Abu Dhabi is making its biggest energy play yet, as it seeks to become a major global force in liquefied natural gas (LNG). Its state oil company, ADNOC, through its investment arm XRG PJSC, has led a $19 billion takeover offer for Australia’s Santos Ltd., a move that would give it direct access to LNG production and exports into booming Asian markets, according to Bloomberg.

“Abu Dhabi is long oil, but is seeking to be a more material player in LNG markets,” said Bernstein analysts led by Neil Beveridge. “The acquisition of Santos would help enable Adnoc to become a bigger LNG player in key growth markets in Asia.”

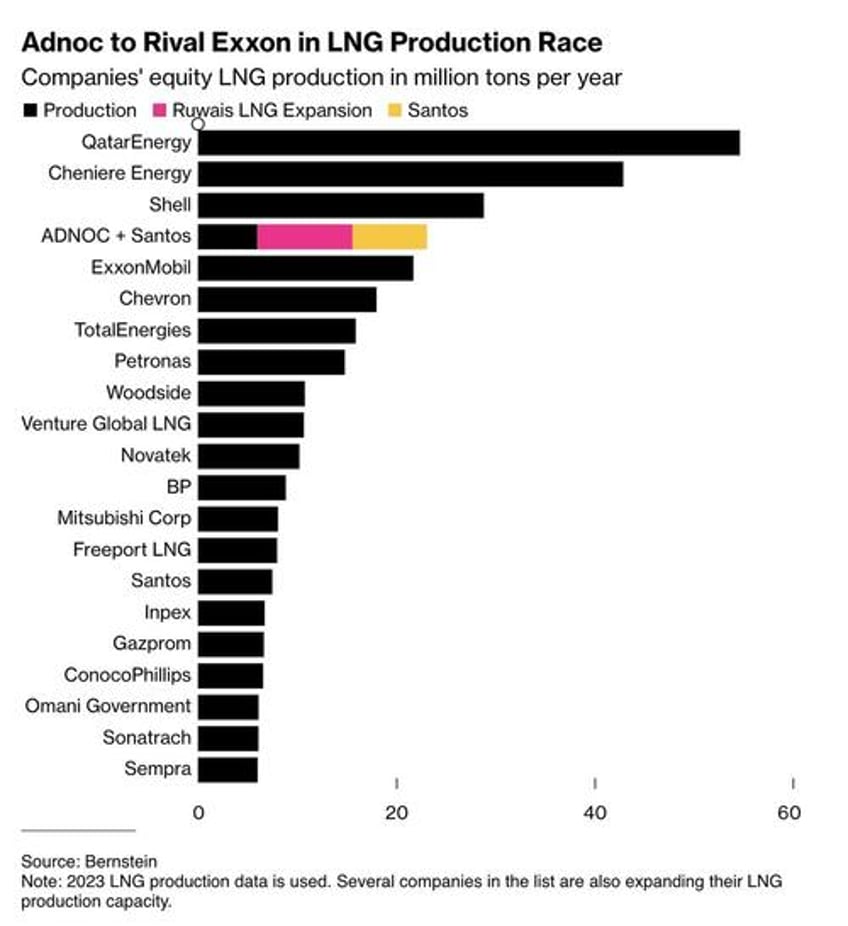

Santos’ LNG capacity is expected to hit 7.5 million tons annually once Australia’s Barossa project begins later this year. Combined with ADNOC’s existing 6 million tons of domestic LNG capacity and a planned 9.6 million-ton terminal, the deal would position Abu Dhabi as a competitive mid-tier global LNG supplier.

“If completed, the deal could push Adnoc into the ranks of majors like Shell and ExxonMobil,” Bernstein analysts noted. Bloomberg Intelligence adds that it could give Adnoc a 15–20 million ton per year (MTPA) portfolio, depending on how it scales operations. “It would still be a big leap from where they are now, which is mostly domestic-focused,” said BI analyst Salih Yilmaz.

Bloomberg writes that the acquisition also advances Abu Dhabi’s broader strategy: convert oil wealth into sustainable economic growth. Beyond LNG, the UAE is investing in tech, tourism, and manufacturing while aiming for gas self-sufficiency this decade.

XRG PJSC, ADNOC’s $80 billion investment arm launched in late 2023, is leading the charge. It aims to double its value within 10 years and become one of the top five integrated global gas and LNG businesses. XRG already has LNG deals in place, including a 20-year supply contract for 1.9 million tons per year from NextDecade’s Rio Grande LNG in the U.S.

With Santos’ addition, XRG’s portfolio would swell to about 14 million tons per year in projects, stakes, and supply contracts — expanding its reach into high-demand Asian markets and reducing reliance on U.S. deals.