While it wasn't quite as catastrophic as Japan's 20Y auction earlier this week which saw the biggest tail since 1987, moments ago the US also sold 20Y paper in what was one of the worst auctions for this tenor since its launch 5 years ago.

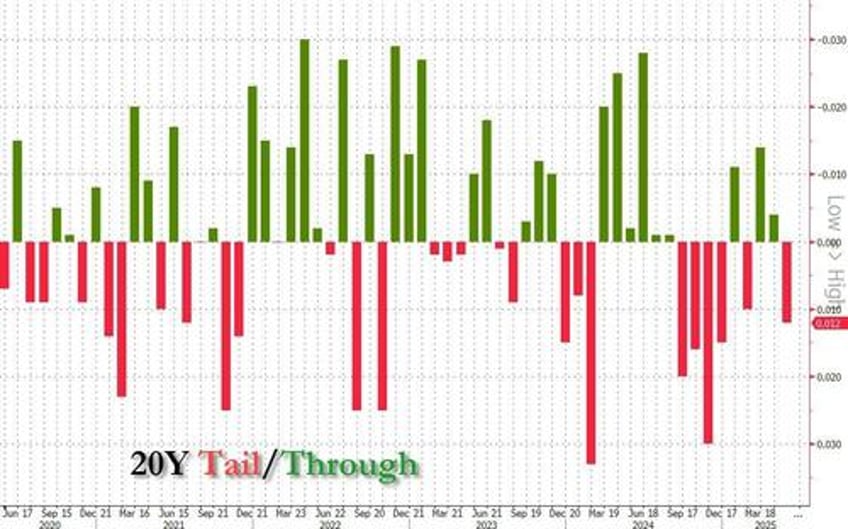

Indeed, exactly 5 years since the first 20Year auction took place in May 2020, moments ago the US Treasury sold $16 billion in 20 Year paper in a dismal auction which sent yields spiking to session highs. The high yield was 5.047%, only the second 20Y auction to have a 5%+ yield, and only the second 20Y auction with a 5% coupon. The high yield was 24bps higher than April's 4.810% and also tailed then 5.035% When Issued by 1.2bps, the biggest tail since December.

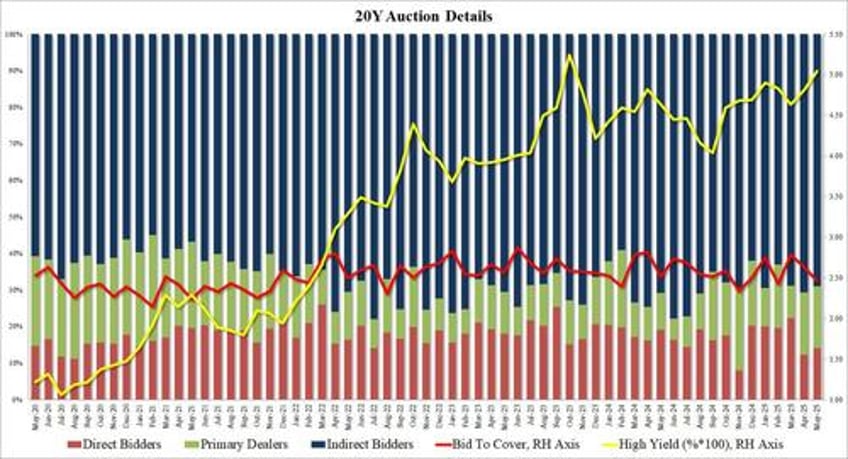

The bid to cover was also ugly, sliding to 2.46 from 2.63 in April, and the lowest since February.

The internals were less jarring, with Indirects awarded 69.02%, down from 70.7% last month but above the 67.2 last month. And with Direct taking down 14.1%, up from 12.3% last month, Dealers were left holding 16.9%, just lower from 17.0% last month.

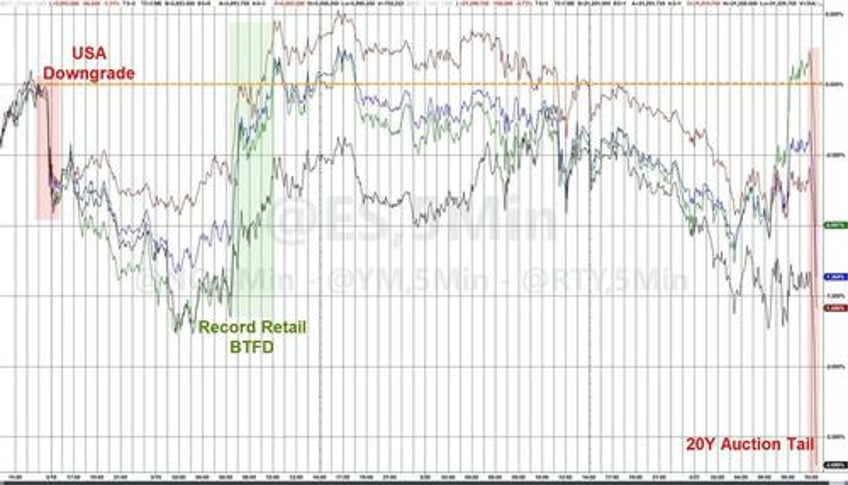

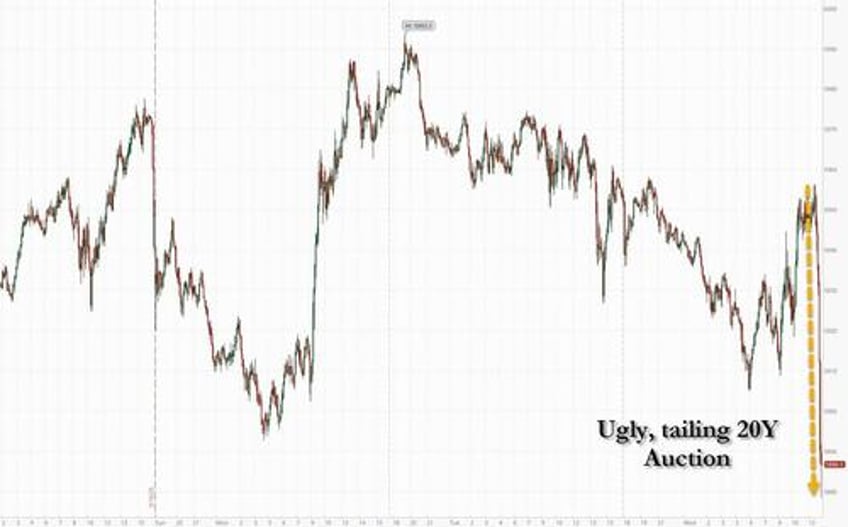

Overall, it was an ugly (if hardly catastrophic) auction, certainly ugly enough to send yields to session highs of 4.58%, up 4bps from 4.54% before the auction...

... which in turn sparked an insta-rout in stocks, which are now tumbling to session lows.