Last Friday, ahead of the BOJ's surprise Yield Curve Control tweak, we predicted that not even the BOJ - a central bank that has traditionally won the Olympics in monetary policy stupidity - would be so mentally challenged as to pursue the type of half-assed YCC "tweak" that the Nikkei had leaked just hours earlier. After all, it should have been obvious to most - we thought - that a non-tweak tweak such as the one we learned the BOJ may was contemplating, would achieve nothing in terms of propping up the yen (the clear intention of Ueda, who is terrified of seeing the USDJPY rise to 150 again at which point it may be game over for Japan), while it would certainly blow up the JGB market, and set the BOJ on collision course with an even bigger bond market disaster than the one seen in January 2023, while at the same time sparking even more aggressive yen selling.

7 hours until the BOJ blows up its own bond market according to the Nikkei. Or maybe not

— zerohedge (@zerohedge) July 27, 2023

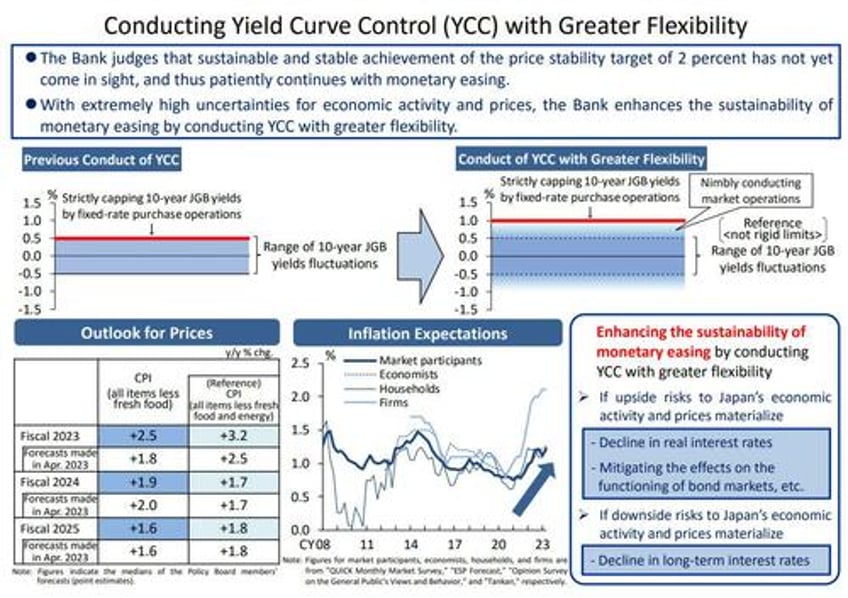

Alas, we were wrong and the BOJ again managed to shock us, and the market, with its stupidity when on Friday it announced it would engage in a half-pregnant YCC "tweak" where it would still keep the 10Y target at 0.5% but raise the JGB intervention "strict cap" from the old 0.50% level to anywhere between 0.5% and 1.0% (a range in which it would "nimbly conduct market operations" whatever the hell that means).

For timestamp purposes, we made it clear at the time, that this would be another catastrophic decision by the one central bank that will be the first to lose control of everything.

TL/DR

— zerohedge (@zerohedge) July 28, 2023

1. BOJ too scared to explicitly normalize policy and lift 10Y yield target

2. BOJ too afraid of blowback if it does nothing with inflation at 3%, so it implicitly raised 10Y target to 1.0%.

3%. Market confused by half-assed measure which does nothing to tame inflation

Just to be clear, we also predicted that the latest "tweak" would promptly break the JGB market while doing nothing to contain the collapsing yen, which is driven as much by the market's outlook on how likely Japan is to normalize, as it is by the staggering yield differentials between the yen (-0.1%) and every other currency pair (the US is now at 5.50%), resulting in the juciest carry trade in history.

*BOJ TO BUY 10-YEAR JGBS AT 1% EVERY BUSINESS DAY

— zerohedge (@zerohedge) July 28, 2023

So BOJ is doing a half-assed YCC adjustments, just enough to break the JGB market again, and the panic and go back to square one

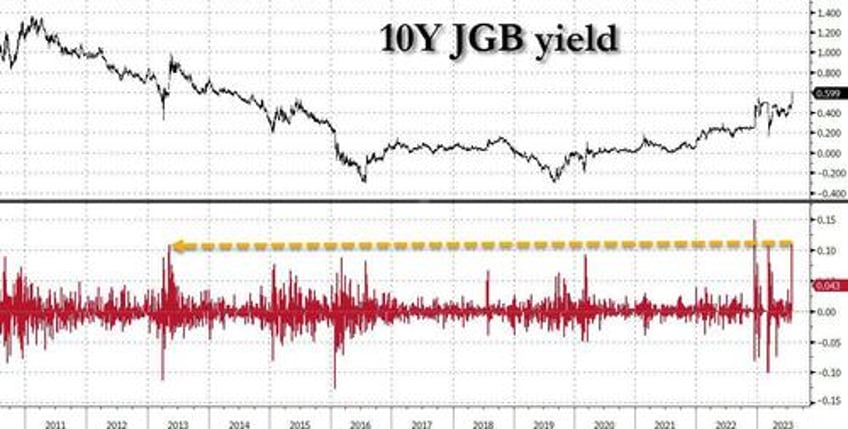

Anyway, while we may have been wrong in underestimating the BOJ's stupidity and pursuing a YCC "tweak", we were absolutely correct in predicting what will happen if the BOJ went ahead with said "tweak" and just one day later, the 10Y JGB blew out by more than 10bps, which may sounds small but for the economy with the centrally-planned bond market, this was the third biggest spike in the past decade.

