After Russia invaded Ukraine, the Russian firm Aero-HIT emerged as a top drone supplier for Moscow's war effort, relying heavily on overseas partnerships with Chinese companies to bypass Western sanctions to ramp up production of kamikaze drones.

Internal documents obtained by Bloomberg reveal how Aero-HIT—backed by the Russian government and supported by Chinese entities like Autel Robotics—worked to manufacture thousands of FPV (First Person View) drones, such as the Veles, which have been deployed in Ukraine's Kherson region. Aero-HIT plans to scale production to 10,000 drones per month later this year.

"Taken together, the documents show how sensitive technologies can move from China to Russia even if President Xi Jinping's government says it's not supplying either side," Bloomberg journalist Alberto Nardelli wrote in the report.

To grasp how radically FPV drones have transformed modern warfare, consider the recent remarks by Erik Prince, founder and former CEO of military contractor Blackwater.

Speaking at a Hillsdale College seminar titled "AI and the Future Battlefield," Prince highlighted how "citizen innovation" in weaponized FPVs has rendered traditional snipers nearly obsolete, extending the reach of battlefield lethality far beyond anything previously imaginable, from just 1,000 yards with a sniper scope to now miles.

FPV drones can cost anywhere from several hundred to several thousand dollars, depending on their configuration. Bloomberg noted that one order of 100 Veles models was priced at around $1,000 per drone, according to a purchase order from March.

Here are the key points from the report:

Aero-HIT launched in late 2022 with state support and aims to produce up to 10,000 drones per month, scaling to even more advanced models.

Despite Chinese company Autel Robotics officially denying any business with Russia, documents show cooperation on technology transfer, firmware, and production of the Autel EVO Max 4T.

A $90 million proposal outlines plans to localize Chinese drone tech in Russia, integrating it with domestic systems and producing up to 30,000 units annually.

The project involved former KGB-linked individuals, shell companies, and obscure intermediaries in agriculture, seafood, and airline catering to hide the supply chain.

As China imposed tighter drone export controls in late 2023, some Chinese firms pulled out, but others—like Shenzhen Huasheng Industry, which was later sanctioned—stepped in.

Russia's Ministry of Defense coordinated with Aero-HIT, ordering thousands of drones and integrating them into the military supply chain via sanctioned intermediaries like Renovatsio-Invest and Aeromar-DV.

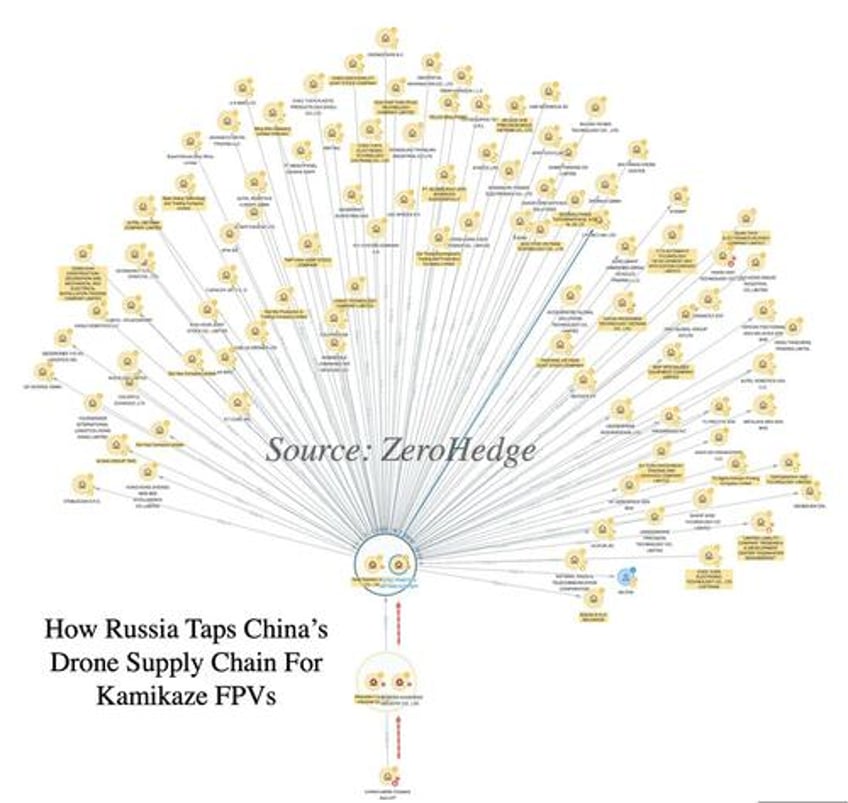

Our supply chain risk analysis of Aero-HIT aligns closely with the conclusions in Bloomberg's report. Aero-HIT has commercial ties to Shenzhen Huasheng Industry, which in turn is connected to Autel Robotics. The commercial intelligence and data analytics platform we used, Sayari, then maps out Autel's broader network of suppliers.

Bloomberg's report exposes how Russia has exploited private and semi-private Chinese firms—despite Beijing's claims of neutrality—to build a domestic drone industrial base for its war in Ukraine. We've taken it a step further, illustrating for readers exactly how this dark supply chain operates.