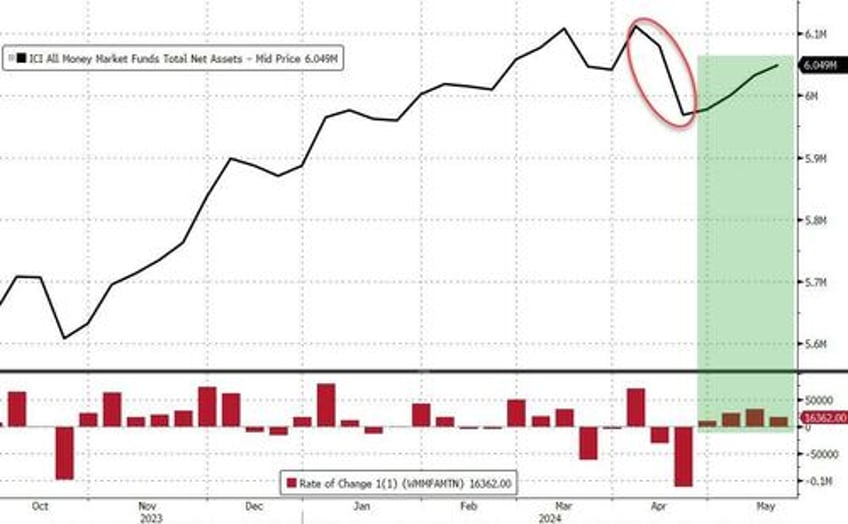

For the fourth straight week, money market funds saw inflows (+$16.4BN), pushing back towards record highs above the $6 trillion level - the highest level in a month - after the seasonal tax-related dip...

Source: Bloomberg

Retail investors have piled into money funds since the Fed began one of the most-aggressive tightening cycles in decades in 2022. On the institutional side, about $2 billion of cash left prime money-market funds, an indication investors are starting to shift their allocations ahead of the Securities and Exchange Commission’s latest set of regulations, which are slated to take effect later this year.

Source: Bloomberg

In a breakdown for the week to May 15, government funds - which invest primarily in securities such as Treasury bills, repurchase agreements and agency debt - saw assets rise to $4.89 trillion, a $17.2 billion increase.

Prime funds, which tend to invest in higher-risk assets such as commercial paper, saw assets rise to $1.03 trillion, a $1.89 billion increase.

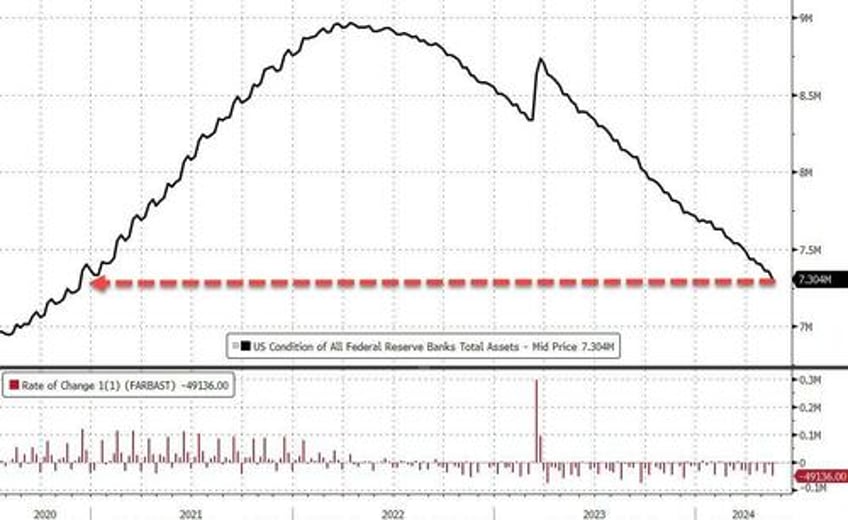

The Fed's balance sheet continues to contract (by a sizable $49BN last week), now at its smallest since Jan 2021. This weekly drop was the largest in three months...

Source: Bloomberg

On a side note, foreign central bank usage of the Fed’s reverse repurchase agreement facility facility rose to the highest level in a year, an indication policymakers around the world added to cash positions.

Source: Bloomberg

As Bloomberg explains, the foreign reverse repo pool, like the domestic RRP, is a place where counterparties can park cash overnight with the Fed. Monetary authorities such as the Bank of Japan can keep a big chunk of funds there earning interest instead of in Treasury bills and other securities. And when they need to do something with those dollars, they can just withdraw it from the facility without ruffling markets.