What happened next was the second biggest surprise by the BOJ in the past two days: with yields spiking to a fresh nine-year high in morning trading, in hopes of containing the bond rout which we warned was coming, the BOJ announced an unscheduled bond-purchase operation to contain the JGB crash, saying it would buy the equivalent of more than $2 billion bonds at market rates, just as we had joked it would a day earlier.

10Y JGB from 0.57% to 0.55%. Is that the BOJ buying already?

— zerohedge (@zerohedge) July 28, 2023

It was the first time since February that the BOJ had barged into the bond market this way, suggesting that it will continue to smooth any sharp upward moves. And while the 10-year yield dropped back below 0.6%, the yen quickly reversed its advance against the dollar as FX traders realized that any attempts at tightening would lead to a collapse in the bond market, just as we warned they would. In fact, after dropping as low as 138 in the minutes after the BOJ's Friday morning announcement as a wrong kneejerk reaction dominated the Mrs. Watanabe trading flow, the USDJPY has since blown out as high as 142.50, almost 500 pips higher in 2 days!

As Bloomberg put it, "the aggressive purchases are another reminder that Japan’s slow retreat from ultra-loose monetary policy brings a heightened risk of volatility and intervention across multiple asset classes globally. It also underscores the challenge in interpreting a rates regime that is built on gray lines to let the BOJ be flexible rather than clarity for markets."

“That flexibility is obtained with opaqueness on when they intervene,” said Calvin Yeoh, portfolio manager at hedge fund Blue Edge Advisors Pte in Singapore. “Flexibility is another word for optionality, which potentially manifests as volatility. No one knows exactly when, between 0.5 to 1%, does the BOJ step in meaningfully, which is an awfully wide range.”

Well, we now know: 0.6% is where the BOJ's valiant effort at normalization draws a red line. In other words: a whopping 10bps move higher which somehow is supposed to contain Japan's 3% inflation.

Hilariously, after spending all of Friday praising the BOJ's "bold" decision, the chorus flipped overnight, and all those who predicted the USDJPY would collapse to 130 in hours, suddenly changed their tune with some BOJ watchers going beyond what even we said, noting that the YCC band is now so wide as to render the notion of a zero target largely meaningless. Yet Monday’s operation also shows that the BOJ can come into the markets at any time.

“Unscheduled operation was a surprise,” said Keiko Onogi, senior JGB strategist at Daiwa Securities in Tokyo. “The action is probably aimed at slowing the speed of yield gains after a sharp rally in the yields, and before a 10-year bond auction Tuesday.”

Speaking after Friday’s policy adjustment, Governor Kazuo Ueda had said he didn’t expect yields to get to 1% under current circumstances. The view of many Tokyo-based economists is for 10-year yields to settle around 0.7%-0.8% by year-end, with some pointing to 1% as more likely next year than anytime soon. That, however, does little to contain the collapse in the yen, while assuring massive periodic injections of liquidity which will weaken the yen well beyond 145.

“In the near term, 10-year yields may face upward pressure, and the BOJ will try to calm that with unscheduled JGB purchase operations,” said Shigeto Nagai, Japan head of Oxford Economics.

Kyohei Morita, chief Japan economist at Nomura Securities Co., expects “the next policy move from the BOJ to be the end of negative rates and YCC around April to June” when it is sure of sustainable inflation and wage gains. Good luck with that.

The most apocalyptic take on the entire YCC "tweak" disaster came from Win Thin, the top FX strategist at Brown Brothers Harriman, who appears was reading Zerohedge when commenting in a Bloomberg TV interview.

Paraphrasing what we have been saying for the past week,

The Bank of Japan’s surprise move to ease its yield curve control program was a “half-hearted attempt” to alter policy and will only weigh on the Japanese yen going forward, according to Brown Brothers Harriman & Co.’s top currency strategist.

Realizing that the BOJ is now chasing after the impossible trinity that has kept China's monetary policy in check, Thin told Bloomberg that "You can’t have free capital flows and also control interest rates and exchange rates. The Bank of Japan is trying to do all three."

Repeating what we said almost verbatim, the FX strategist said that the central bank’s policy decision Friday was a “very puzzling move" - “They kept the yield curve control and kept the target, but they made it a moving target in terms of the upper limit. It was a halfhearted attempt, I think, to do something."

And the punchline: “I think they squandered a lot of credibility for really a lot of nothing.” Equity market gains and the yen’s retreat since Friday “tells me the markets really don’t believe the Bank of Japan,” Thin added.

“Where it is going to lead is the currency rate. That’s where pressure is going to be let out. I am more convinced than ever that we should buy dollar-yen” he said, and we completely agree as we explained last Friday. Not surprisingly, the BBH strategist sees USD/JPY going to 145 “if not higher.” Spoiler alert: it will be much higher.