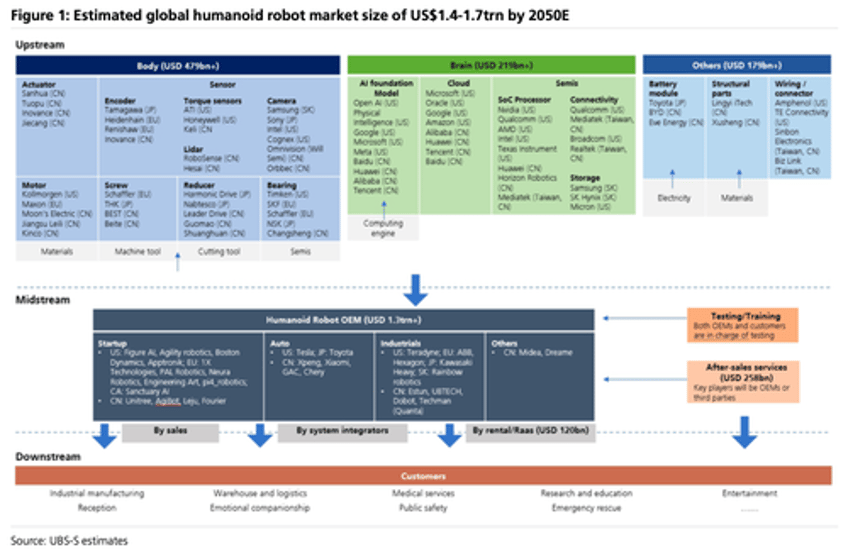

UBS analysts published a note earlier today that lays out a fascinating timeline straight out of sci-fi: the rise of humanoid robots. Powered by artificial intelligence, falling hardware costs, an aging global workforce, and labor shortages, humanoids are projected to reach 2 million units globally by 2035 and surge past 300 million by 2050, unlocking a $1.7 trillion market. The analysts pinpoint a major inflection point—the so-called 'EV Moment'—when these robots begin marching into homes.

"Aging populations, labour shortages and low productivity gains in service sectors all support the use case for robots. Having human form offers the added benefit of adaptability into everyday life. Early types of humanoids are already working in manufacturing and warehouses, but currently the majority are general models built for R&D and training," UBS analysts, led by Phyllis Wang, wrote in a note.

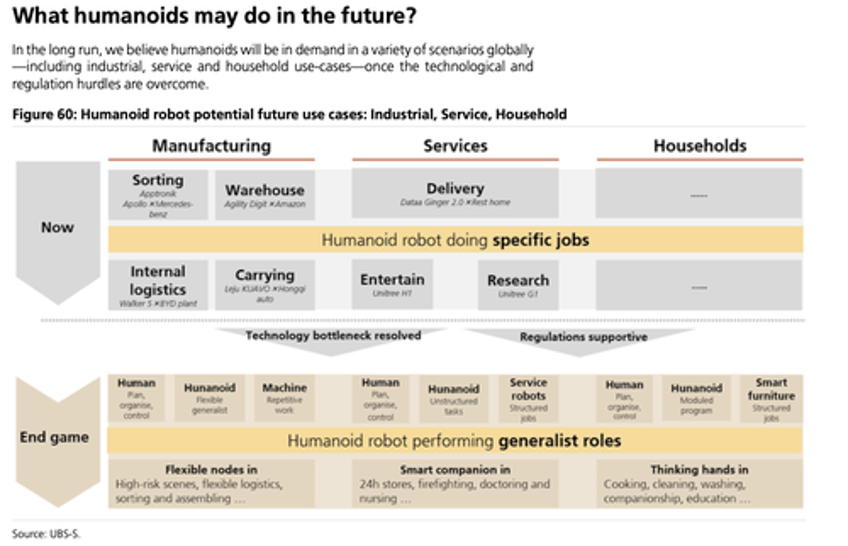

Wang continued, "Our interactive model places industrial sectors as the adoption leaders, followed by service sectors and households. By 2030E, 63% of use cases should still be industrials, with more than half of models still non-bipedal. For humanoids' full potential to be realised, we believe they eventually need to become a household consumer product and human-form humanoids (upper bodies with dual arms, dexterous hands and bi-pedal lower bodies) to become mainstream."

