One month after the prevailing conventional wisdom was that US Treasuries are on their way out as the world's safest asset class (to be replaced by what Japanese bunds? Chinese bonds? Zimbabwean whachamacallits?) as a result of coordinated selling by China and basis trade unwinds, and which led to a plunge in Direct Bidders (offset by record foreign buyers), moments ago the US Treasury sold $42 billion in 10Y paper in a stellar auction, and all the concerns from one month ago now seem like a distant memory.

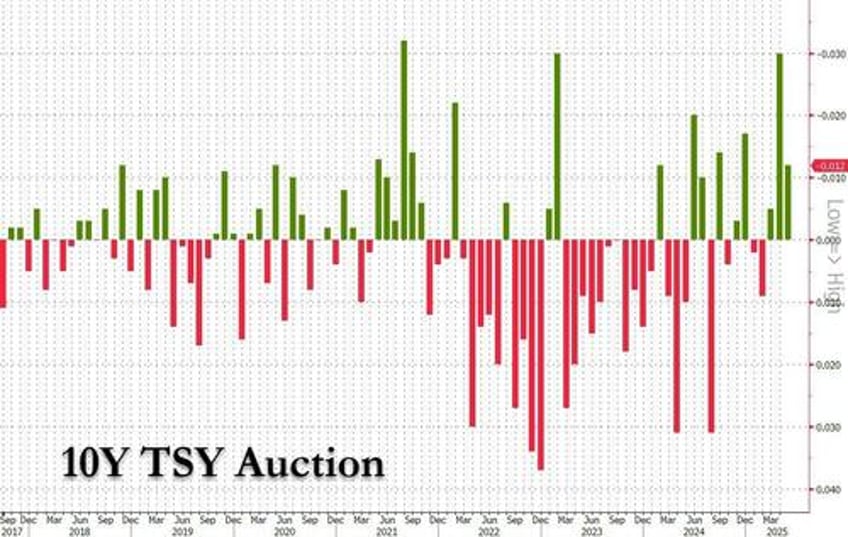

At 1pm, the Treasury announced that it had sold $42 billion in 10Y paper at a high yield of 4.342%, down from 4.4350% last month, and the second lowest of 2025. So much for yields exploding higher and nobody wanting to hold US paper any more. More importantly, with the When Issued trading at 4.354% ahead of the break, the auction stopped through by 1.2bps, the 3rd straight stop through and 5th of the last 7.

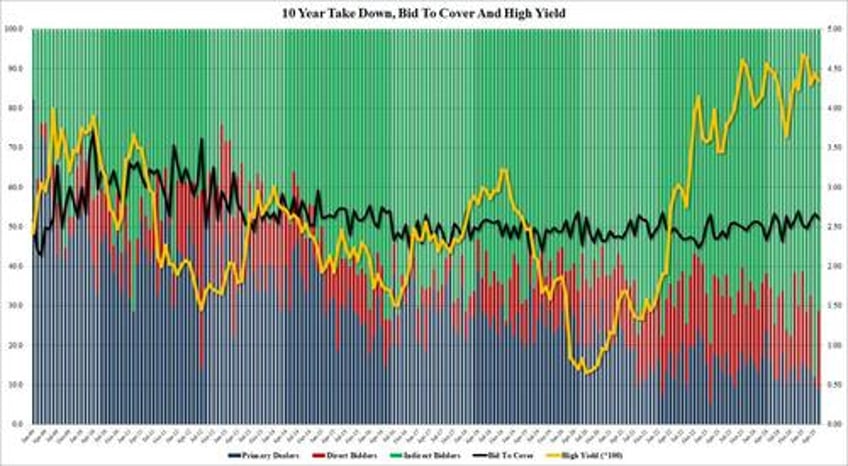

The bid to cover was 2.604, down from 2.665 in April but the second highest of 2025 and above the six auction average of 2.59.

The internals were also stellar, with Indirects, or foreign buyers, awarded 71.2% of the auction, down from a record 87.9 in April, but one of the highest on record.

And with Directs taking down a perfectly normal 19.9%, up sharply from April's record low 1.40% (arguably the worst aspect of last month's auction), and back to normal and above the 16.8% recent average - as if April never happened...

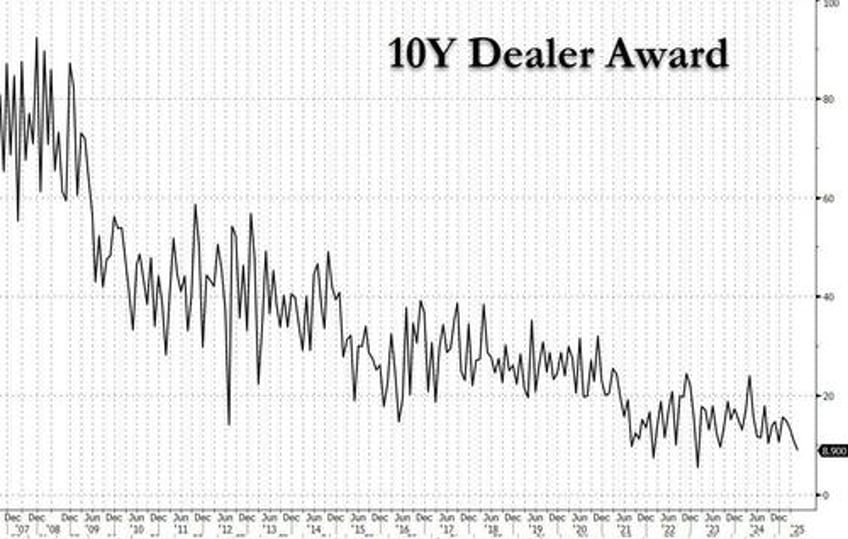

... Dealers were left holding 8.9%, the second lowest on record.

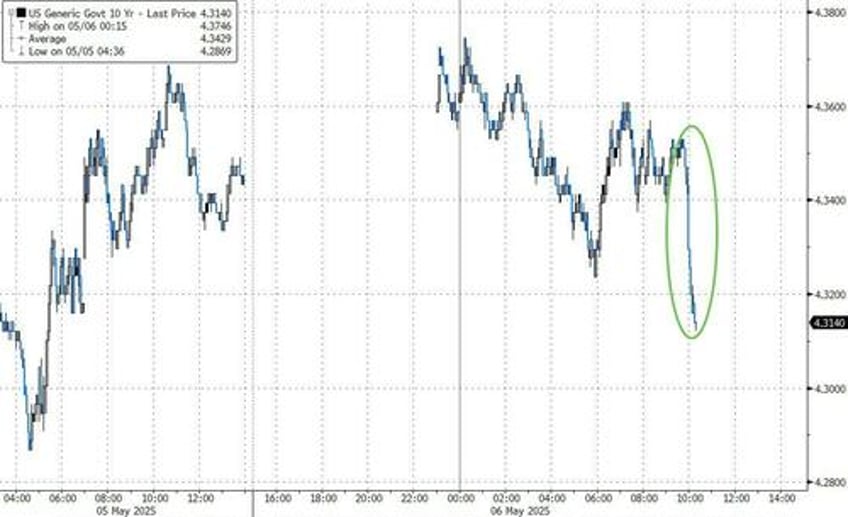

And while the market was far less on edge compared to the last 10Y auction when liquidity was almost literally zero, judging by the market reaction which has sent 10Y yields tumbling, there were clearly quite a few nerves on edge ahead of today's auction, and the result is yields sliding to session lows as shorts were forced to cover.