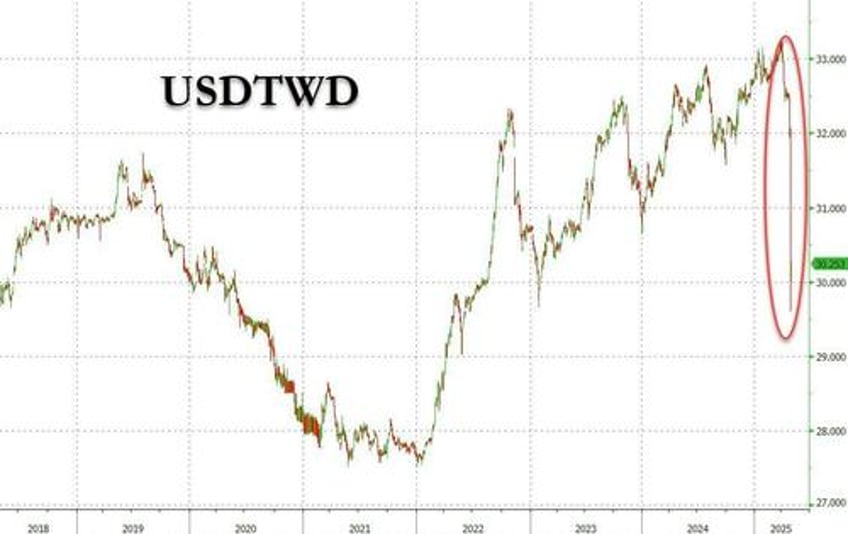

After the historic moves in USDTWD since last Friday, which saw the currency surge by 5% on Monday, its biggest intraday gain in more than three decades before retracing much of the move after the central bank stepped in to calm the market, the question according to Goldman FICC trader Nimita Bhargava is "what’s next?"

Today we saw USDTWD retrace (for a full breakdown of what caused it why it took place now as well as some discussion on what happens next, please see here) one big figure sell-off seen post the CBC press conference yesterday, with liquidity also normalizing slightly. This seems to have been driven by state-owned banks and government funds buying USD as well as HFs looking to use this opportunity to buy dips for hedges or carry.