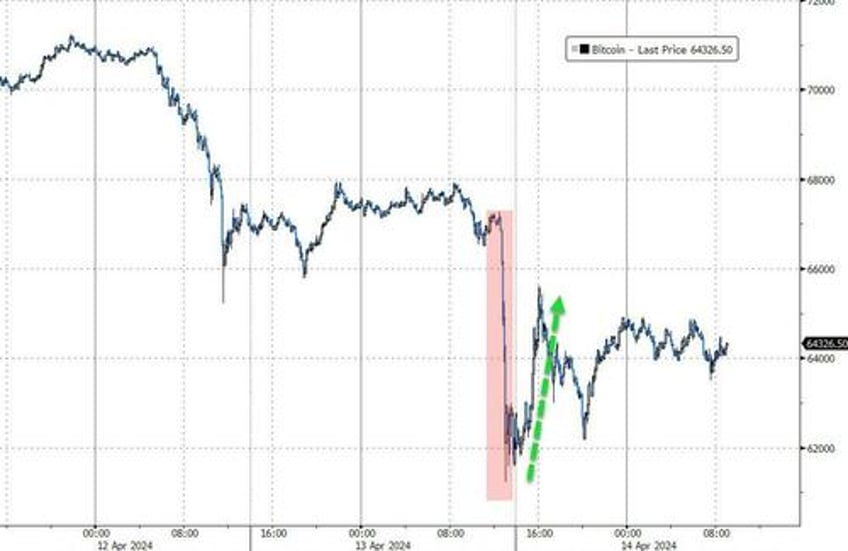

The first actual 'market' response we have seen to Iran's attack on Israel is in crypto, which saw - rather intriguingly - a huge puke as the drones/missiles flew, and then some comeback as the impact of the attack seemed marginal at worst (and for now retaliation remains muted)...

Source: Bloomberg

But, this afternoon is when things will really heat up as FX and futures markets open, with much riding on whether Iran’s unprecedented weekend strike on Israel triggers rounds of retaliation.

Amid already frayed nerves from resurrected inflation fears and higher-for-longer rates outlooks, geopolitical risk premia will be forced top of mind.

“Investors’ natural reaction is to look for safe-haven assets in moments like this,” said Patrick Armstrong, chief investment officer at Plurimi Wealth LLP.

“Reactions will be somewhat dependent on Israel’s response. If Israel does not escalate from here, it may provide an opportunity to buy risk assets at lower prices.”

For now, the optimists may be winning as Iran’s statement that “the matter can be deemed concluded” and a report that President Biden told Israeli PM Netanyahu that the US won’t support an Israeli counterattack against Iran, seems to be driving down the odds of a more escalatory retaliation (meaning anything other than a 'theatrical' response).

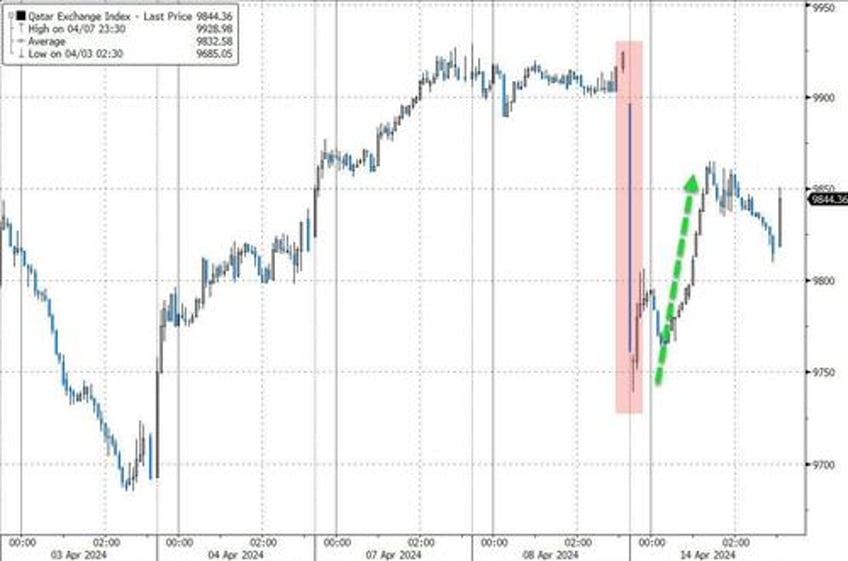

Bloomberg reports that stock markets in Saudi Arabia and Qatar posted modest losses under thin trading volumes...