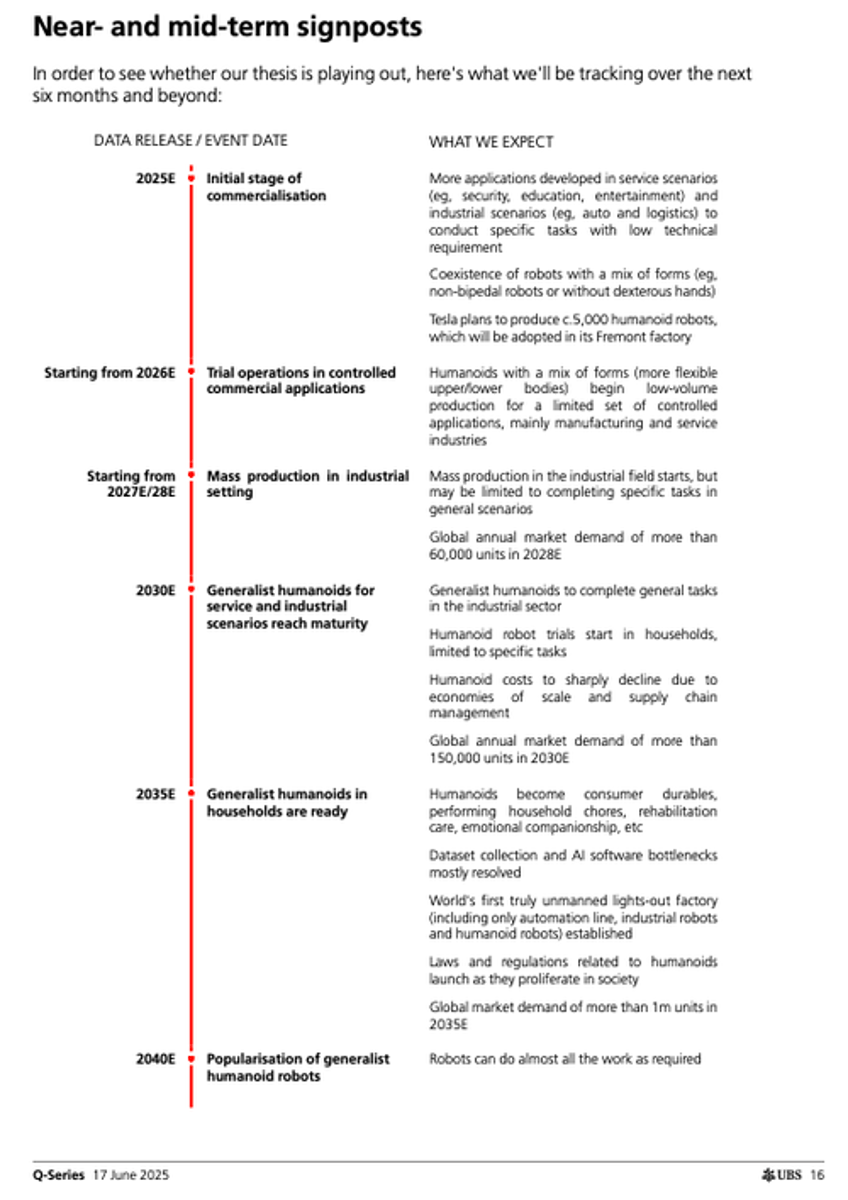

Humanoids will evolve from industrial environments to the services sector to households from this year through 2035.

Here's how the analysts laid out the deployment process:

Industrial pilot adoption (2025–2030)

Service sector generalization (2030–2035)

Household penetration and consumer-scale adoption (post-2035)

More color on the deployment timelines and phasing into various industries:

2025–2028: Early commercial deployment, largely in automotive plants and logistics centers. Tesla to deploy 5,000 Optimus units in Fremont.

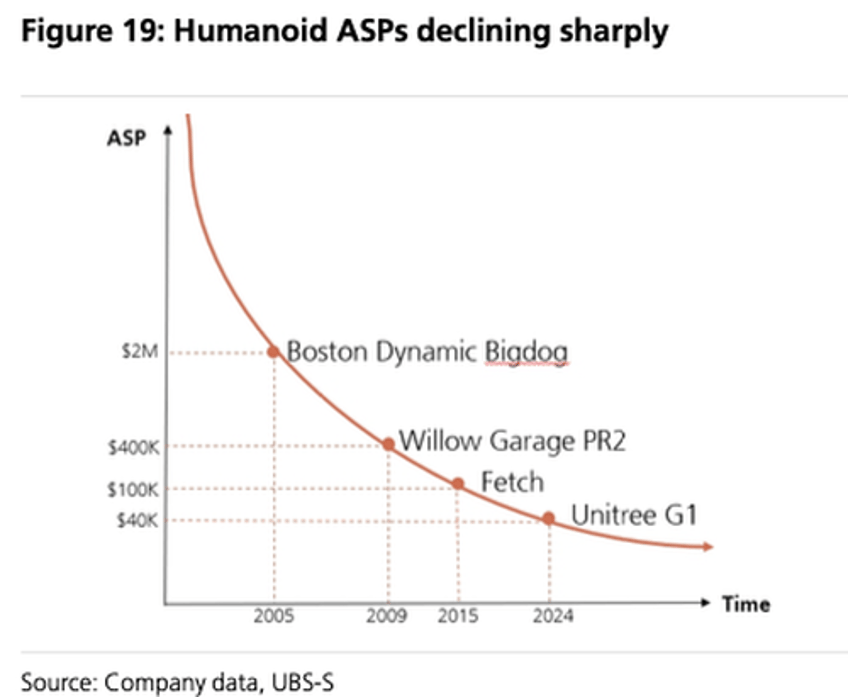

2028–2035: Expansion into generalist industrial use. Cost per unit falls sharply due to scale and supply chain maturation. First household use cases appear (e.g., cleaning, caregiving).

