On Thursday, Bloomberg reported that President Donald Trump has been urging GOP lawmakers to raise taxes on Americans making at least $2.5 million annually, or couples making $5 million. We waited for a denial, only to get some 'clarification' today.

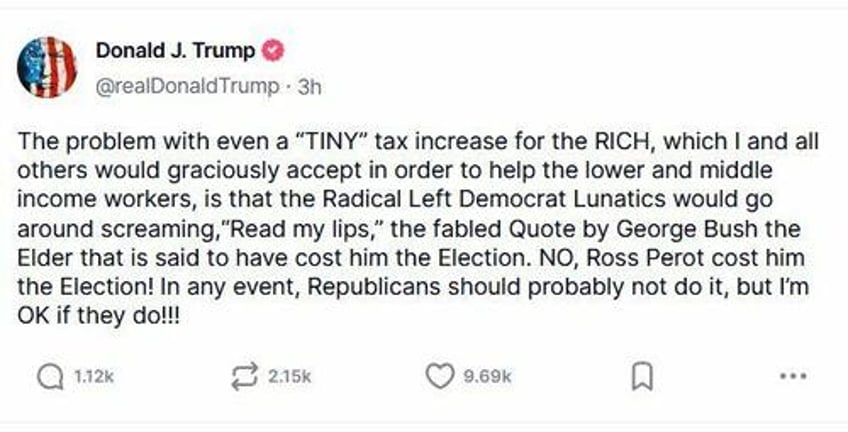

In a Friday morning Truth Social post, Trump suggested that Republicans 'should probably not do it,' but "I'm OK if they do!!!"

Trump says that the problem with 'even a "TINY" tax increase for the RICH' is that 'Democrat Lunatics would go around screaming, "Read my lips," the fabled Quote by George Bush the Elder that is said to have cost him the election," - referring to then-candidate George H.W. Bush’s 1988 campaign promise not to raise taxes as president - which of course he did not keep, and was seen as a factor in his loss in the 1992 election.

Trump reportedly reached out to House Speaker Mike Johnson (R-LA) to push the tax, which would restore a 39.6% bracket to its pre-2017 level. The current top rate stands at 37%. The president also reiterated support for ending the carried interest tax break, a longstanding benefit claimed by private equity and venture capital managers, according to the report.

The proposal is undoubtedly an attempt to mitigate concerns over the GOP's current plans to make Trump's 2017 tax cuts permanent without having to chip away at hot-button entitlement programs.

Representative Jason Smith, the Missouri Republican who chairs the powerful House Ways and Means Committee, is expected to meet with President Trump today. A congressional aide told BBG that Smith plans to assure the president that the forthcoming tax bill 'will deliver on the president’s priorities.'

While the proposal’s full contours remain under negotiation, it is not yet clear whether it would include an expansion of the existing small business income exemption under the individual tax code.

The push to raise the top rate comes as House Republicans face mounting fiscal pressure in drafting what President Trump has labeled the “one big beautiful bill” — a multi-trillion-dollar package aimed at extending the 2017 tax cuts while enacting a range of new promises, including eliminating taxes on tips and overtime pay.

To finance the plan, GOP leaders have struggled to find consensus on cuts to entitlement programs such as Medicaid, prompting President Trump to float alternatives.

Last month, Johnson said that he was "not in favor of raising the tax rates, because our party is the group that stands against that traditionally."

Also last month, Trump told Time magazine that "I would be honored to pay more, but I don’t want to be in a position where we lose an election because I was generous — but me, as a rich person, would not mind paying and you know, we’re talking about very little," adding "We’re talking about one point. It doesn’t make that much difference, and yet, I could just see somebody trying to bring that up as a subject, and, you know, say, ‘Oh, he raised taxes.’"