Something strange is going in below the market's relative calm surface. While on one hand hedge funds, long onlies, CTAs and other institutions remain largely on the sidelines (if not tilting bearish) and occasionally getting dragged in to chase the market higher (such as today when according to Goldman's trading desk, "HFs are +10% better to buy, which ranks in the 95th %-ile and the highest we’ve witnessed since early January") retail is trading as if it's on full tilt, buying at a frenzy that has surpassed the post-2020 stimmy euphoria that launched the first memestock bubble.

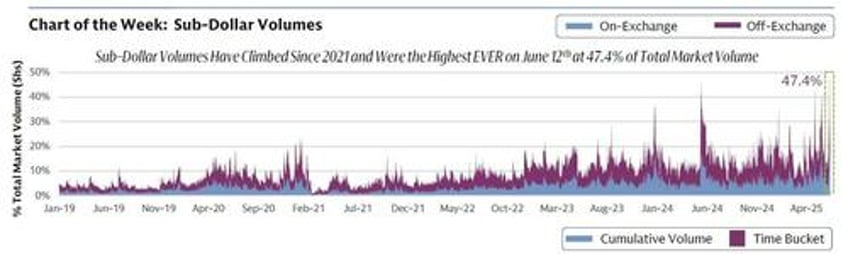

Almost five years after a historic short squeeze in GME, AMC and many other highly shorted names created a cottage industry out of forced short squeezes, retail is back with a vengeance, and as the following chart from Goldman's Ecetronic Trading group shows, penny stocks - a proxy for retail activity simply because institutions are prohibited from trading such small names - accounted for a record 47.4% of total market volume last Thursday.