For the first time since the week of April 19th (related to tax payments), money market funds saw net outflows last week ($4.66 billion)...

Source: Bloomberg

Ignoring the usual tax-related outflow in April, this is the first money-market outflow since February... presumably all flowing into NVDA?

Notably, the outflow was all institutional (-$8.46 billion) while retail MM funds saw $3.8 billion in inflows (the 8th straight week)...

Source: Bloomberg

Despite this small fund outflow, money-market assets remain dramatically decoupled from deposit flows in recent weeks (which as a reminder showed a shocking $186.5 billion deposit inflow (NSA))...

Source: Bloomberg

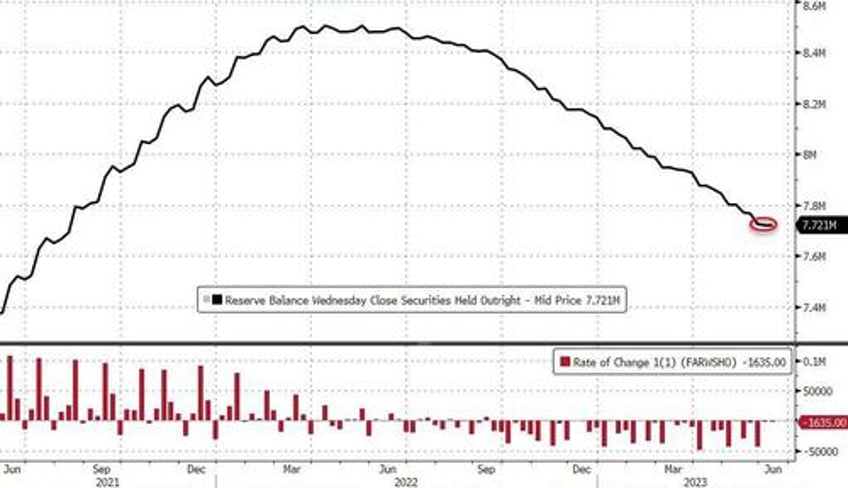

After the prior week's small ($3.47 billion) growth in The Fed's balance sheet, last week saw it rise... barely... by $1 billion... remaining above the SVB lows...

Source: Bloomberg

As far as QT is concerned, The Fed sold a tiny $1.64 billion to its lowest since August 2021...

Source: Bloomberg

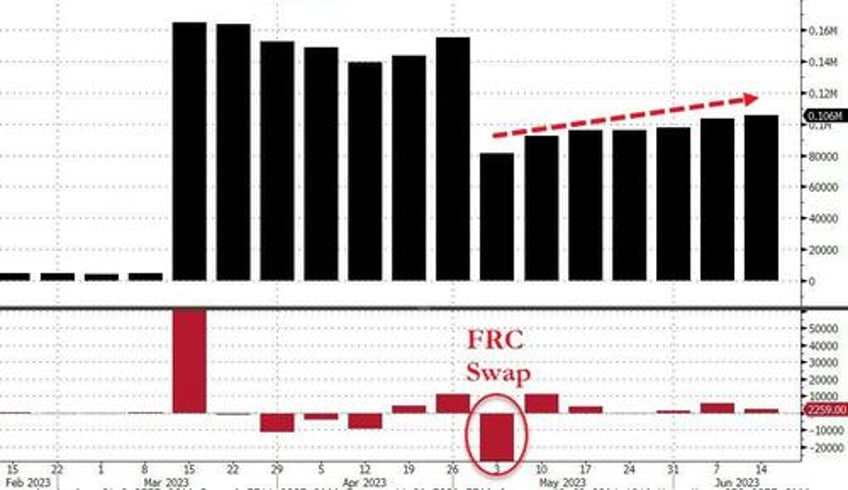

Most notably, the US central bank had $106 billion of loans outstanding to financial institutions through its two backstop lending facilities, up $2.26 billion from last week...

Source: Bloomberg

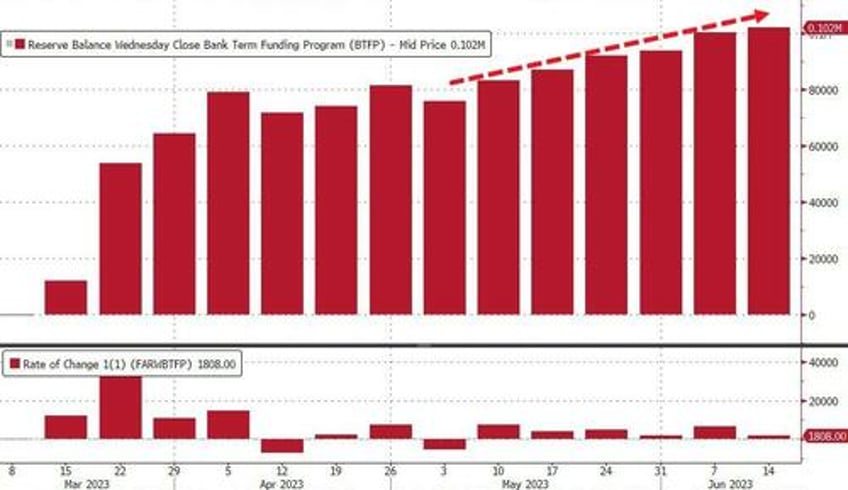

With banks' usage of The Fed's emergency Bank Term Funding Program rising once again to a new record at $102 billion (up $1.8 billion from last week)...

