US Money Market funds saw a third straight week of inflows ($29 billion this past week) to a new record high of $5.15 trillion...

Source: Bloomberg

Retail money-market funds saw inflows for the 15th straight week (and institutional funds also saw a second straight week of inflows)...

Source: Bloomberg

The decoupling between money-market fund inflows and bank deposits continues...

Source: Bloomberg

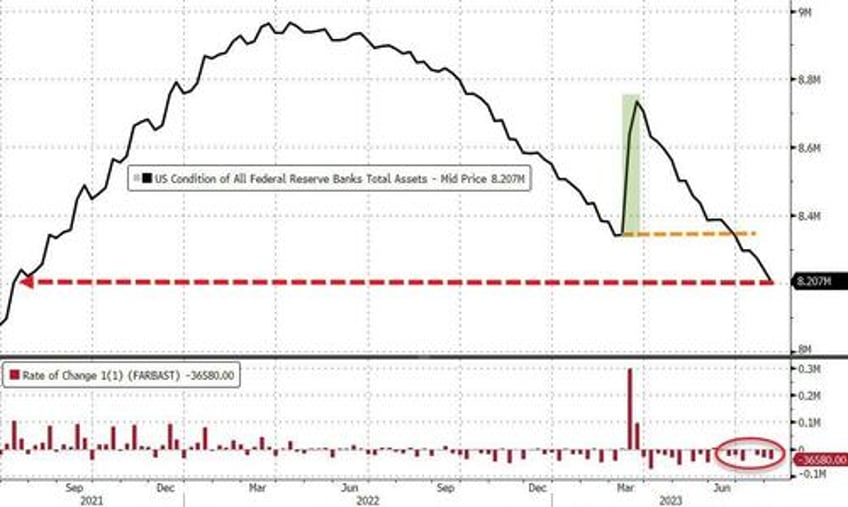

The Fed's balance sheet shrank for the 8th straight week, tumbling $36.6 billion on the week to its lowest since July 2021...

Source: Bloomberg

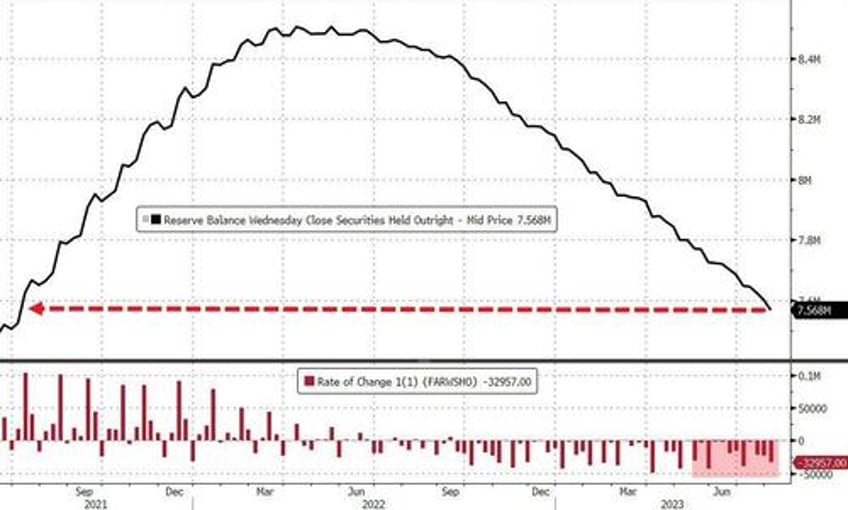

As far as QT is concerned, The Fed is back to selling with Securities down almost $33 billion on the week to its lowest since July 2021...

Source: Bloomberg

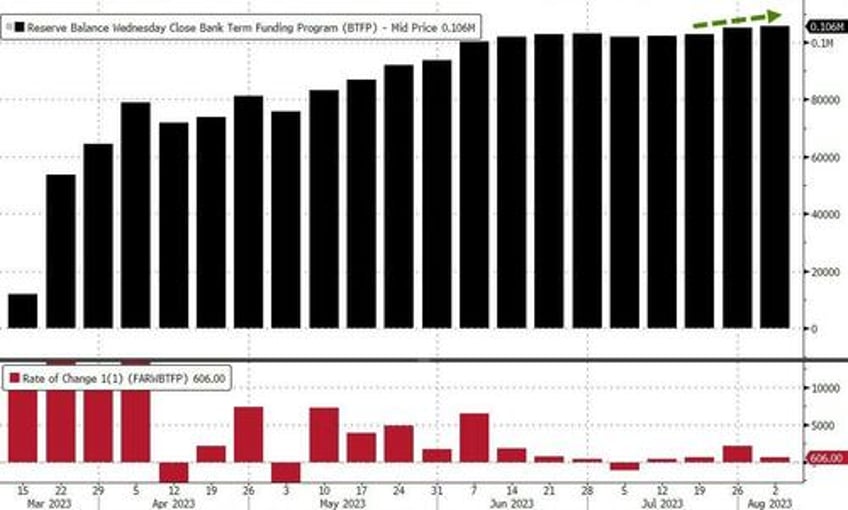

Usage of The Fed's emergency bank bailout facility rose by $606 million to a new record high at $106 billion...

