Submitted by QTR's Fringe Finance

It is of the utmost importance that my readers know I am capable of being bullish.

I always find it necessary to repeat this, over and over, when I feel like I am droning on about what I believe to be a forthcoming, looming bearish scenario. There are tons of people out there claiming stocks are going to crash 90% and never recover, and I’m just not in that camp. But that’s not to say I’m not totally cautious on markets right now.

You can lump me in with doomsday sayers, conspiracy theorists and total hack financial newsletter writers if you want. I don’t mind. Hell, nowadays, I take that as a compliment. But if one thing sets me apart from many other “permabears”, it’s the fact that I have been bullish and I will be bullish again. And I genuinely feel understood by most of my readers.

To quote Grace from Ferris Bueller’s Day Off:

“The sportos, the motorheads, geeks, sluts, bloods, wastoids, dweebies, dickheads - they all adore him. They think he's a righteous dude.”

So thanks for that.

One instance where I was both bearish and then bullish was in 2020, when Covid was newsworthy enough to be right in front of our faces, but wasn’t being touted by U.S. media enough to induce panic just yet.

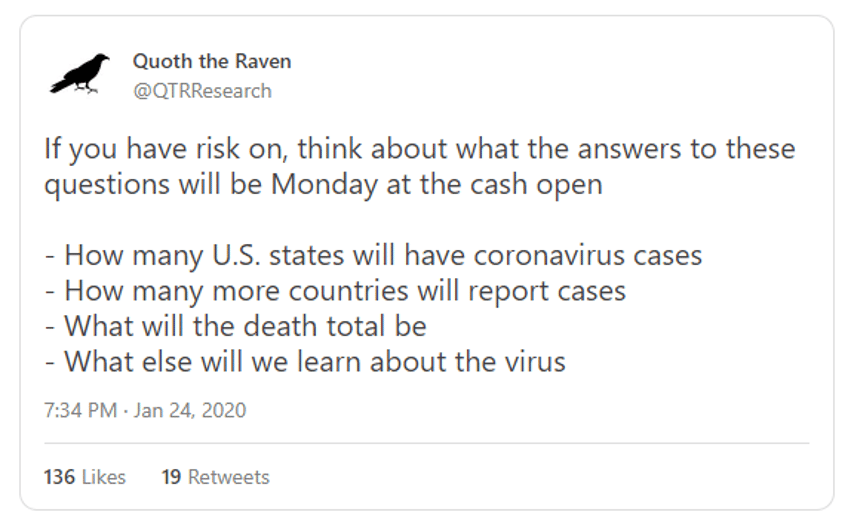

On January 24, 2020, with the Dow at 29,230, I warned that the stock market was “not pricing in any type of event involving this coronavirus spreading across the U.S.” and that the market was “extraordinarily overpriced relative to near-term risk”.

I also urged people to consider how many U.S. states would eventually have cases, how many more countries would have cases and what else we will learn about the virus.

On February 2, 2020, I noted via tweet that people were starting to use the word “pandemic” to describe the coronavirus and say:

“I take zero pleasure in this but I think a serious wake up call is coming for some asset managers. And is long overdue. Just my opinion.”.

The World Health Organization doesn’t declare the coronavirus a pandemic for another 38 days. Later in February, I wrote:

“The world’s second largest economy is shut down amidst an epidemic/pandemic that we have questionable details about - and the market can’t stop scorching to new highs.”

On Februrary 20, 2020, with the Dow at 29,296, I again warned there was a “wake up call for those ignoring virus impact coming”, that the market was underpricing risk due to the virus and that “pain is coming”.

The Dow would drop more than 30% in coming weeks to a 52-week low of 18,213.

Shortly thereafter, on March 11, 2020, I appeared on Jon Najarian’s podcast where he asked whether or not the market had finally capitulated in reacting to the emerging pandemic. We talk about the difference between being a permabear and being a skeptic based on common sense.

“I don’t think we have systemic financial risk now,” I say when asked about the state of the macroeconomic as a result of the developing pandemic.

I talk about why I am overweight gold and silver and plan on continuing to be overweight precious metals. Gold was about $1,689 at the time.

“I don’t think we’ve seen capitulation yet. We don’t really know what the long-term impact of this recession, and more importantly the Fed’s response to it, is going to be. We could turn into Japan as a result of this,” I say.

The VIX was at 53 on the day the podcast was recorded.

