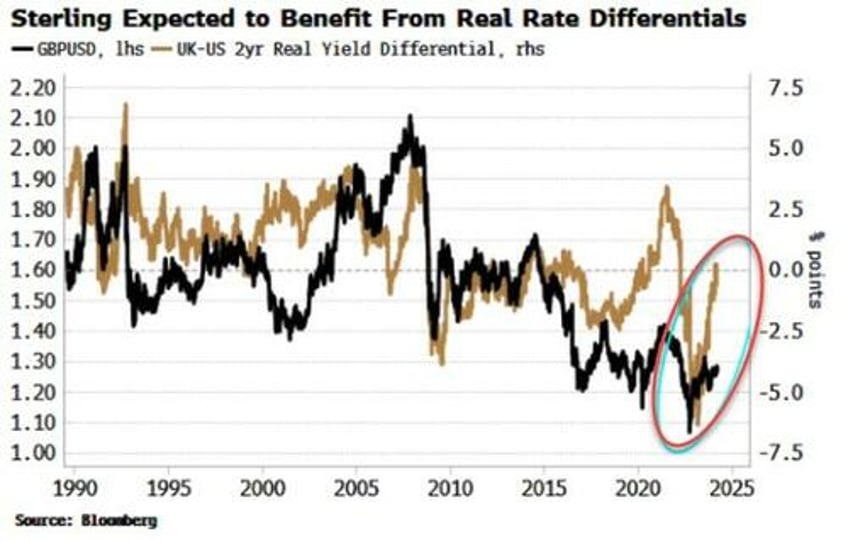

A rise in UK real rates relative to those in the US is potentially behind the very long speculative positioning in sterling.

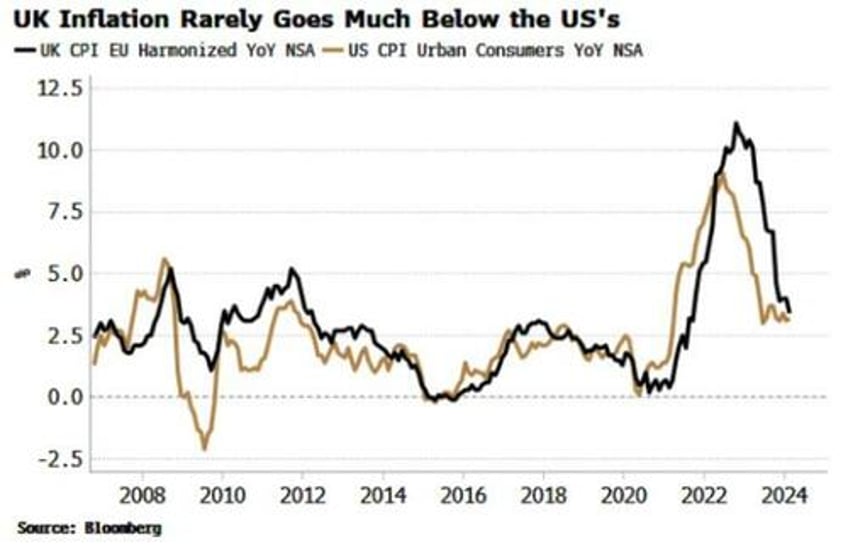

However, traders expecting the fall in UK inflation to drive the rise in the real rate are set to be disappointed.

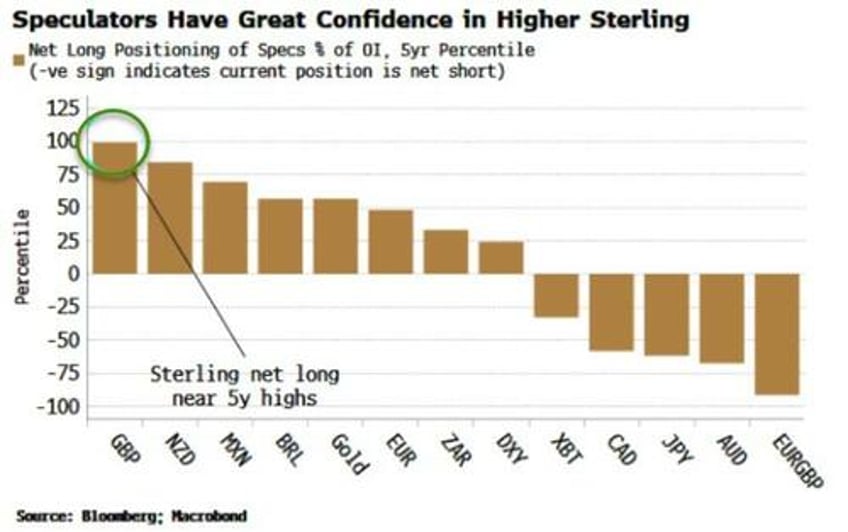

The net long in sterling positioning of speculators is close to five-year highs. That’s relatively higher than all the other currencies tracked in the Commitment of Traders report, and in fact higher than any global FX, bond, equity and commodity future it tracks. In other words, there appears to be greater confidence the pound is going higher than almost anything else.

That looks predicated on UK real rates being much higher than their US counterparts.

But higher real rates in the UK are reliant on UK inflation continuing to fall.

The data released today for February showed the disinflationary trend continuing, and April should bring a steep drop as the energy price cap falls 12% in the second quarter.

But after that, progress may be slower than expected. Sterling’s rise requires UK disinflation to continue to outpace that in the US.

Yet inflation leading-indicators for the UK are stalling, and it is rare for UK CPI to go much below US CPI.

Further, the UK had the most persistent price growth in the Great Inflation of the 1970s. Sterling bulls may yet be disappointed.