Despite our repeated attempts to disabuse traders of the laughable notion that the BOJ is about to adjust its Yield Curve Control again...

The Bank of Japan will buy bonds with repurchase agreements for the first time since March 2022 after spike in interbank borrowing costs.

— zerohedge (@zerohedge) July 9, 2023

But yeah, sure, the BOJ will "tweak" YCC any minute and blow up the entire JGB market.

SocGen: "BOJ Call change: we change our BOJ call to no YCC tweak in July; we still think that the BOJ could widen the YCC range in September"

— zerohedge (@zerohedge) July 16, 2023

Spoiler alert: the BOJ won't change YCC band in either July or September.

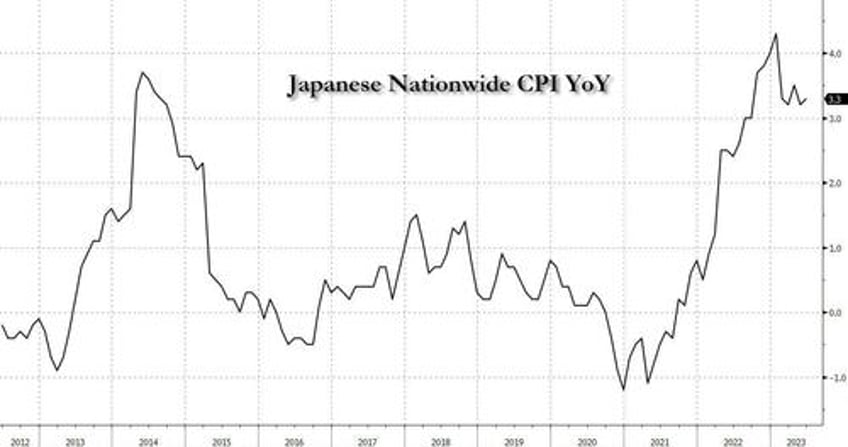

.... after the catastrophic band widening in December which led to hundreds of billions in emergency spending by the central bank to contain the rout and avoid a bond market catastrophe, the market had nonetheless made up its mind that because Japan's inflation had spiked in recent months, the BOJ would seek to crush inflation spirits and further revise YCC, even though CPI had clearly peaked already and was turning down.

As a result, after peaking just around 145 in early July, the yen exploded higher as the idiotic tag-team of Mrs Watanabe and momentum-chasing CTAs accelerated the yen short squeeze and pushed the USDJPY as low as 137 one week ago, huge carry and rate differentials be damned.

But not for long: confirming what we had been saying all along, this morning the yen plunged just shy of 142, the USDJPY surging almost 200 pips after Bloomberg cited "people familiar" that Bank of Japan officials see "little urgent need to address the side effects of its yield curve control program, though they expect to discuss the issue." Reuters echoed that and reported that the BOJ is "leaning towards keeping its yield control policy unchanged at the upcoming meeting"

According to the report, there was "no consensus" within the BoJ on how soon it should begin phasing out stimulus as many policymakers saw "no imminent need for fresh steps given the 10yr yield is trading stably within the 0.50% cap." Furthermore, the "BoJ can wait until there is more clarity on whether a hard landing can be avoided and allow for further wage increases next year." And taking a page out of the HBO series Silo, the sources noted that while "YCC needs to end at some point" that point the not today (or next week).

Another source added that even if tweaks were made, it would likely be a minor fine-tuning to make YCC sustainable. Still, the BOJ is expected to revise up its core inflation forecasts for FY23, via source; though, FY23 & FY25 expected to be largely in-line with current projections.

The reaction in the yen was predictable, with USDJPY spiking to 142 and rapidly approaching where it was before the entire idiotic move lower started.

What is remarkable is that none of this should have been news: just two weeks ago Reuters made it very clear that YCC would not be changing.

So what happens next? While yen bulls had a lot of egg to wash off their collective faces for an extremely wrong call, those who correctly called the move as transitory are already positioning for USDJPY 150.

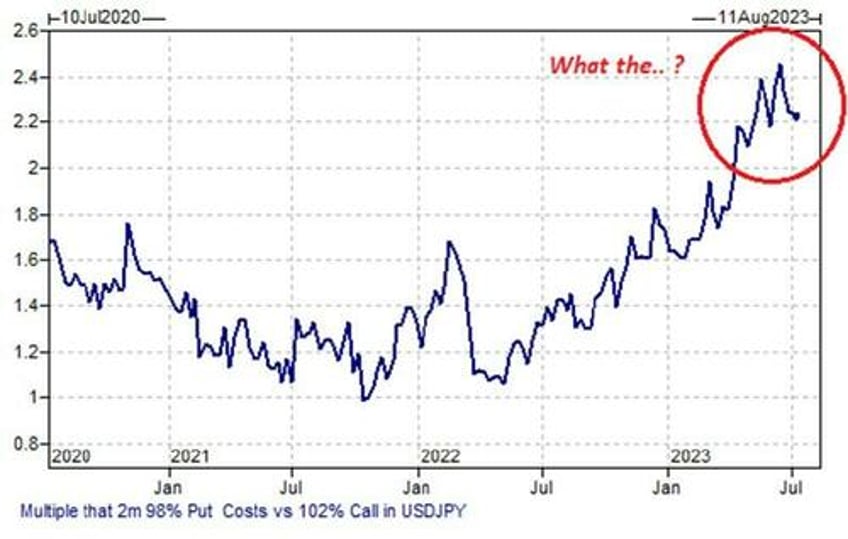

As Goldman FX trader Matt Dewitter wrote in a note titled "Positioning for 150 in USDJPY", the asymmetry in the FX pair is very clearly for the topside. Consider this: "premium you pay to own a 2-month USDJPY put, say 2% from spot, isn’t just 20% more than the equivalent USDJPY call. Or even 50% more. Its nearly 2.5 times more."