Two days later, on a day the Dow falls 10%, I start coming around to the idea that the virus isn’t going to be devastating enough to stand in the way of what the Fed is doing with QE infinity.

I tweet that “there's a chance the tailwind coming out of the coronavirus WAY down the line, with 0% rates, discount window open, short sell ban, etc. could be ungodly.”

12 days later Bill Ackman says “hell is coming” live on CNBC and the market bottoms, the S&P closes at 2,447.

One year later, the S&P would fly through 4,000.

In May, I continued my bullish thoughts and talked to George Gammon about market direction going forward, joking about how Jim Cramer was telling people to sell their index funds and how Warren Buffett was claiming he had been priced out of the market by the Fed.

“I almost find this as a contrarian indicator. I wouldn’t be surprised if the market goes straight up now. Just because Buffett’s been priced out of the market and doesn’t see value doesn’t mean that this crazy psychotic tailwind of stimulus isn’t going to continue to drive the market higher.

First day after Cramer says that. Dow’s up 400 points. Something to have fun with. I just found it pathetic that people cling to Buffett’s narrative like it’s the end all be all. He gets things wrong. He was in the airlines, they just got clobbered. It’s possible for him to get things wrong.”

By August 2020, I was full-on bullish. With the S&P at 3294 and the Dow at 26,664 , I appeared on Seeking Alpha’s Alpha Trader podcast and said:

“I feel like the S&P is going to go over 4,000 next year,” I tell the hosts. “The market is basically sipping on rocket fuel that the Fed is giving it.”

“Remember, every single person in March and April that went on CNBC said ‘we have to retest the lows’ and ‘we have to go back to Dow 17,000’. Gundlach said it, everyone said it. I’m the only person who didn’t say it and said we could just launch from here.”

“I’m long equities and I’m long gold and silver,” I said.

With regard to the reaction to Covid, I say: “Over the next 6, 12, 18 months I think we’re gonna look back and say ‘OK, we may have overreacted a little bit. I think we have a lot of tailwinds. I think we are going to have one good vaccine and therapeutic headline after another from now until next summer.”

The point here isn’t to take a victory lap, go full Barry Horowitz and spend this article patting myself on the back. The point is to show you that I have the capability of being bullish, yet I am still extremely bearish on both equities and the economy right now.

Just as Buddhists say things like “there is no light without darkness” and “there is no day without night”, I’ll add “there is no being furiously bearish without, at some point, being bullish”.

With that out of the way, I have to once again - and maybe for the millionth time since I started this blog - reiterate that Fed policy makes it a near-mathematical-impossibility for a soft landing for the economy. The flawed psychology of the last 2 decades of “buy the dip always”, fueled by dovish monetary policy and 0% interest rates, simply isn’t going to cut it with rates at 5% and the Fed tightening.

The entire playing field has changed, yet our psychology and sentiment toward the market has remained exactly the same. Something’s going to have to give. Does all of this sound familiar? I have been writing different versions of the same article for months now.

But make no mistake about it, I am choosing to start yet another week proclaiming the same message: the soft landing charade is exactly that - a charade. It’s a fallacy, nothing else, that remains alive and well in the ethos of finance and the financial media that, in my opinion, poses a sizeable current threat to markets at this point.