2035+: Mass consumer-grade adoption. First fully automated factories using humanoids projected by 2035E. Brain-computer interfaces explored by 2040E.

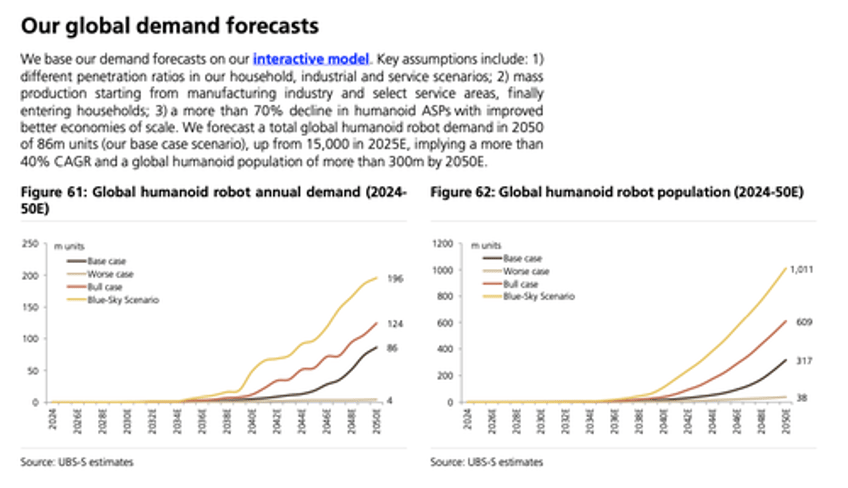

The trajectory suggests that a total installed base of humanoid robots by 2035 will be around two million, with hypergrowth expected through 2050 that will take that total up to 300 million.

2035E: >2M units deployed

2050E: >300M cumulative units; 86M units sold annually

2050E TAM: $1.4–1.7 trillion

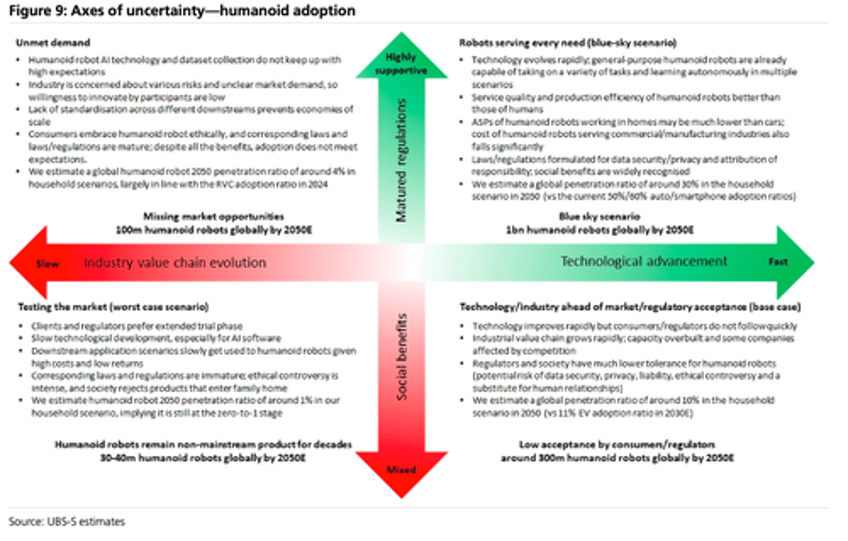

UBS warns the humanoid revolution won't hit its 'EV Moment'—defined as a rapid production surge following the resolution of key bottlenecks—until the end of the decade. Once the AI brains, data pipelines, and regulatory red tape are resolved, that's the moment when the floodgates open and humanoid robots begin marching into homes.

More from the analysts on the 'EV Moment'...

'EV moment' may not happen within five years: We define the 'EV moment' as when the EV technology bottleneck was resolved and volumes increased from 1m units to 10m over a five-year period. As futurologist Roy Amara has stated, people tend to overestimate the short-term impact of new technologies while underestimating their long-term effects. We identify a few hurdles that need to be overcome before humanoids scale up, namely AI, dataset collection and regulations. We foresee significant demand potential in household scenarios in the long term as humanoids could provide value-added services with AI empowerment. However, we expect commercialisation to start in industrial (eg, object carrying in specific areas) and service scenarios because household scenarios have higher—technological, cost, implementation, safety and acceptance—requirements than other downstream applications. Considering the tech (mainly AI models and data collection) and regulatory barriers, we believe humanoids' 'EV moment' may start after 2030. Our view is supported by our study of use cases and comparisons with AD.

