Mega retailer Target slashed its annual sales forecast after reporting weaker-than-expected quarterly results, citing trade tariffs, boycotts, and slumping consumer confidence. A broader turnaround plan to re-establish the retailer as a leading discount department store appears to be faltering, with Goldman's top consumer analyst taking a bearish stance on the stock.

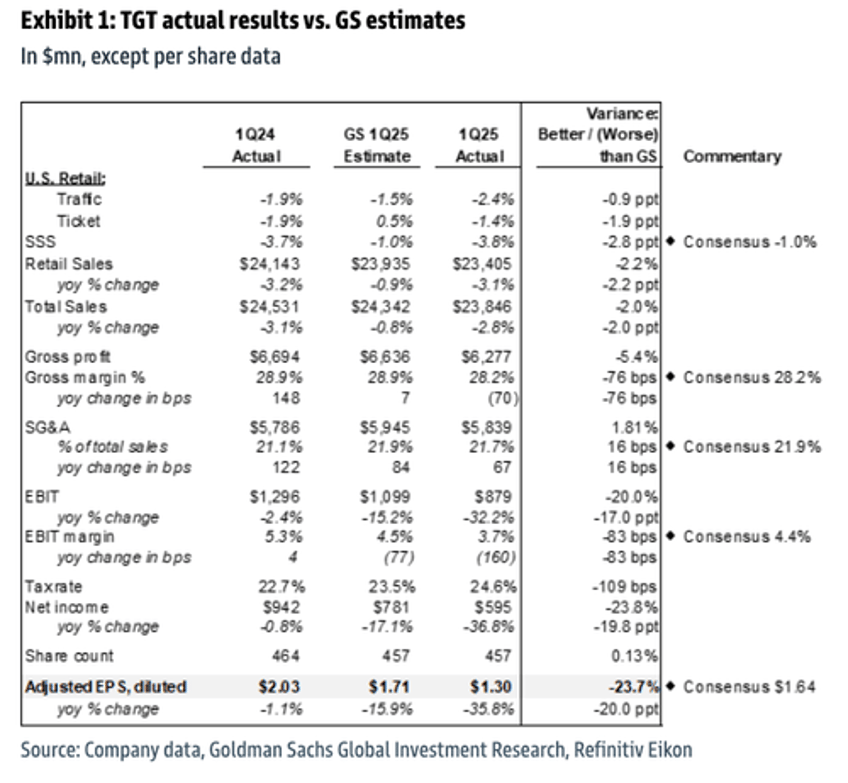

In the quarter that ended May 3, Target reported a 1Q25 adjusted EPS of $1.30, missing both Goldman and Refinitiv consensus estimates of $1.71 and $1.64, respectively. Comparable sales declined 3.8%, versus consensus expectations of a 1.0% decline, driven by a 2.4% drop in traffic and a 1.4% decrease in average tickets.

Consumers visibly spent less per visit, and Target CEO Brian Cornell expressed his dissatisfaction with the quarter's results to analysts in an earnings call:

"I want to be clear that we're not satisfied with these results. We've got to drive traffic back into our stores and visits to our site."

By channel, store comps fell 5.7%, while e-commerce comps rose 4.7%. This was supported by over 35% year-over-year growth in same-day delivery via Target Circle 360 and continued strength in drive-up services. Key seasonal events such as Valentine's Day and Easter led to outperformance for stores; however, performance during non-holiday periods was weaker.

Target executives warned that the lingering issues that impacted sales in the first quarter would roll into the current quarter, which is one reason the discount retailer slashed its full-year earnings and sales guidance. The retailer expects a low-single-digit decline in sales for the fiscal year ending next January, with prior guidance forecasting sales growth around 1% for the year.

Here's more color from Goldman on Target's dismal outlook:

TGT lowered FY25 sales guidance and now expects a LSD decline (vs. +1% prior), compared to GS/consensus of +0.2%/+0.3%. The company also lowered adj. EPS guidance by 14% at the midpoint to $7.00-9.00 (vs. $8.80-9.80 prior), compared to GS/consensus at $8.61/$8.46. TGT did not provide guidance for FY25 SSS or operating margin rate.

Goldman's consumer specialist Scott Feiler provided clients with his first take on Target's earnings:

"This felt like it had among the lowest expectations reports into the event. Despite most expecting a very weak print, we had seen some covers the last few days, mainly from those cognizant of the bar. The print did come in about as bad (but not necessarily worse) vs expected. At 11.7x the mid-point of the newly lowered EPS guide, the stock will be a fascinating one to watch. If TJX is a buyer on dips (as indicated above), we think most investors will look to short TGT on positioning driven pops, until they can show an infection in comp sales (-3.8% comps vs most all peers in pretty solidly positive territory)."

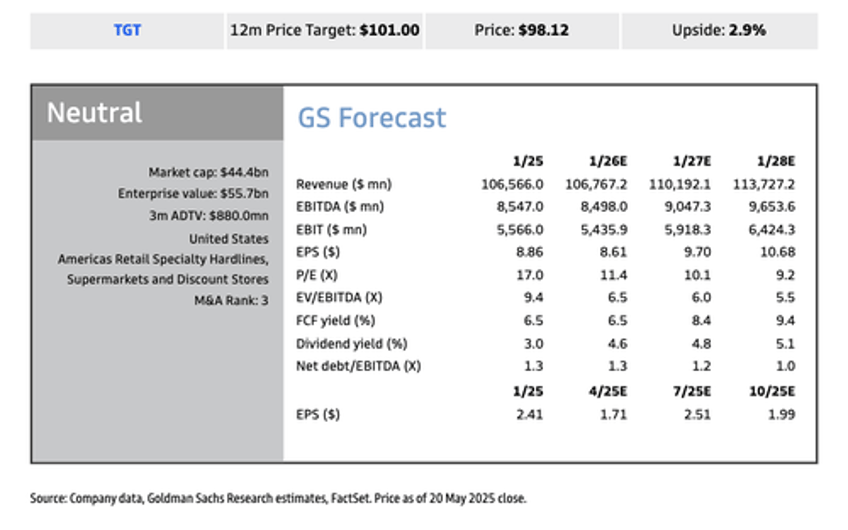

Goldman has a "Neutral" rating on Target with a 12-month price target of $101.

In a separate note, JPMorgan analysts Christopher Horvers and his team described the retailer's earnings results as "soft."

Horvers noted that EPS missed JPM and consensus estimates due to "higher markdown rates and digital fulfillment supply chain costs, partially offset by lower shrink." JPM is rated "Neutral" on Target.

Bloomberg Intelligence analysts Jennifer Bartashus and Jibril Lawal said, "Weaker-than-expected 1Q performance make full-year cuts to sales and adjusted EPS a prudent move against an uncertain backdrop."

Bartashus and Lawal noted that the retailer's product mix makes it more vulnerable to tariffs than other big-box retailers.

"Target's implementation of a new multiyear acceleration office underscores the need for a broader turnaround plan to re- establish the brand's cachet with customers," the analysts said.

In April, we asked, "Are Democrats Unintentionally Sabotaging Retailer Target?"...

After all, Democratic-leaning respondents have expressed to the UMich Survey their views of an economic apocalypse ahead.

To note, Morning Consult's data recently showed who exactly shops at Target: "Walmart is more popular among Republicans, while more Democrats see Target in a favorable light."

So again, we ask: "Are Democrats Unintentionally Sabotaging Retailer Target?"...

Target shares are down more than 6% in premarket trading.