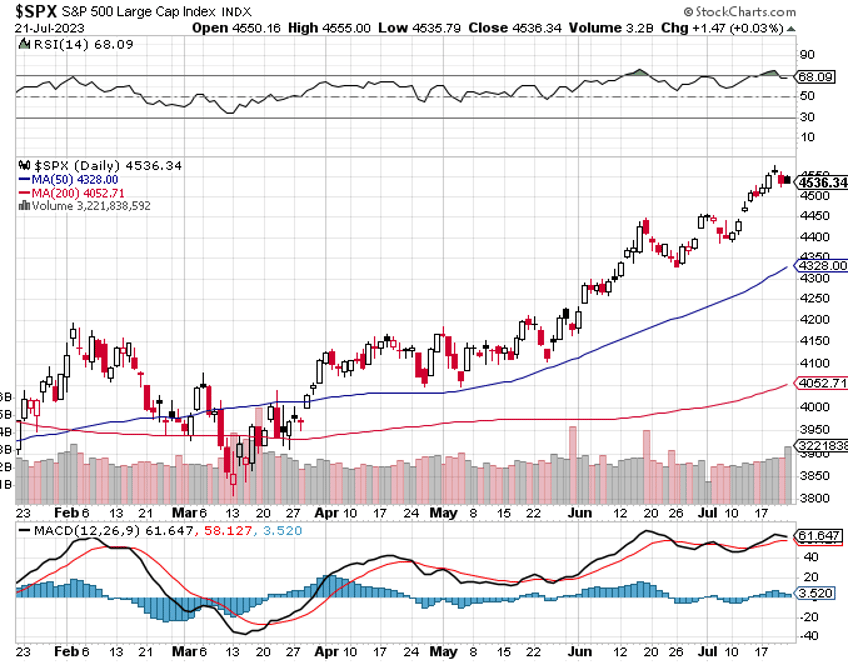

Have a look at this chart.

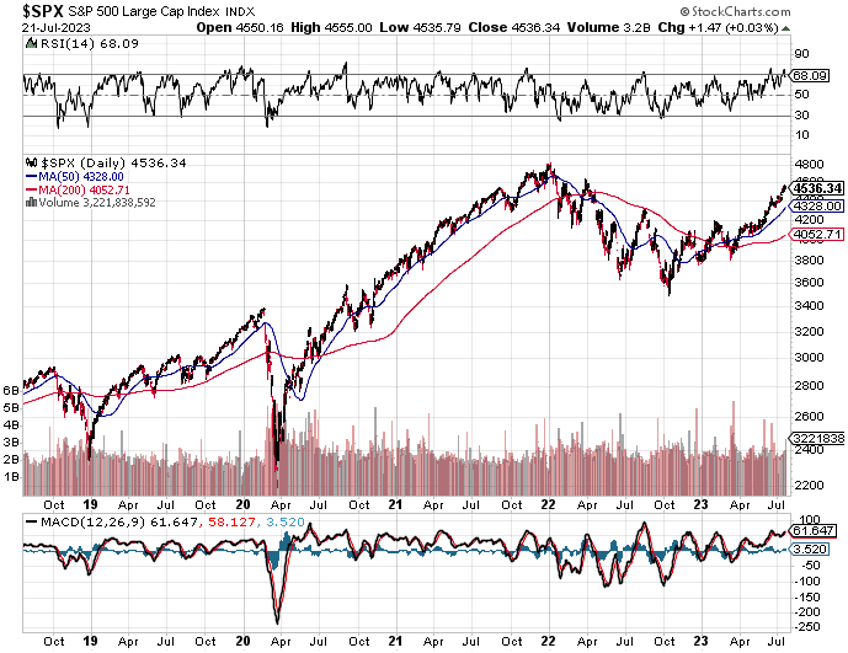

The market has performed exceptionally well for the last 6 months, given the circumstances. Now look at the below chart. Technical analysis is in the eye of the idiot beholder, so I’m going to tell you the market could be setting up for a massive double top, while bulls are going to tell you that we’re about the launch from the world’s largest “cup and handle” formation.

The moral of the story is that technical analysis is a joke and nobody really knows jack shit about where the market is going from here. But one thing is for sure: a pronounced move higher through all-time highs (a “breakout”) hasn’t happened yet.

This also seems like another great time to warn that stocks take the stairs up and the elevator down. Think about how long it took to get to 3400 in early 2020 before the market puked up shards of its own pelvis and slammed lower to 2200 in a matter of just days. Years of gains, wiped away in moments.

Keep this in mind when I remind you again that the fundamental indicators that I have been watching over the last 18 months are basically redlined in favor of recession or a market crash. I noted these indicators two weeks ago and have updated them here.