Source: Bloomberg

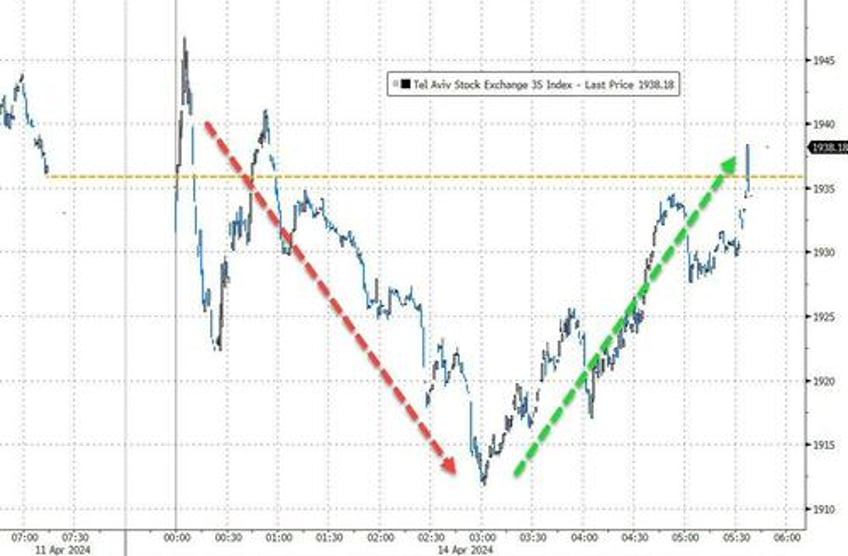

...while Israeli stocks fluctuated and ended with a very modest gain.

Source: Bloomberg

“Middle Eastern markets opened with relative calm following Iran’s attack, which was perceived as a measured retaliation, rather than an attempt at escalation,” said Emre Akcakmak, a senior consultant at East Capital in Dubai.

“However, the market impact might extend beyond the Middle East due to secondary effects on oil and energy prices, potentially influencing the global inflation outlook.”

Worries about turmoil in the region have also been filtering through global markets. The S&P 500 is coming off its biggest weekly decline since October on the back of higher-than-expected inflation and disappointing bank earnings.

Here’s what investors and analysts are saying (courtesy of Bloomberg):

Erik Meyersson, chief emerging markets strategist at SEB:

“Our oil analysts do not see much sign of a geopolitical risk premium in oil prices so far. We expect this to reflect market perceptions of low risks of escalation up until now. This equilibrium is likely to be tested if Iran and Israel continue to attack each other.”

Gonzalo Lardies, senior equities fund manager at Andbank:

“A new environment of uncertainty is now opening up, but the market on Friday already partially priced in this situation, so if it does not get worse the impact should not be very high. The risk is if this situation escalates and there is contagion in the region.”

Alfonso Benito, chief investment officer at Dunas Capital:

“I wouldn’t expect sharp drops given how Israel has defended its air shield. We should see defense companies up, oil up and gas up, while airlines could decline. Bonds will rise, but I don’t think excessively. Investors could take advantage to partially correct the increases of recent months.”

Joachim Klement, a strategist at Liberum:

“The reaction will very much depend on the reaction of Israel today and whether the US can manage to restrain Benjamin Netanyahu.”

“In the next couple of days, stock markets will focus on the geopolitical situation, rather than central bank action or the strong economy in the US. Hence, we expect the rally to stall until there is more clarity if the situation in Iran-Israel calms down. If we end up in a shooting war between Israel and Iran, then the rally will be stalled for longer.”

Mark Matthews, strategist at Bank Julius Baer in Singapore:

“The good thing is that Iran did warn about the attack well beforehand. Military analysts say it was done in a way that minimized casualties. I don’t see why it would cause Fed rate expectations to fall more or it would cause the oil price to go up a lot. Iran is trying to defuse this and so is the US. The key is what Israel’s answer will be, and then Iran’s answer to that. If Israel does a de-escalatory strike, and then the Iranians do an even more de-escalatory strike, then it will be over with.”

Geoff Yu, senior strategist for EMEA Markets at BNY Mellon in London:

“There is scope for further accumulation of dollars, even with recent buying after the CPI data. Our clients remain overweight the euro, Canadian dollar and some high-carry currencies such as the Mexican peso, so this is where we would watch for rotation in the greenback’s favor.”

Neil Shearing, chief economist at Capital Economics in London:

“Our sense is that events in the Middle East will add to the reasons for the Fed to adopt a more cautious approach to rate cuts, but they won’t prevent it from cutting altogether. We expect the first move in September. And assuming that the energy prices don’t spiral over the next month or so, we think that both the ECB and BOE will cut in June.”

US equity and bond futures will open at 6 p.m. New York time Sunday; FX markets before that.