be in focus, as a third month of stronger inflation would make it harder to dismiss as a temporary move higher.

In terms of what to expect, our US economists think that monthly headline CPI will be at +0.27%, which would see the year-on-year measure pick up two-tenths to +3.4%. But for core CPI, they see the monthly number slowing down to +0.24%, which would push the year-on-year measure down a tenth to +3.7%. In the meantime, it’s clear that markets are becoming more concerned about the issue, and last week saw the US 2yr inflation swap close at its highest since October, at 2.54%. For more on this week’s CPI report, see the full preview from our economists here, along with how to sign up for their webinar.

Over in Europe, the main event this week is likely to be the ECB’s policy decision on Thursday. It’s widely expected they’ll leave rates unchanged at this meeting, including by market pricing and the consensus of economists. So the big question is likely to be what they signal about the subsequent meeting in June, which investors are pricing in as a very strong probability for an initial rate cut. Indeed, we found out last week that Euro Area core inflation fell to a two-year low in March of +2.9%, and the account of the last ECB meeting said that “the case for considering rate cuts was strengthening.” In their preview (link here), our European economists think that the ECB needs additional data over the next couple of months to underpin its confidence in price stability and open the door for a June rate cut. But they think it should be clear that a June cut is the working assumption, barring a significant shock.

This week ahead also marks the start of the Q1 earnings season, with several US financials reporting on Friday, before the number of releases starts to pick up over the subsequent couple of weeks. Friday’s reports include JPMorgan, Citigroup, Wells Fargo and BlackRock, and DB’s asset allocation team has released a preview of the Q1 earnings season here.

Rounding up the week ahead, there are monetary policy decisions from both the Bank of Canada and the Reserve Bank of New Zealand on Wednesday, along with the Bank of Korea on Friday. Separately on Wednesday, there’s the release of the FOMC minutes from the March meeting. And on Friday, the Bank of England will publish the Bernanke Review into its forecasts. When it comes to data, we’ll also get China’s CPI and PPI reading for March on Thursday, and on Friday’s there’s the UK’s monthly GDP reading for February.

As the week begins, the main story so far has been the fall in oil prices overnight, with Brent crude down -1.54% from its Friday close to $89.77/bbl. That’s partly because last week’s fears of an escalation in the Middle East didn’t materialise over the weekend, although oil prices still remain above their levels throughout the entirety of Q1. Otherwise, there’s been a subdued start for equities, with the Hang Seng (-0.09%), the CSI 300 (-0.44%) and the Shanghai Comp (-0.17%) all losing ground, and futures on the S&P 500 are down -0.10% as well. However, there have been gains elsewhere, including for the Nikkei (+0.79%) and the KOSPI (+0.31%).

Recapping last week in more detail, that strong jobs report was the main news on Friday, with the headline payrolls number firmly surpassing expectations with a +303k gain (vs +214k expected). That was accompanied by an increase in average weekly hours to 34.4 (vs 34.3 expected), whilst average hourly earnings (+0.3%) and the unemployment rate (down a tenth to 3.8%) came in as expected. Altogether, the report added to the view of the Fed being under little urgency to reduce rates, raising the bar for a June cut. Indeed, Friday saw fed funds futures reduce the pricing for a cut by June from 74% to 54%, with a first 25bps cut now only fully priced by the September meeting. By contrast, ECB pricing saw little change, with overnight index swaps pricing 89bps of cuts by December.

Concerns about persistent inflation were further cemented by the jump in oil prices, which has occurred amidst rising tensions in the Middle East. That saw Brent crude and WTI rose +4.22% and +4.50% respectively, reaching $91.17/bbl and $86.91/bbl respectively (+0.57% and +0.37 on Friday). Inflation concerns also meant that Treasury yields reached their highest levels since November across the curve. At the front end, 2yr yields jumped by +10.4bps on Friday to 4.75% (+13.1bps over the week), whilst 10yr yields rose +9.4bps to 4.40% (+20.3bps over the week). The bond sell off was more moderate in Europe however, with 10yr bund yields rising +10.0bps over the week (and +3.7bps on Friday).

But even as there was a fresh selloff in fixed income, US equities saw a strong recovery on Friday, with the S&P 500 and the NASDAQ up +1.11% and +1.24% respectively. Nevertheless, the Friday rally was insufficient to reverse losses earlier in the week that followed on from rising geopolitical tensions and hawkish Fedspeak, as the S&P 500 fell -0.95% over the week. In the meantime, the Russell 2000 saw a larger underperformance of -2.87% for the week, whilst the Magnificent 7 gained +0.53%. This volatility sent the VIX up +3.0 points to its highest weekly close since October (despite a -0.3pt decline on Friday). On the other hand, European equities did not participate in Friday’s rally, with the STOXX 600 down -1.19% on the week, and -0.84% on Friday.

Finally in commodities, gold saw another +4.48% gain last week (and +1.87% on Friday) to $2,330/oz, hitting another all-time high.