By Alex Kimani of OilPrice.com

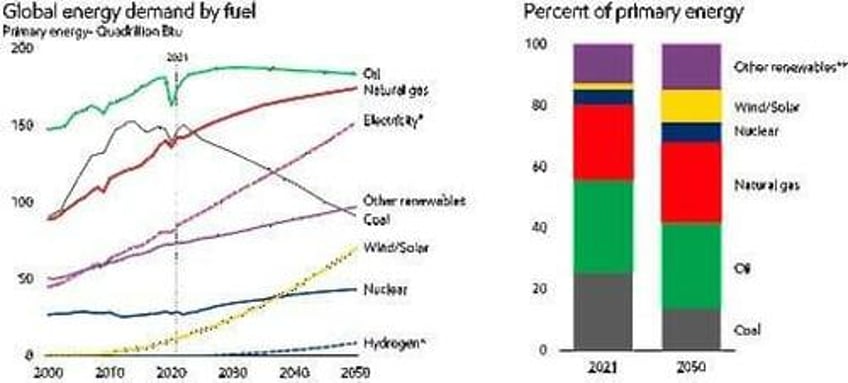

Last month, U.S. oil and gas supermajor Exxon Mobil released its long-term global energy outlook report. Exxon has predicted that global energy demand will reach about 660 quadrillion Btu in 2050, good for a 15% increase from 2021 levels reflecting a growing population and rising prosperity.

The energy company has projected that renewables and nuclear will record strong growth through 2050, contributing around 70% of incremental energy supplies; natural gas demand will remain robust and reach almost 30% of all demand by 2050, oil demand will peak in the 2030s but only fall slightly over the next two decades while coal demand will continue to decline sharply. Interestingly, the developing world is expected to drive all of the demand growth, with Exxon predicting that non-OECD share of global energy demand will reach around 70% in 2050 while the combined share of energy consumption by the U.S. and Europe will decline from about 30% in 2021 to about 20% in 2050.

Whereas these appear like healthy trends that might help the world ameliorate its climate crisis, not everybody is that sanguine. Al Jaber, chief executive officer of the Abu Dhabi National Oil Company (Adnoc) and president of last year’s Cop28 summit says that the current trajectory of rapid energy demand growth is unsustainable.

“The energy transition will lead to energy turmoil … if we only address the supply side of the energy equation. We must be balanced, we must tackle the demand side … We cannot and should not pursue the energy transition by only looking and working on one side of the equation,” Al-Jaber has told the Guardian.

According to Al-Jaber, it is unlikely that global carbon reduction targets can be met unless the world cuts energy demand, adding that many governments are reluctant to look at the complex issues around this area.

Al-Jaber’s sentiments are shared by the U.S. climate envoy John Kerry, “Saying we will, for the first time in history, transition away from fossil fuel, and adjust in an orderly equitable manner … and in accordance with the science that by 2050 [we will] accomplish net zero, means everybody has to have a plan, and that is not where we are today,” Kerry has said. Kerry has taken a veiled swipe at China and its plan to bring 360 Gigawatts of coal-fired power online, saying, “And if that happens, it will wipe out all of the gains of Europe, the U.S. and other parts of the world.”

Peak Oil Demand

It’s interesting to note that in this report, Exxon Mobil sees global oil demand peaking in just a decade, though it has predicted that oil will remain the world’s most dominant form of primary energy by 2050. Last year, ExxonMobil and Saudi Aramco pushed back on a prediction by Bloomberg that global oil demand will peak in 2027.

According to Bloomberg, electric vehicles, ever-improving fuel efficiency and shared mobility will displace a staggering 20 million barrels per day in oil demand by 2040, 10 times what they are currently displacing. Bloomberg claimed that demand for gasoline and diesel for road transport in the U.S. and Europe has already peaked while demand in China is set to peak in the current year. Bloomberg has predicted that oil demand in other major consuming nations like India will go into a tailspin in the 2030s.

In its report, Exxon has concurred with many of Bloomberg’s points. Exxon has predicted there will be 920 million plug-in hybrids, battery electric, or fuel cell vehicles on the roads in 2050, good for 44% of the global fleet. In the near term, the company sees EV sales growing from 6.4 million in 2021 to 33 million in 2030, good for a healthy compounded annual growth rate of about 20%.

Exxon says efficiency gains in developed countries will be more than enough to offset energy demand growth due to population growth. However, unlike Bloomberg, Exxon has predicted that global transportation-related energy demand will grow more than 30% from 2021 to 2050, with oil supplying the lion’s share.

Speaking at last year’s World Petroleum Congress in Calgary, Exxon CEO Darren Woods said it will be difficult to replace today’s energy system thanks to the wide availability of oil and gas, adding that the energy transition would take time.

“There seems to be wishful thinking that we’re going to flip a switch from where we’re at today to where it will be tomorrow. No matter where demand gets to, if we don’t maintain some level of investment industry, you end up running short on supply which leads to higher prices.”

Aramco CEO Amin Nasser noted that previous predictions about peak oil demand have failed to materialize,“This notion is wilting under scrutiny because it is mostly being driven by policies, rather than the proven combination of markets, competitive economics and technology. We need to invest, otherwise in the mid- to long-term we will have another crisis and we will go backward in terms of using more and more coal and other cheap products that are available today,” he said.

Nasser has predicted that global oil demand will hit 110 million barrels per day (bpd) by 2030, up from 102 million b/d in 2023.