OnlyFans' parent company, Fenix International Ltd., is in talks to sell the porn-driven platform, built for creators, to a U.S.-based investor group at a potential valuation of around $8 billion, according to Reuters, citing three sources familiar with the matter.

The sources said the group is led by Forest Road Company, a Los Angeles-based investment firm. They noted that Forest Road executives explored taking OnlyFans public via an SPAC in 2022.

The sources noted that other potential buyers have been discussing an OnlyFans acquisition with Fenix, though no additional details were provided about their identities. They added that a deal could be reached within weeks.

Here's more from Reuters:

The London-based company has drawn interest from several suitors in recent months.

Talks have been held at least since March, the people said. Three sources said a deal could be reached in the next week or two. The sources also cautioned that there was no certainty a deal will be struck and requested anonymity ahead of an official announcement.

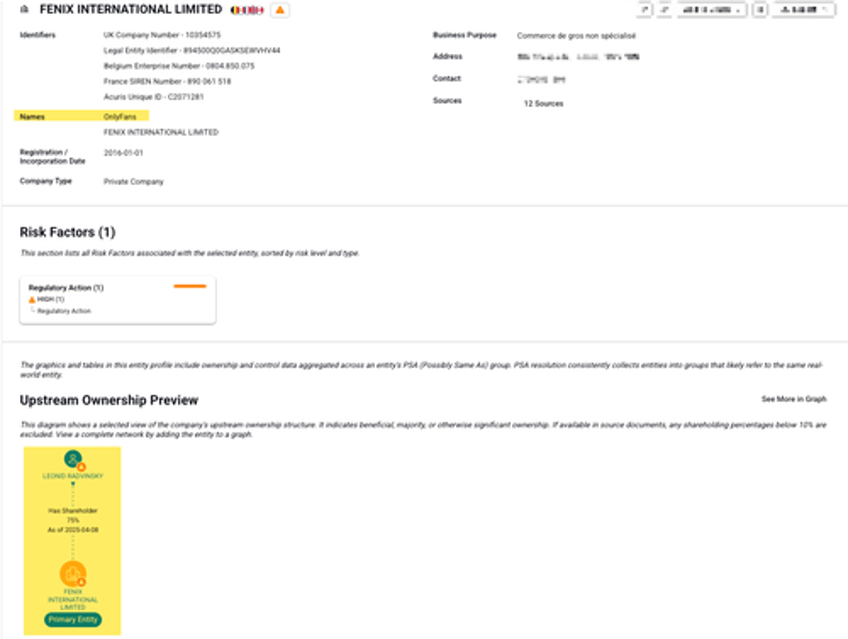

According to publicly available data, Ukrainian American Leonid Radvinsky owns Fenix.

British filings showed that Radvinsky had paid himself at least $1 billion in dividends since buying OnlyFans in 2018.

OnlyFans surged in popularity during the Covid pandemic by allowing adult content creators to monetize their subscribers, reported $6.6 billion in revenue for the year ending November 2023—up from $375 million in 2020. Radvinsky's company takes about a 20% cut of creators' earnings.

Reuters noted, "Porn makes OnlyFans untouchable for many big banks and investors ... because due diligence might find illegal content such as child sexual abuse material, trafficking victims and nonconsensual porn."