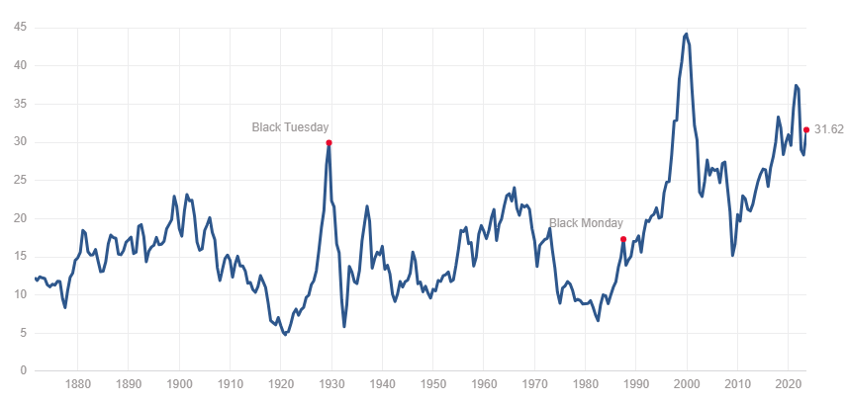

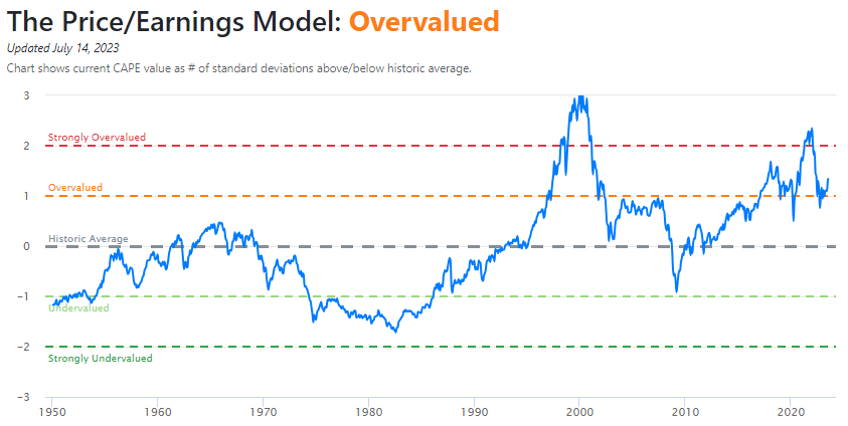

Since then, the Shiller PE has moved higher, to 31.62x. For comparison, that’s about twice its median of 15.93x and almost twice its mean of 17.03x.

Nearly every other metric over at Current Market Valuation continues to scream “overvalued” more than it did two weeks ago.

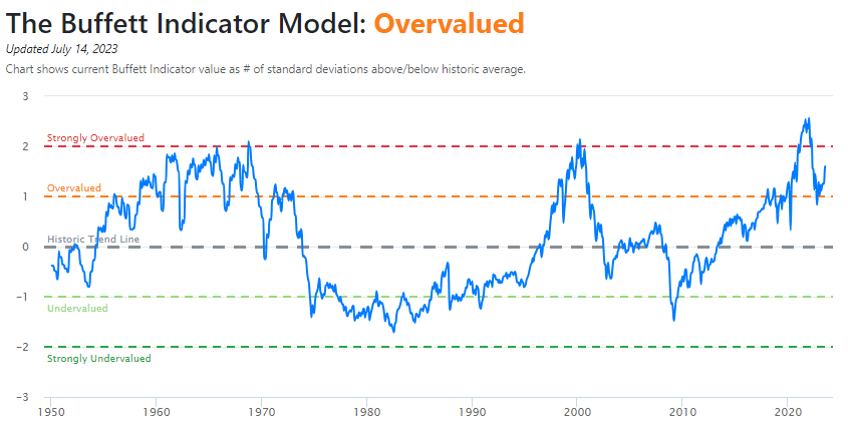

The Buffett Indicator (market cap/GDP) pins us somewhere between “overvalued” and “strongly overvalued”, at about 1.5x standard deviations from its trend.

Looking again at a price/earnings model, we see that the current CAPE value as a # of standard deviations from the average is also above 1x.

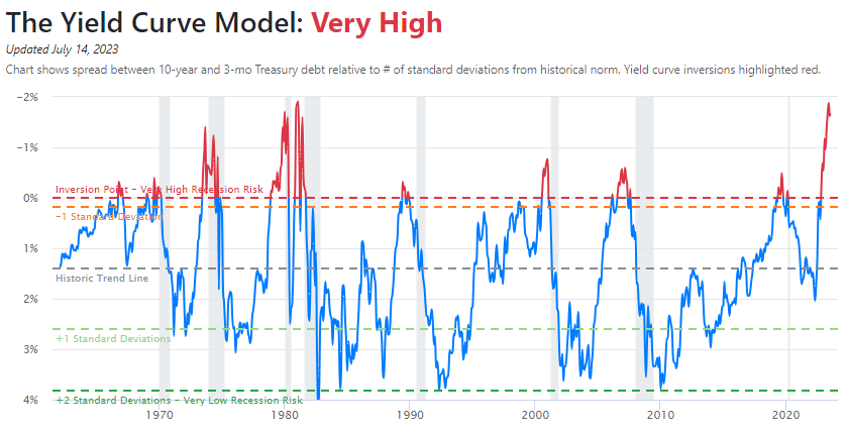

Most interesting of these metrics is the yield curve, which has been screaming recession for months (I pointed this out all the way back in February, whilst the bond market was malfunctioning, albeit not quite as much).

