Bitcoin and Ether investors piled into their respective crypto-themed funds on Thursday, marking their second-largest daily inflows since their inception.

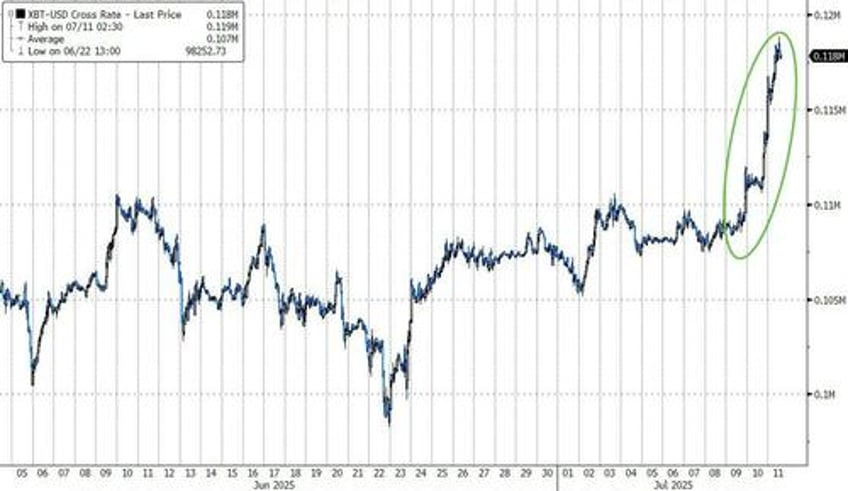

US spot Bitcoin exchange-traded funds inflows totaled $1.17 billion, with $448 million coming from BlackRock’s iShares Bitcoin Trust ETF (IBIT) and $324 million from Fidelity’s Wise Origin Bitcoin Fund, according to Farside Investors. The near-record inflows came as Bitcoin topped $113,800, setting new highs and continuing to rally into Friday.

CoinTelegraph reports that the inflows come second to the $1.37 billion recorded on Nov. 7, 2024, when Donald Trump won the US presidential election.

Meanwhile, Ether spot ETFs witnessed a total net inflow of $383.1 million on Thursday, which also marks the second-highest net inflow in history for the funds.

The lion’s share of inflows came from BlackRock’s iShares Ethereum Trust ETF (ETHA), which saw $300.9 million in net inflows — its highest daily inflow on record.

In a Friday X post, NovaDius Wealth Management president Nate Geraci said the near-record inflows occurred despite legacy financial advisers’ hesitation to offer Bitcoin or Ether spot ETFs.

“Major platforms such as Vanguard are still gatekeeping these ETFs,” Geraci added.

Bitcoin demand beating production

Both Bitcoin and Ether spot ETFs are absorbing the net issuance of their respective coins.

In the past 24 hours, ETH net issuance stood at 2,110 ETH, worth approximately $6.33 million, according to the Ethereum tracking website Ultra Sound Money.

This far exceeds Thursday’s total net inflow into Ether spot ETFs, which stood at $383.1 million.

Meanwhile, Strategy and the US Bitcoin ETFs have collectively bought Bitcoin worth $28.22 billion in 2025, while Bitcoin miners’ net new issuance has amounted to $7.85 billion during the same period, according to Galaxy Research.

Bitcoin soared to a new record high

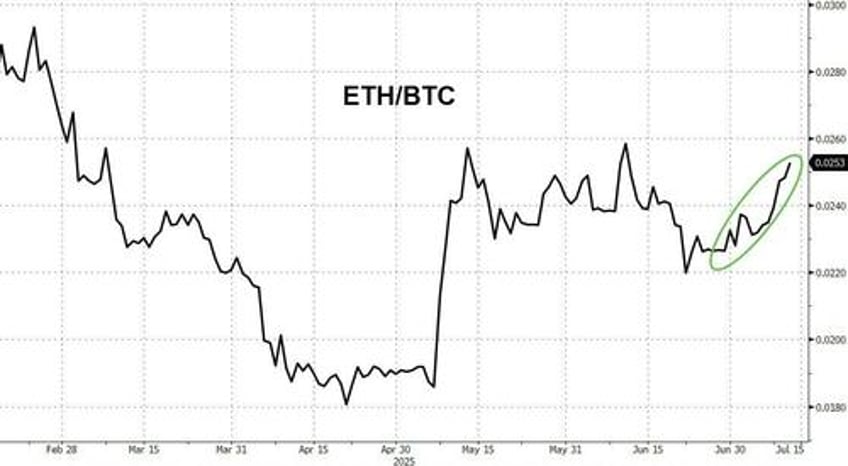

Ethereum topped $3000 for the first time in 5 months...

With ETH outperforming BTC amid the Ethereum Community Conference, or EthCC, taking place...

EthCC, now in its eighth year, has tracked Ethereum’s trajectory from scrappy experiment to institutional backbone.

“That impact was unmistakable this year,” Falleur said.

“From Robinhood embracing decentralized finance infrastructure via Arbitrum to local governments like the City of Cannes exploring deeper integration with the crypto economy.”

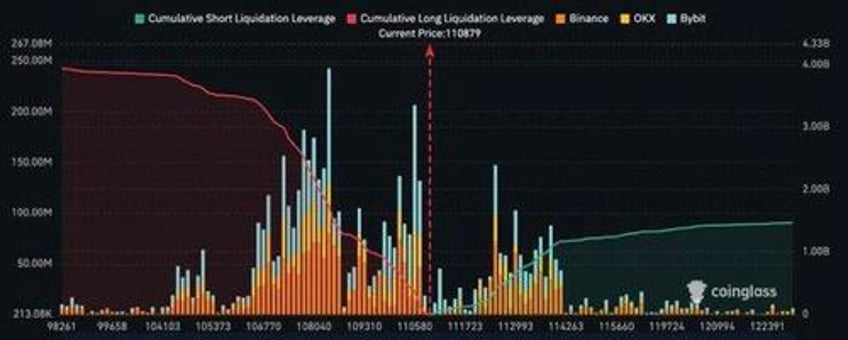

Finally, as Bitcoin Magazine reports, $50 million worth of Bitcoin shorts were liquidated in the past hours and over $1.5 billion worth of Bitcoin short positions are set to be liquidated at $120,000, according to data from Coinglass.

If Bitcoin continues its upward trajectory, a massive short squeeze could be triggered, forcing bearish traders to buy back in at higher prices and further accelerating the price action.