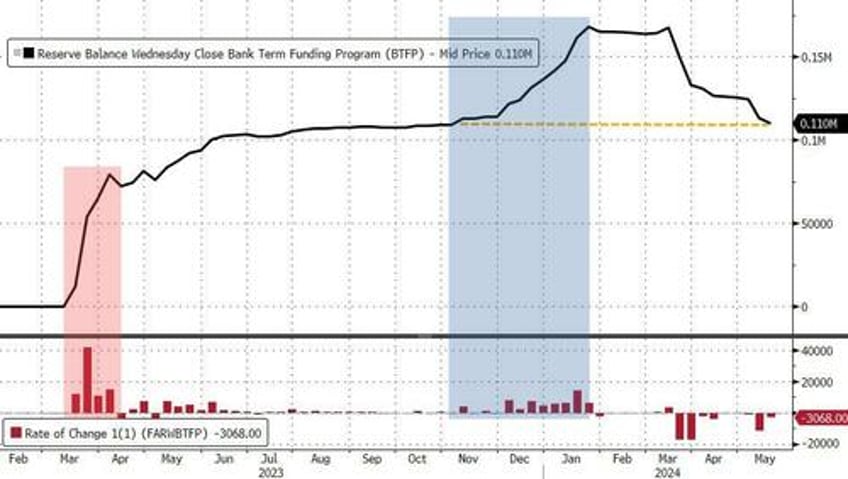

Additionally, usage of The Fed's Bank Term Funding Program fell $3.1BN in the week through May 15, leaving a still-huge $109.6BN outstanding filling holes on bank balance sheets. Notice that this week's decline basically erases all of the arb-driven flows - leaving the bigger more problematic 'real' borrowing to come...

Source: Bloomberg

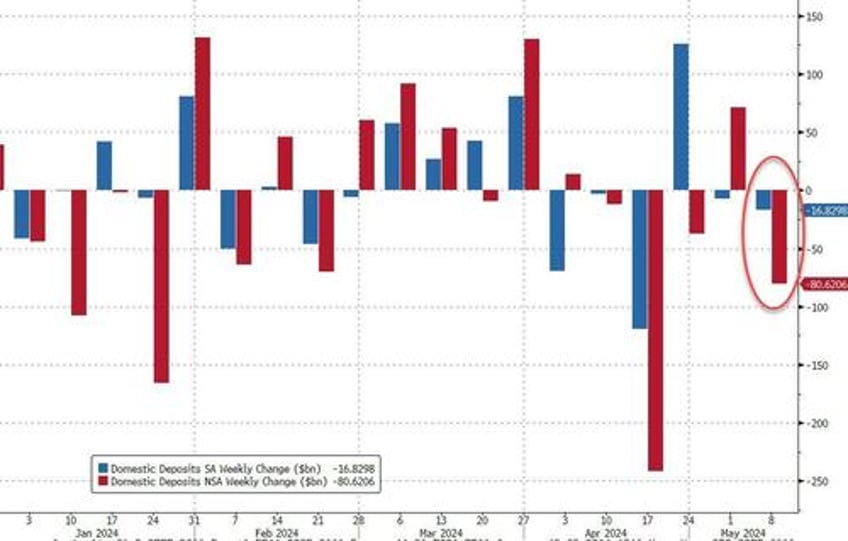

After a huge flip-flop in deposits over the last few weeks, seasonally-adjusted total deposits fell $17BN last week...

Source: Bloomberg

But on a non-seasonally-adjusted basis, total deposits tumbled $70BN last week...

Source: Bloomberg

Excluding foreign deposits, domestic bank deposits fell $80.6BN (NSA) with Large banks -$83.8BN and Small banks +$3.2BN. On an SA basis, domestic deposits fell $16.8BN (large banks -$28BN, small banks +$11.2BN)...

Source: Bloomberg

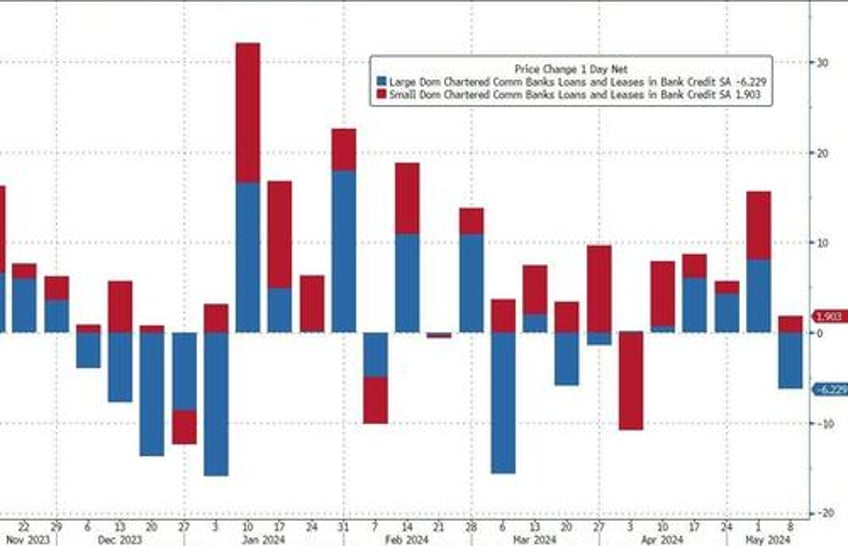

On the other side of the ledger, loan volumes shrank last week, dominated by large banks (-$6.2BN) while small bank loan volumes rose $1.9BN...

Source: Bloomberg

Finally, US equity market capitalization surged to a new record high this week, dramatically decoupled from bank reserves at The Fed..

Source: Bloomberg

How will this end?