And so here we are on another Monday, with me droning on about boring old fundamentals while, to quote Vin Diesel in Boiler Room, bears are going to “miss yet another opportunity and watch your colleagues get rich…”

Sometimes I feel like it is fruitless to repeat myself over and over again – especially when the only scorecard that matters, what the market has done lately, has given me a grade of F over the last 18 months. Since rates have started to rise, I have been predicting that the market is going to crash yet again. As I have said before, I don’t think I’m wrong, I just think my timing has been.

I thought earnings last week for Netflix, and Tesla were very telling. All things being equal, both names had positive undercurrents in their reports: Tesla said demand for the Cybertruck was “off the hook” and the company beat both revenue and EPS estimates. Netflix unveiled blockbuster subscriber growth, demolishing expectations. And so with these good pieces of news, the market had its reason to rally these stocks if it wanted to. But instead, the market chose to sell them both off by about 10%.

Is it possible that, for the very first time, the market is actually giving a quick, one second glance at valuations?

At this point I know that sounds like something you’d be more likely to hear from a drunk at a bar at 3AM than an financial analyst, but if you think valuations are never going to matter again, you’re sorely mistaken. The only question is when? Last week? This week? When Jim Cramer starts growing hair back on his head?

Among the detritus that will be washed out to shore when reality rears its head is the message that ARK’s Cathie Wood often peddles: that we have reached some type of new paradigm where valuations will never be the same, and the market will put prices on securities going forward in a totally different way than it ever did. In other words, the “good ole’ days” of wussy-ass 10x PEs are over. This is the age of cash incinerating dumpster fires that require robust valuations regardless of fundamentals. This is the age of valuations that are the equivalent of a 4am cocaine bender at a goat show in Tijuana, Mexico.

Art: Financial Review

Wood and her ilk explain this paradigm shift with an attitude of being inconvenienced by us peons who simply cannot grasp their complex thinking.

Get with the f*cking program, guys, they think.

This noxious ideas remain a massive fool’s errand. While inflation does mean that there is somewhat of a rising tide under the price of stocks, to make the argument that multiples are going to simply move higher from here, for no reason, is batshit insane.

If the average span of a human life doubled and people were living to be 200 years old, maybe I would understand the argument that stocks should be looked at with a 40 year time horizon instead of a instead of the S&P average of about 15-20 years. But none of that has happened. There’s no huge body of evidence that suggests there is a legitimate reason for paying for 60 years of earnings now, when in the past the same company had an average PE of 15 or 20. In fact, anyone with their eyes open should only be able to see reasons for multiple compression from here. 15 or 20.

The continued insulting notion from the government and economists that the economy “may or may not” slip into a recession, is insane. We’re heading into a recession. We’re probably already in one. The policy out of the Fed has all but assured it, regardless of what incomprehensible blather comes out of Janet Yellen’s mouth this week.

The die have already been cast, and the economic pipe bomb is already in the plumbing. Now it’s only a question of when the bomb goes off and the pipe bursts. Stay tuned for next Monday, where I re-write the same thoughts using slightly different words and continue to be wrong.

--

🔥 50% OFF FOR LIFE: If you’re still not a subscriber, you can take 50% off of an annual subscription by using the below link. I have not raised my prices since I started the blog and this is a chance to lock in a discount that you can retain for as long as you wish to be a subscriber. The discount is good for life: Get 50% off forever

QTR’s Disclaimer: I am an idiot and often get things wrong and lose money. I may own or transact in any names mentioned in this piece at any time without warning. Contributor posts and aggregated posts have not been fact checked and are the opinions of their authors. This is not a recommendation to buy or sell any stocks or securities, just my opinions. I often lose money on positions I trade/invest in. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. None of this is a solicitation to buy or sell securities. These positions can change immediately as soon as I publish this, with or without notice. You are on your own. Do not make decisions based on my blog. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. Also, I just straight up get shit wrong a lot. I mention it twice because it’s that important.