Among the growing list of countries embracing nuclear are now both Thailand and the Philippines, both of whom are "charging ahead" with plans to start nuclear reactors, according to a new report from Nikkei.

In September, Thailand plans to reveal a national energy strategy extending to 2037, featuring the deployment of small modular reactors (SMRs) with a combined capacity of 70 megawatts. Despite previous nuclear ambitions halted by the Fukushima disaster in 2011, SMRs have renewed Thailand's interest due to their safety and smaller size. The same has been true in places like the U.S., U.K., and China.

Prime Minister Srettha Thavisin, discussing nuclear power prospects with U.S. Commerce Secretary Gina Raimondo, emphasized research into SMR safety and public consultation. Thailand is realizing what the rest of the world is starting to wake up to: that nuclear is the solution to the 'green' energy issue. Nikkei notes that as Thailand's natural gas reserves dwindle and electricity demand surges, the move towards nuclear energy supports its 2050 carbon neutrality goal.

Similarly, the Philippines plans a nuclear facility by the early 2030s, bolstered by a U.S. civil nuclear agreement. This initiative revives ambitions from the era of Ferdinand Marcos Sr., aiming to fulfill a long-standing vision under President Ferdinand Marcos Jr.

Indonesia aims to add 1,000 to 2,000 MW of nuclear capacity by the 2030s, shifting from a coal-heavy energy mix towards a 2060 carbon neutrality target. Despite Southeast Asia's renewable energy efforts, the region's high energy costs and absence of operational nuclear plants underscore the challenges ahead. Business leaders like Dhanin Chearavanont advocate for nuclear energy as crucial for economic progress.

Safety concerns persist, highlighted by a 2023 incident involving lost radioactive material in Thailand. Additionally, Myanmar's increasing nuclear collaboration with Russia amidst international isolation raises fears of military misuse of nuclear technology.

Kei Koga, associate professor at Singapore's Nanyang Technological University, commented to Nikkei: "If Southeast Asia becomes involved in the competition between global powers to export nuclear technology, it could lead to fragmentation in the region."

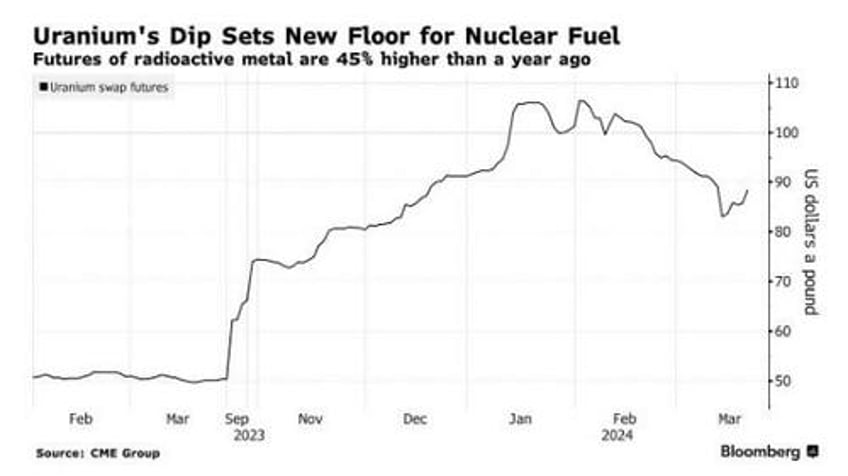

Nuclear, the oft-bastardized common sense solution to most of the world's 'green' energy issues, is finally starting to see an uptick in adoption. Recall, days ago we wrote that uranium prices were set to jump once again after a small correction.

Jonathan Hinze, president of UxC, a nuclear industry research firm told Bloomberg last week: “We have reached a bottom. The fundamentals are still strong, with increased demand and supply that hasn’t fully responded.”

According to Cantor Fitzgerald analyst Mike Kozak, there's evidence to suggest that uranium prices have stabilized. Kozak forecasts a resurgence of fundamental buyers in the market, which is expected to propel prices upwards once more, Bloomberg wrote.

Optimistic investors are focusing on uranium's future, driven by an increasing supply shortage and higher demand, as nations (finally pull their heads out from their a** and) seek nuclear energy solutions for climate change.

This interest is highlighted amid supply warnings from Canada's Cameco and Kazakhstan's Kazatomprom, the leading producers responsible for half of the worldwide uranium supply. Kazatomprom forecasts a significant supply deficit escalating from 21 million pounds in 2030 to 147 million pounds by 2040.

Geopolitical tensions, including a U.S. proposal to ban Russian uranium imports, which are essential for nuclear power and weapons, add complexity to the supply scenario, the report says. However, the potential resurgence of dormant mining operations due to rising uranium prices poses a risk of dampening the market rally, reminiscent of the recent boom-to-bust cycle in battery metals.

“We have a number of geopolitical factors that have a really significant influence on buyer behavior, even though fundamentally nothing has changed. Buyers can use the spot to tell them the sentiment of the day, but must look at the long-term market to see that it is marching steadily up, it hasn’t taken a hiccup at all,” concluded Treva Klingbiel, president of uranium price provider TradeTech.