After several mediocre coupon auctions, moments ago - with some worried that demand for US paper may flag just 24 hours before the Fed decision - the US Treasury sold $13 billion in a 20Y paper in what can only be described as a stellar auction.

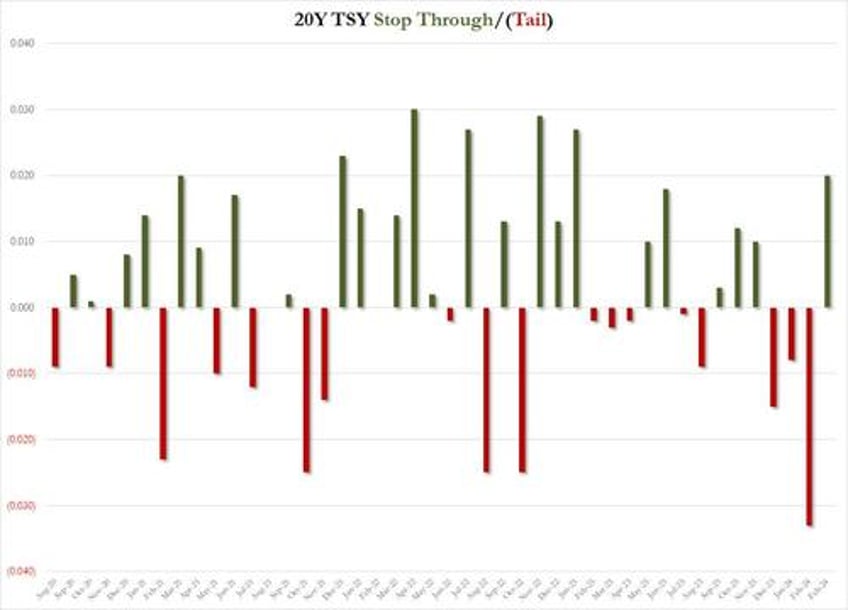

The 19-Year, 11-Month reopening of cusip TZ1 priced at a high yield of 4.542% which was just over 1 basis point below last month's 4.595%, and also stopped through the When Issued 4.562% by an impressive 2 basis points, the biggest stop through since Jan 2023.

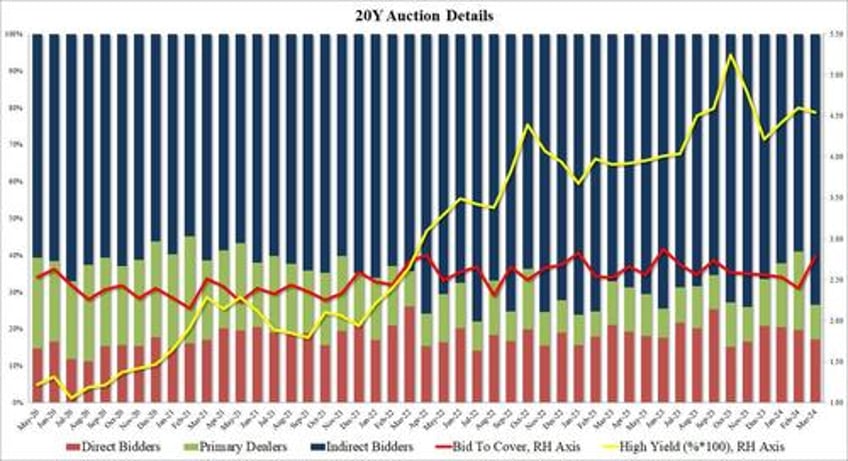

The bid to cover jumped from 2.39 in February to 2.79, one of the highest on record, and far above the 2.56 six-auction average

The internals were also stellar with Indirects awarded 73.5%, a surge vs the 59.1% last month, and just shy of the highest on record. And with Directs awarded 17.2%, below last month's 19.7% which also was the six-auction average, Dealers were left holding just 9.3%, one of the lowest Dealer awards on record.

Overall, this was a stellar auction, and news of the blowout demand helped send yields to session lows across the curve, which in turn also helped propel duration equivalents (read tech names) to session highs, with the S&P rising to session highs just as the auction broke for trading.