Source: Bloomberg

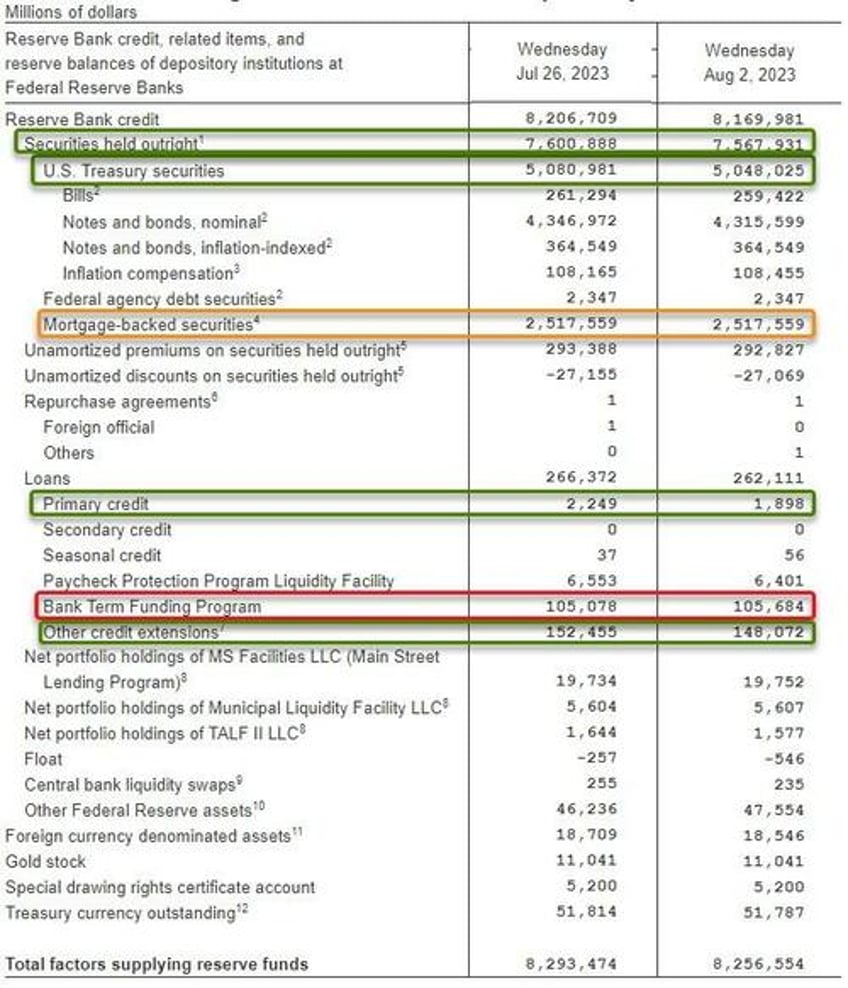

The breakdown from The Fed's H.4.1 table...

QT: down $33BB, dominated by $32BN sale of US Treasury, MBS flat

Discount Window: down $0.3BN to $1.9BN

BTFP: up $0.6BN to $106BN

Other Credit Extensions (FDIC loans): down $4BN to $148BN

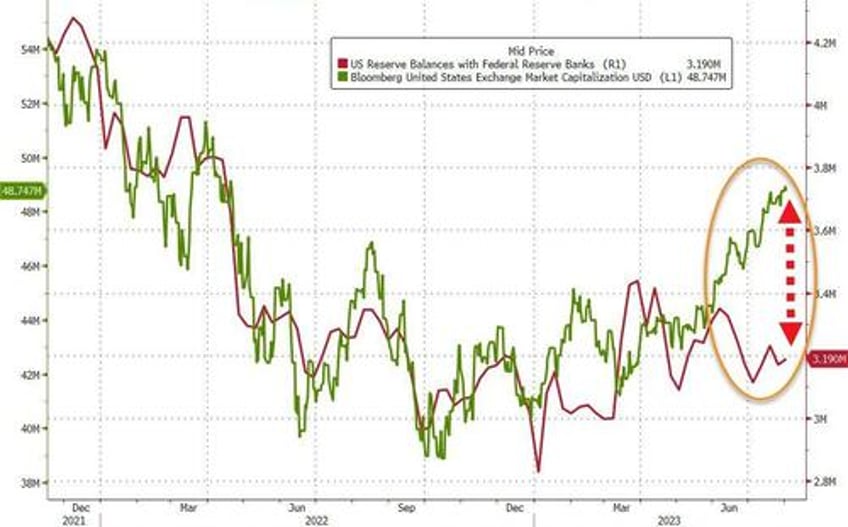

Finally, US equity markets continue to diverge significantly from bank reserves at The Fed...

Source: Bloomberg

We leave you with one thought - in 7 months and counting, America's 'smaller' banks will need to find that $100-billion plus from somewhere as that is when the BTFP bailout program ends (theoretically). Will regional bank balance sheets be stabilized by then? Or will the current bloodbath in bonds be the catalyst for another round of pain?