Most important graphics from the 142-page report:

Sizing the humanoid market

Timelines

Sliding cost of production

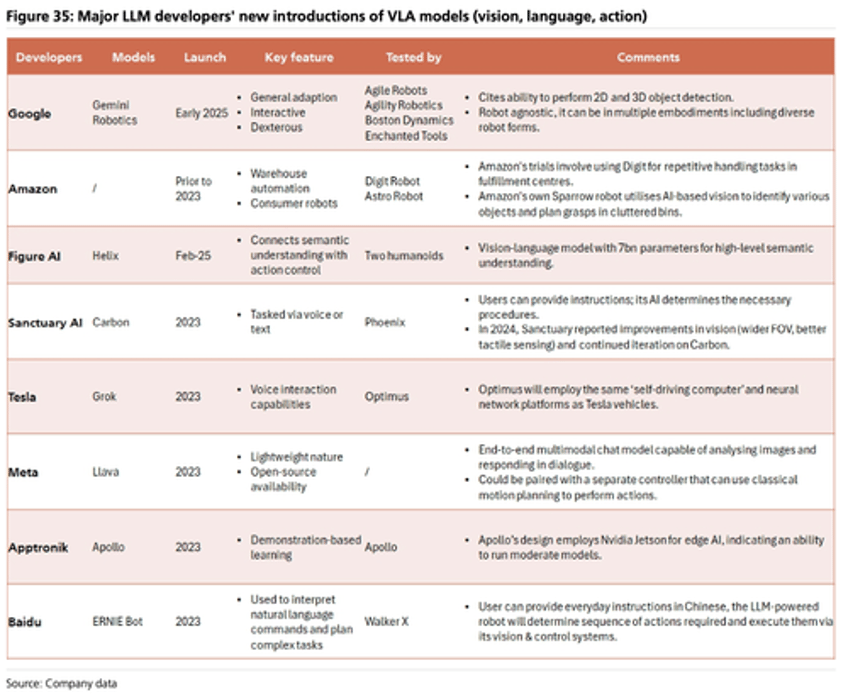

Chatbot companies and robotics firms partner up

What tasks can humanoids do?

UBS' global demand forecast through 2050

Various pathways

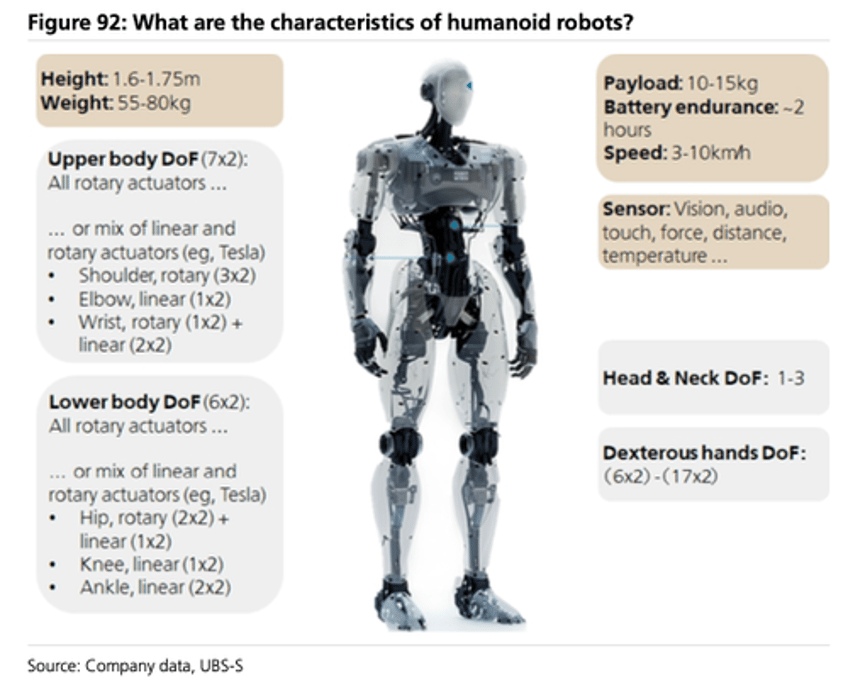

Characteristics of a bot

How to profit from the humanoid wave?

UBS' take:

"It is difficult at this point to predict clear leaders among robot OEMs, a dynamic similar to EVs at their early stage. Based on current progress, Tesla, though not Buy rated, is well positioned to participate in the humanoid robot industry."

Bicentennial Man...