Source: Bloomberg

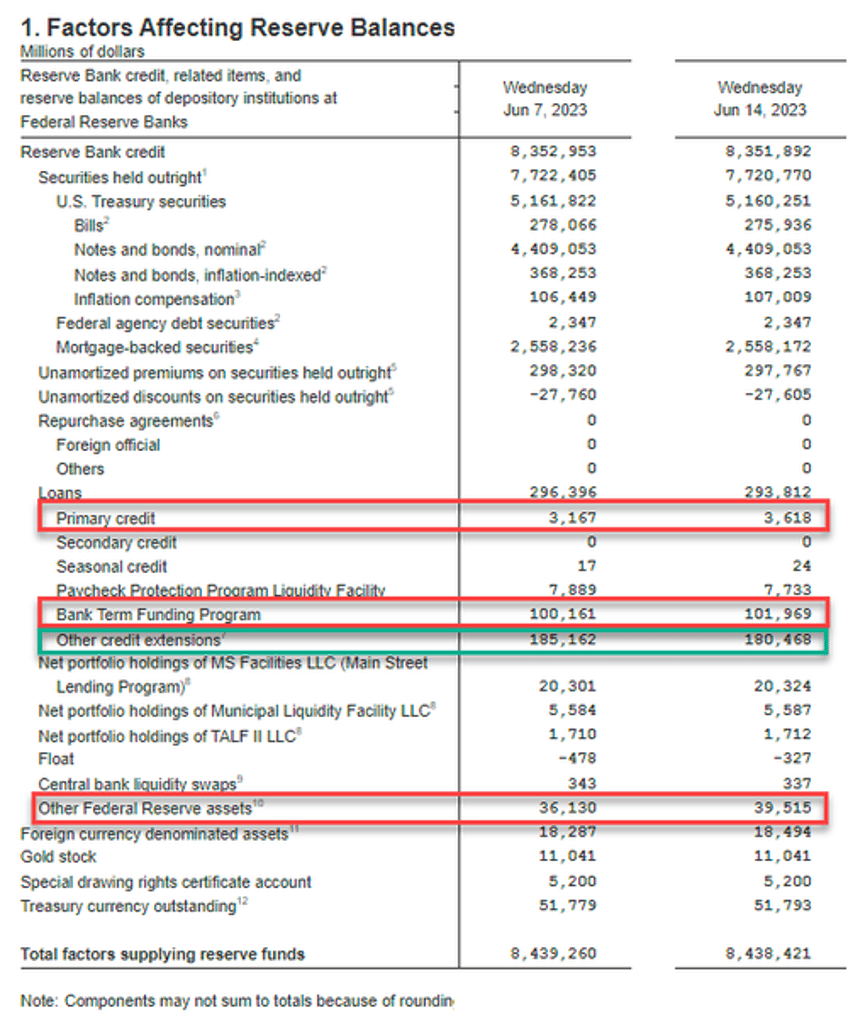

The breakdown from The Fed's H4...

QT no impact this week

Discount window usage up $0.4BN from $3.2BN to $3.6BN

Other credit extensions (FDIC loans, which are then loans to JPM) down $5BN to $180.5BN

Other Fed assets +$3.4BN to $39.5BN

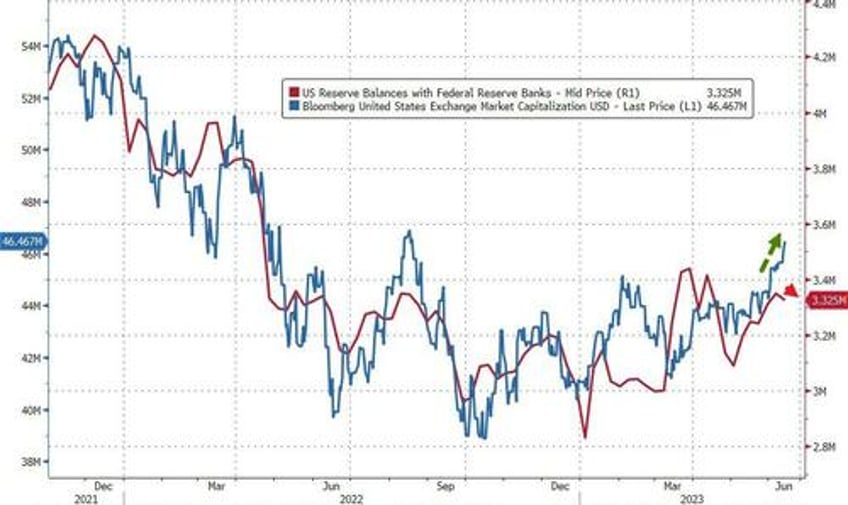

The US equity market continues to charge ahead, even as bank reserves at The Fed contracted modestly...

Source: Bloomberg

Finally, as a reminder, banks have 9 months left under the original 12-month BTFP Fed bailout program to find a way to stabilize their balance sheets.

Not only have they failed to do so, usage of the BTFP facility is at a new all time high, and yields are rising even more (great MTM losses).