Here is the math:

- USD puts cost 1.25%

- USD calls cost 0.55%

- All for the same 2-month 2% away from spot strike. (Spot 140.55, strikes 137.75 and 143.35 respectively).

Dewitter continues:

At the extremes this imbalance becomes even more pronounced: 10-delta USD calls are now SO LOW they cannot help but offer you exceptionally cheap exponential leverage for a BOJ on hold scenario.

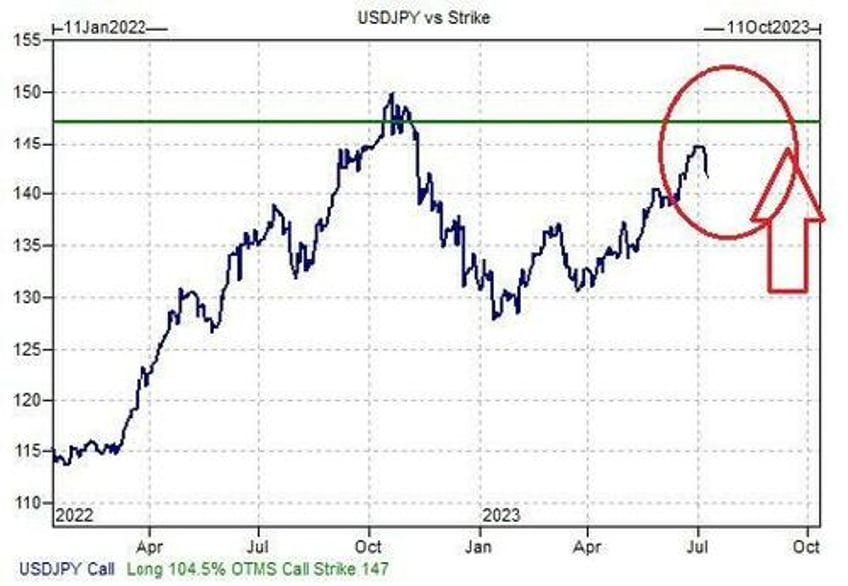

Buy 2-month 4.5% above spot call, roughly 10d, for 0.199% of notional

That’s 200k for $100m of exposure. Strike ~147.00. (the equivalent 134 put would costs 600k.. ) Per the chart, you would expect a 4-5x return on a spot move back to the level from just a few days ago (~145).

The returns get even more exponential, 12-15x, on a BOJ disappointment, with a 145 break plausibly seeing us back to 150 highs.

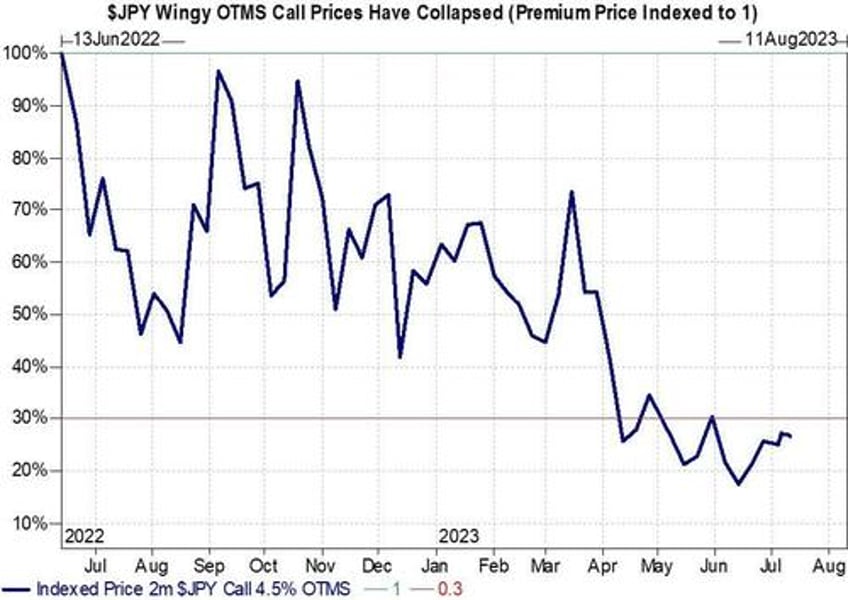

Note that the price for these USD calls has collapsed. It is 70% cheaper than this time last year. And 50% cheaper than the past 1-year average. That effectively DOUBLES your leverage

Bottom Line:

Combine this with a very attractive spot entry level after the 3% collapse, and these wingy USDJPY calls are very compelling.

As Goldman concludes, "Yes BOJ may move. But if they don’t, you can expect a return back to the prevailing level, and a very attractive return."

Pay 20bp to own a 2-month 4.5% above spot USDJPY call

Well, we now know they won't move, so the road to 150 is once again clear. Once there, we cross intervention redlines so it will be time to cover.

More in the full Goldman note available to pro subs.