In March, the designated new German government coalition paved the way for substantial fiscal stimulus on defence and infrastructure, an overture which according to most strategists has so far allowed European markets to escape largely unscathed from the clutches of global trade war (after all, if things go bad, Germany will just issue a boatload of debt and save everyone, or so conventional wisdom goes). The problem, as Goldman European economist Niklas Garnadt explains, is that outside of seemingly unbounded defense spending - which will take years to ramp up and is very much siloed as it is geared toward the defense sector - the German coalition agreement plans little structural reform and delivers only a modest additional boost to competitiveness. In other words, the premise behind Europe's so-called fiscal renaissance is one giant castle in the sky.

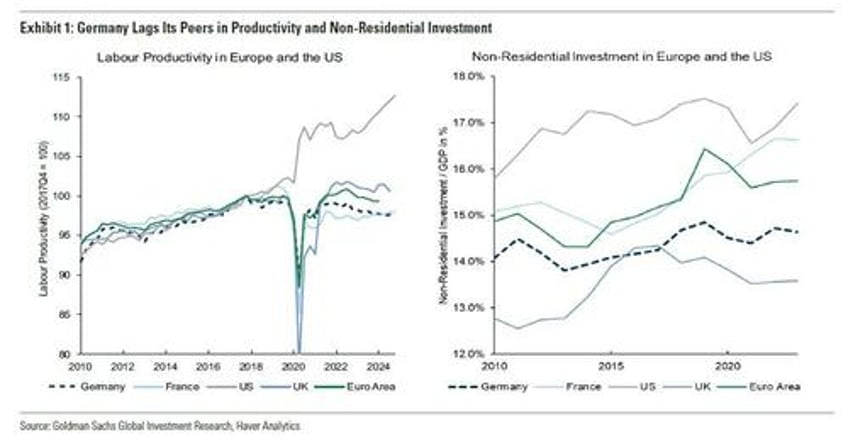

First, some background: after the German fiscal package to boost defence and infrastructures spending was passed in March, the conservative CDU and the social democratic SPD last week also concluded their coalition negotiations. The coalition agreement formulates the goal to improve the competitiveness of the German economy, which in recent years has underperformed both in terms of productivity and investment.