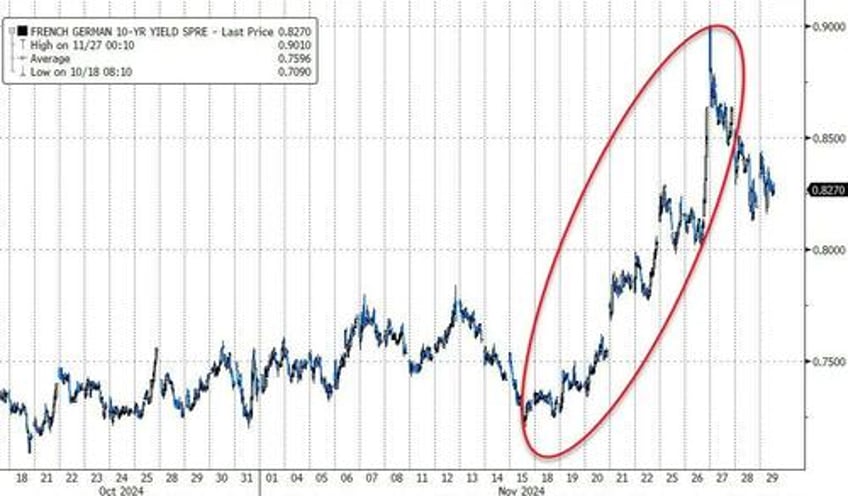

While French bond spreads have compressed modestly overnight (as French Finance Minister Antoine Armand announced that he is ready to amend the 2025 budget proposal to avoid a government collapse), they remain extremely elevated (at their highest since the European financial crisis in 2012) as rising tensions threaten the country’s economic stability.

Source: Bloomberg

As Remix News reports, Armand, warned before the upcoming budget debate that the government must make compromises regarding the 2025 budget proposal. The political situation is constantly deteriorating, because the opposition parties in the National Assembly, led by Marine Le Pen of the National Rally, have called for a no-confidence vote if the government does not accept amendments that make a tangible difference to the proposed tax increases.

Armand made headlines in September for asserting that the National Rally party was not a party he would deal with, as it was not part of what he called “the republican arc,” instigating French Prime Minister Michel Barnier to even phone Le Pen to apologize for the comment.

Le Pen, meanwhile, has insisted her budget demands have been long cast aside.

The budget crisis may have serious consequences for the French economy, with market investors reacting with increased concern, as a result of which the yields on the French bond market have risen.

Armand has said that the government should avoid unnecessary risk and that the adoption of the budget is now vital for the future of the country.

The discussion of the budget proposal will continue in the National Assembly on Dec. 18, with the outcome of the new amendments still unclear. Armand stated that the government is open to remedying the situation by cutting spending instead of implementing the planned tax increases.

Le Pen has called on the government to institute some €60 billion of adjustments, including a tax moratorium, indexed pensions, and more action to counter migration.

In a post on X, National Party leader Jordan Bardella wrote, “The National Rally has just won a victory by obtaining from Michel Barnier the cancelation of the 3 billion euro tax on electricity. Thanks to our determined action, energy prices would not increase for the French in 2025, if this promise is respected and if it is not financed by other tax increases. We will be vigilant. But we cannot stop there. Other red lines remain.”

Bardella goes on to write that Barnier must abandon demands to have the French pay more for medication, especially when medical costs are covered for illegal migrants. He also wants a moratorium on new taxes and a return to the old pension system.

“A serious crackdown on migration and criminal law must be undertaken, without paying lip service to words and promises: our country can no longer accommodate mass immigration which disrupts its identity and weighs heavily on its public finances. These common sense measures are realistic, quickly applicable and expected by an immense majority of French people. The Prime Minister cannot remain deaf to them. He has a few days left,” wrote Bardella.

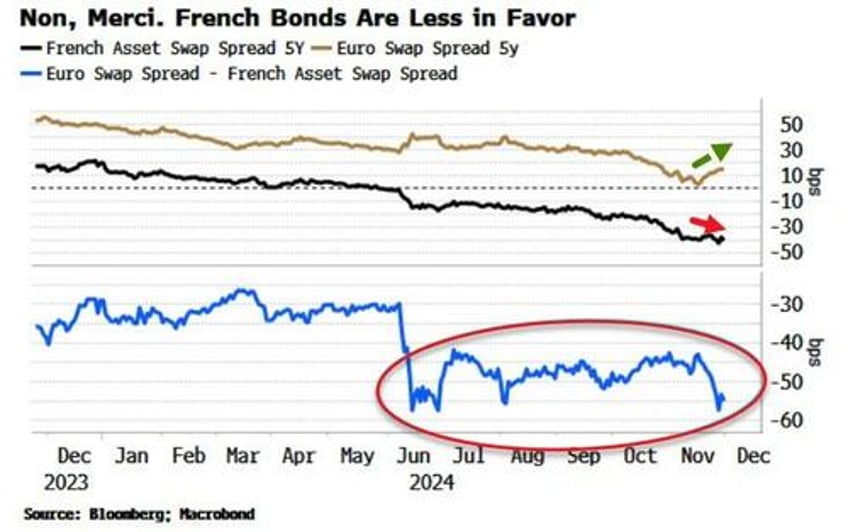

But, despite some optimism that Armand and his 'amis' are moving to Le Pen's pals' position, French asset-swap spreads are diverging from those of Europe, indicating that assets in France are increasingly disfavored as fiscal risks persist.

Asset-swap spreads are what you receive if you want to hedge out the funding risk from owning a bond. They therefore capture the non-interest rate risk from a bond, i.e. supply and demand factors and credit risk. French asset swaps have become much more negative as the market factors in more supply and increased credit risk as the country deals with bigger fiscal deficits and political volatility.

But swap spreads in general have been declining in Europe as well as the US for a variety of reasons, such as QT and rising fiscal deficits. Euro swap spreads have generally fallen with French ASW spreads, but they have seen two big divergences: in June after Macron’s surprise election announcement, and now.

A narrowing in the spread differential would be a key sign the market is becoming less skittish on the budgetary outlook.

Le Pen gave PM Barnier until Monday to accede to her budget demands before she decides whether to topple the government.

How do you say "Tick tock!" in French?