The S&P Global US Flash Composite PMI fell 1.2pts to 52 in July. The rate of growth eased to the slowest since February amid a softer uptick in service sector output.

Source:Bloomberg

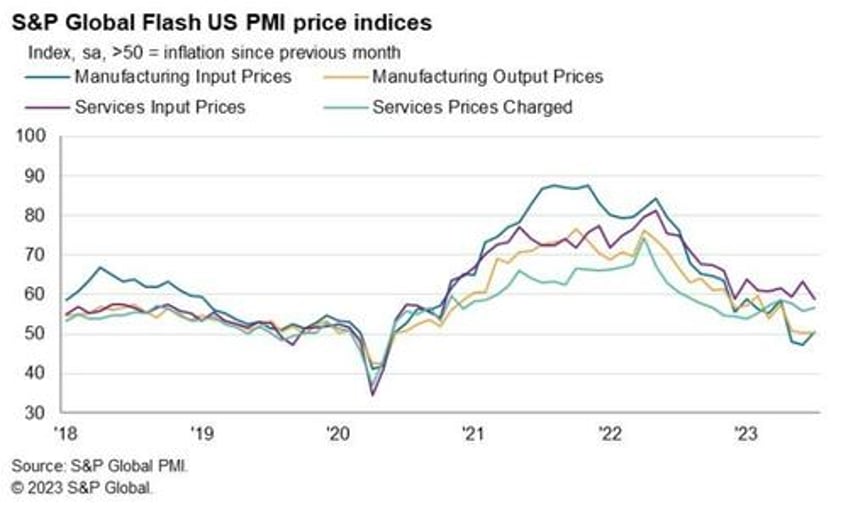

On the price front, elevated cost pressures continued to be led by the service sector.

However, manufacturers saw a renewed rise in input prices, and services firms reported a slower uptick in operating expense.

Commenting on the US flash PMI data, Chris Williamson, Chief Business Economist at S&P Global Market Intelligence said:

“July is seeing an unwelcome combination of slower economic growth, weaker job creation, gloomier business confidence and sticky inflation.

“The overall rate of output growth, measured across manufacturing and services, is consistent with GDP expanding at an annualized quarterly rate of approximately 1.5% at the start of the third quarter. That's down from a 2% pace signalled by the survey in the second quarter.

“However, growth is being entirely driven by the service sector, and in particular rising spend from international clients, which is helping offset a becalmed manufacturing sector and increasingly subdued demand from US households and businesses."

“Furthermore, business optimism about the year-ahead outlook has deteriorated sharply to the lowest seen so far this year. The darkening picture adds downside risks to output growth in the coming months which, alongside the slowing in the pace of expansion in July, will keep alive fear that the US economy may yet succumb to another downturn before the year is out.

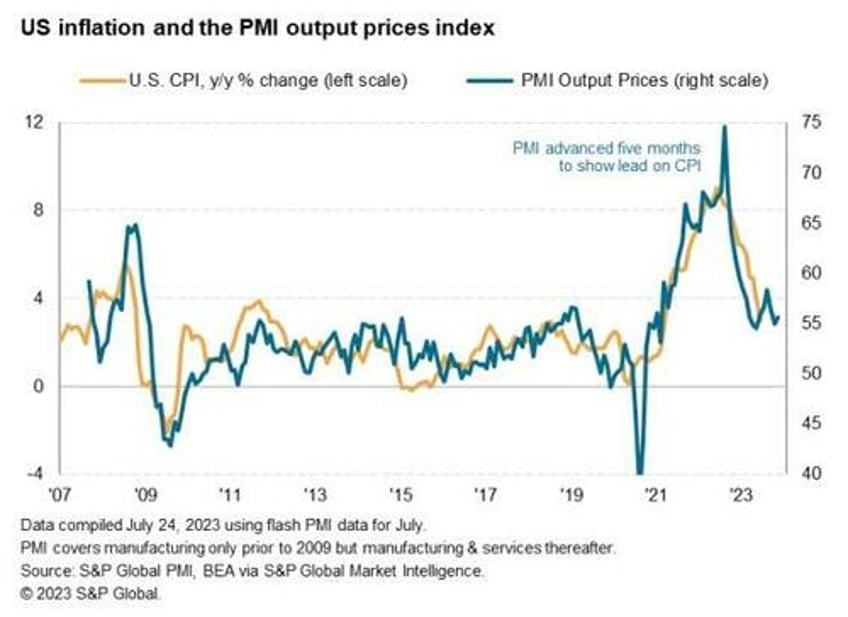

“The stickiness of price pressures meanwhile remains a major concern. As the survey index of selling prices has acted as a reliable leading indicator of consumer price inflation, anticipating the easing to 3% in June, it sends a worrying signal that further falls in the rate of inflation below 3% may prove elusive in the near term.”